The USDJPY pair is climbing to 149.95 on Wednesday. The market expected the Bank of Japan to keep the interest rate unchanged but was still disappointed. Find more details in our analysis for 19 March 2025.

USDJPY forecast: key trading points

- The USDJPY pair continues its ascent as the market assesses the Bank of Japan's decision

- The BoJ is not ready to tighten monetary conditions amid high external risks

- USDJPY forecast for 19 March 2025: 150.02

Fundamental analysis

The USDJPY rate strengthened to 149.95.

The Bank of Japan left the interest rate unchanged at 0.50% per annum at its meeting on Wednesday. Although this decision was expected, investors’ reactions were still clearly evident.

The BoJ's main argument is that high and constantly growing uncertainty amid US President Donald Trump’s tariffs may negatively impact the country’s economy. Against this backdrop, the best thing to do is just to watch and take no action.

The market focus is shifting to the evening meeting of the US Federal Reserve. The Fed will close its two-day meeting and announce its interest rate decision. It will remain unchanged, but comments are important.

The USDJPY forecast is positive.

USDJPY technical analysis

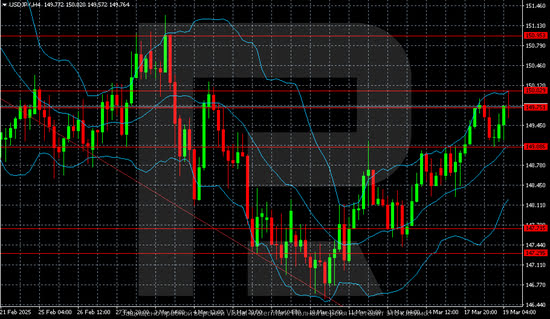

The USDJPY H4 chart clearly shows the next upside target of 150.02. Arguments are needed to consolidate above this level. If they appear, the new buying target will be 150.95.

.png)

Summary

The USDJPY pair is maintaining its upward momentum and rising for four consecutive trading days. There is less reliance on the Bank of Japan’s ambitions. The USDJPY forecast for today, 19 March 2025, expects the current growth wave to extend to 150.02.