AUDUSD is trading near its yearly high at 0.6408, continuing a strong uptrend. Further gains are likely. Full analysis for 18 April 2025 below.

AUDUSD forecast: key trading points

- AUDUSD is approaching its 2025 high at 0.6408

- Current trend: upward

- AUDUSD forecast for 18 April 2025: 0.6408 and 0.6330

Fundamental analysis

AUDUSD has gained steadily over the past two weeks, nearing the yearly high of 0.6408. The rally is supported by broad US dollar weakness and the strong performance of Gold — a key Australian export.

Federal Reserve Chair Jerome Powell recently reiterated that the Fed will not rush to cut interest rates until there is greater clarity on the US economic outlook.

At the same time, the introduction of new tariffs by President Donald Trump’s administration has added pressure on the dollar. According to Powell, these measures may intensify inflationary risks while weighing on US economic growth — both factors favouring commodity-linked currencies like the Aussie.

AUDUSD technical analysis

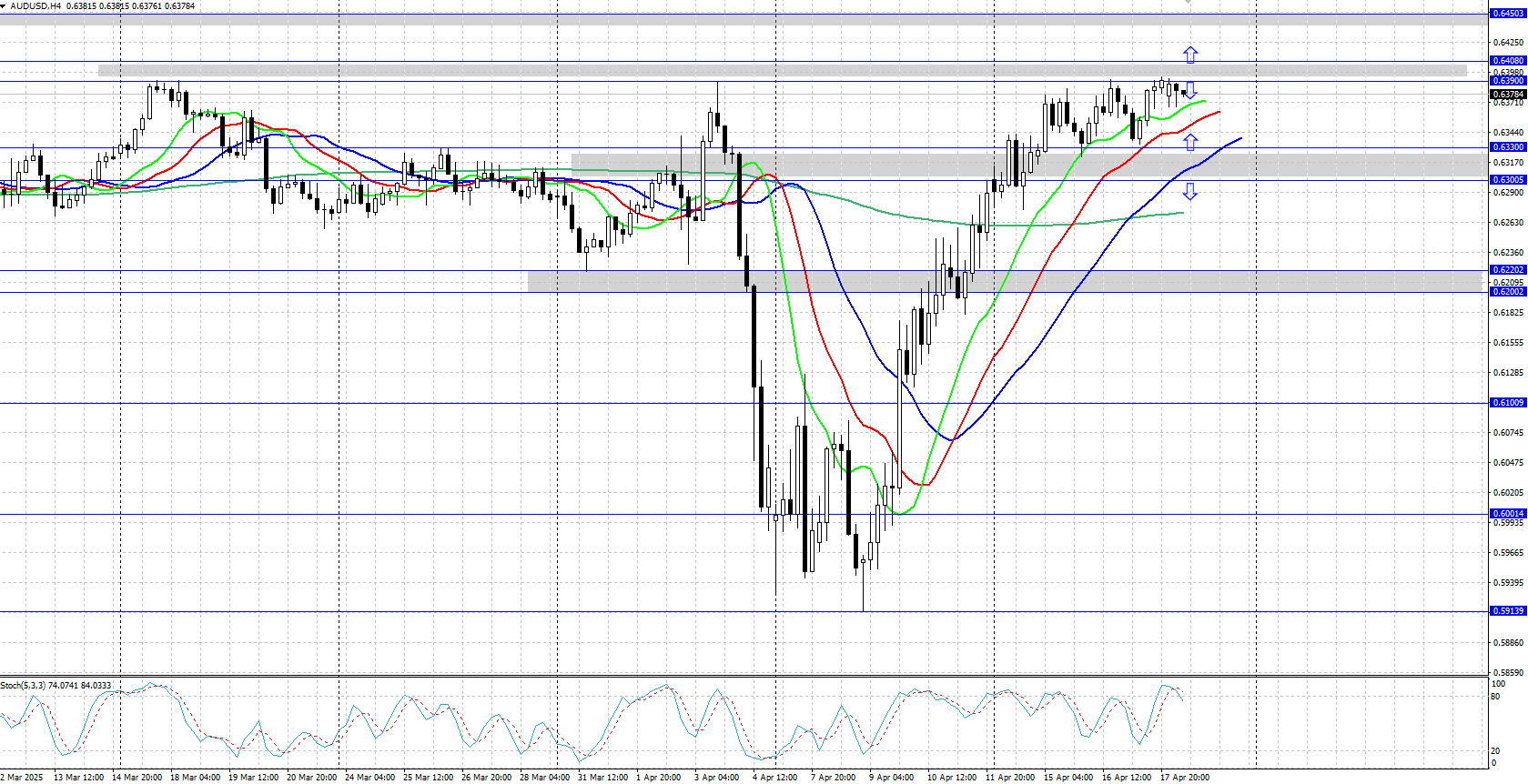

AUDUSD is advancing within a clear bullish trend and is currently trading just below 0.6400. The Alligator indicator confirms the strength of the upward impulse.

In the short term, if buyers maintain momentum, a breakout above the yearly high at 0.6408 is possible. Should sellers regain control, a pullback toward the 0.6330–0.6300 support zone may follow.

.png)

Summary

AUDUSD remains firmly in an uptrend, supported by USD weakness and strong commodity prices. A near-term test of the 0.6408 yearly high is likely. Today’s forecast for 18 April 2025 points to a possible breakout, while key support lies in the 0.6300–0.6330 range.