Gold (XAUUSD) prices tumbled to 2,915 USD. It is nothing to worry about as the market is simply taking profits. Find more details in our analysis for 26 February 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) quotes declined as investors locked in profits

- The global trend for Gold remains upward

- XAUUSD forecast for 26 February 2025: 2,905

Fundamental analysis

Gold (XAUUSD) prices retreated to 2,915 USD.

Yesterday, the precious metal briefly fell to its weekly low. It is nothing to worry about as investors were taking profits.

At the same time, Gold maintains an uptrend amid concerns about US President Donald Trump’s tariff plans and foreign policy. On Tuesday, he signed an executive order to consider possible copper tariffs after reiterating the introduction of duties on imports from Canada and Mexico.

Gold still receives support from gold-backed exchange-traded funds, with net inflows last week. The indicator hit its highest level since 2022.

Total Gold imports into China through Hong Kong fell by 44.8% in January compared to December, reaching the lowest level since April 2022.

The Gold (XAUUSD) forecast is positive.

XAUUSD technical analysis

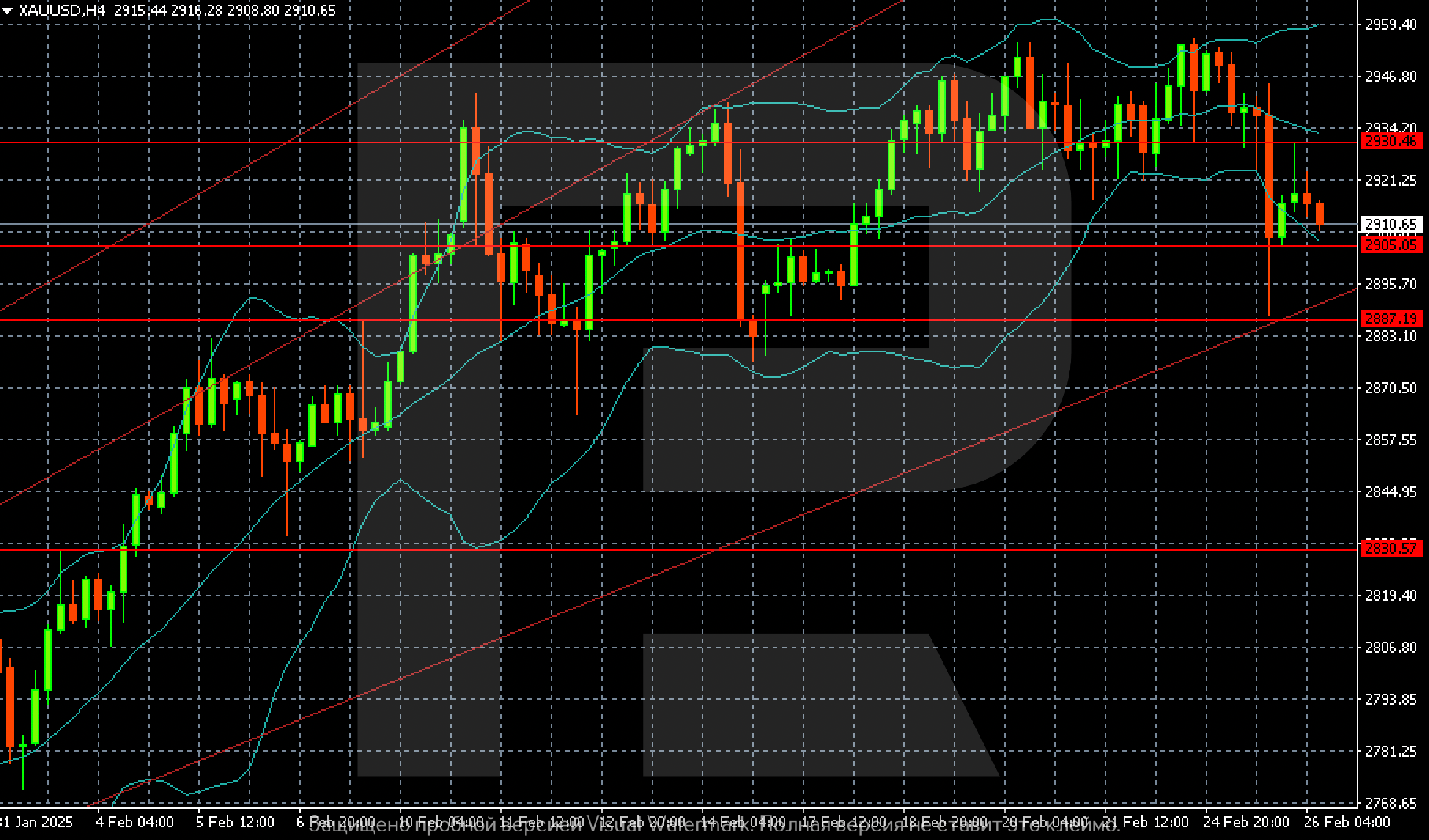

On the H4 chart, XAUUSD prices could decline to 2,905 USD. There is an intermediary support level here, which could deter sellers. If the plan does not work out, the new selling target will be 2,887 USD.

However, if the 2,905 USD level remains intact, the market could move up to 2,930 USD.

.png)

Summary

Gold halted its ascent as the market locked in profits after the previous upward wave. The Gold (XAUUSD) forecast for today, 26 February 2025, does not rule out a decline to 2,905 USD, where the market will have to make important decisions.