Following a decline, Brent crude oil is attempting a recovery, with a potential growth target of 73.00. Discover more in our analysis for 24 December 2024.

Brent forecast: key trading points

- Brent crude oil futures show growth on the London Stock Exchange

- Market participants anticipate a pre-New Year rally

- Brent forecast for 24 December 2024: 73.00 and 72.30

Fundamental analysis

Brent crude oil continues to strengthen amid a reduction in global hydrocarbon reserves.

Brent prices are experiencing moderate growth on 24 December 2024, following slight declines in the previous days. This morning, February futures on London’s ICE Futures exchange increased by 0.35 USD (0.48%), reaching 72.98 USD per barrel.

Analysts attribute this growth to the recovery from the previous decline and market participants’ expectations ahead of the upcoming holidays, which could lead to lower trading volumes and increased volatility.

Nevertheless, the market remains concerned about an economic slowdown in China, one of the world’s largest oil consumers, and the strengthening of the US dollar. All these factors could exert pressure on prices in the near term.

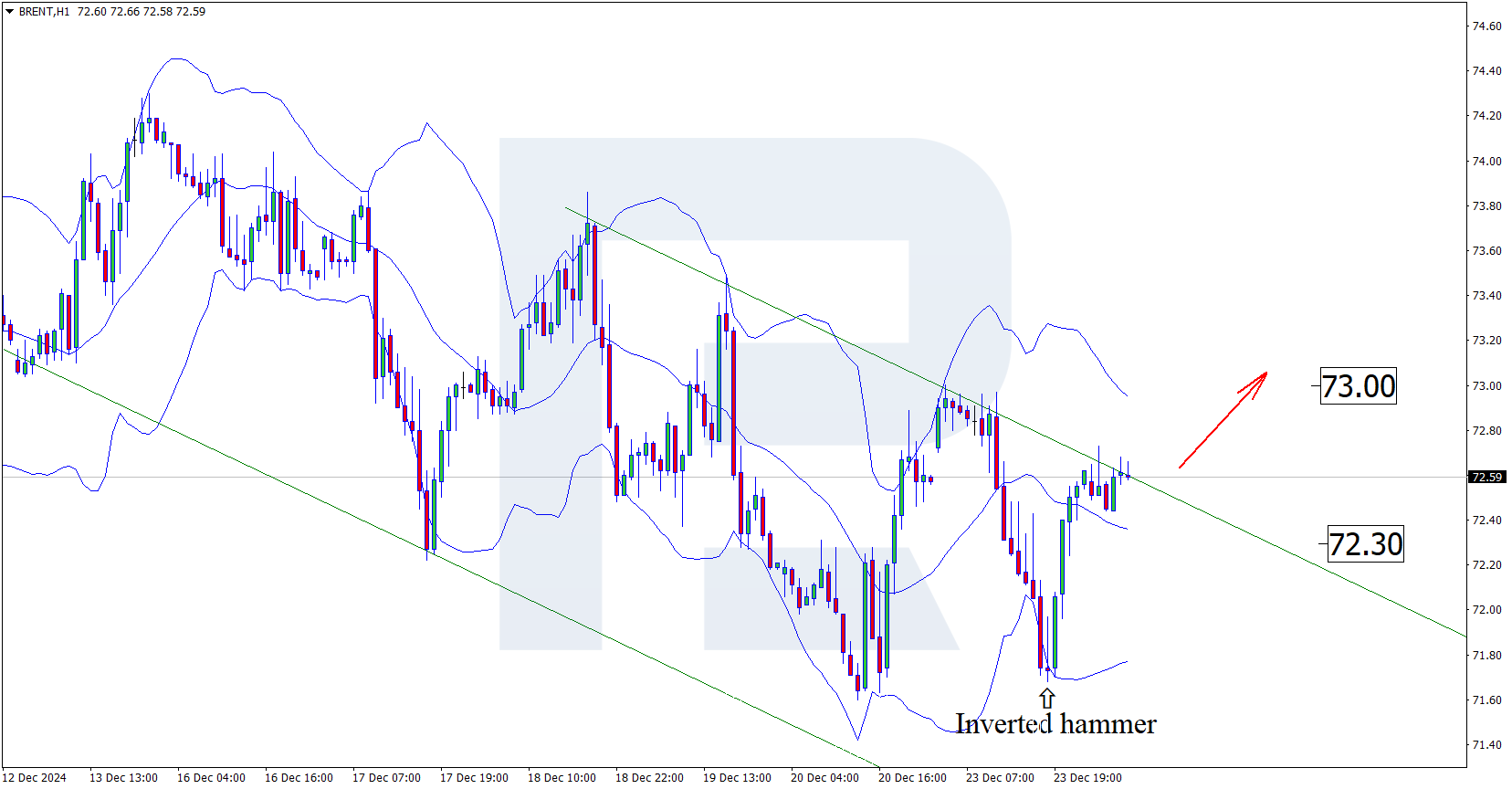

Brent technical analysis

Having tested the lower Bollinger band, the price formed an inverted hammer reversal pattern on the Brent H1 chart. At this stage, the price continues its ascent following the received signal. Since the quotes are testing the upper boundary of an ascending channel after a pullback, a breakout above the resistance level could sustain upward momentum.

Brent analysis for today, 24 December 2024, indicates that the growth target will likely be the next resistance level at 73.00. If this level is breached, it could pave the way for a stronger upward movement. However, an alternative scenario is possible, with the price declining to 72.30 or lower.

.png)

Summary

Alongside technical analysis, the increase in oil futures prices suggests further growth in Brent prices to 73.00 USD.