The DE 40 stock index started yesterday with an initial rise, following the US indices, but ended lower, closing at around 19,000. The DE 40 forecast for next week remains negative.

DE 40 forecast: key trading points

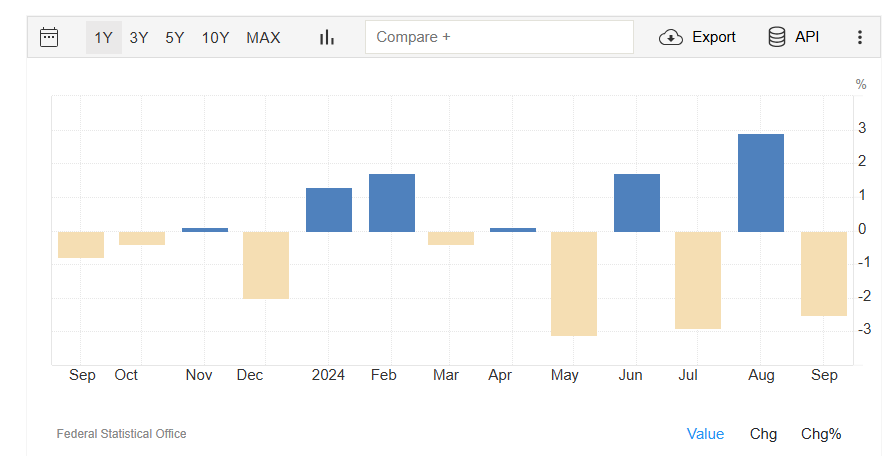

- Recent data: Germany’s industrial production decreased by 2.5% month-on-month in September

- Economic indicators: Germany’s trade surplus sank to 17 billion euros in September

- Market impact: a decrease in economic indicators exerts pressure on the DE 40 index price

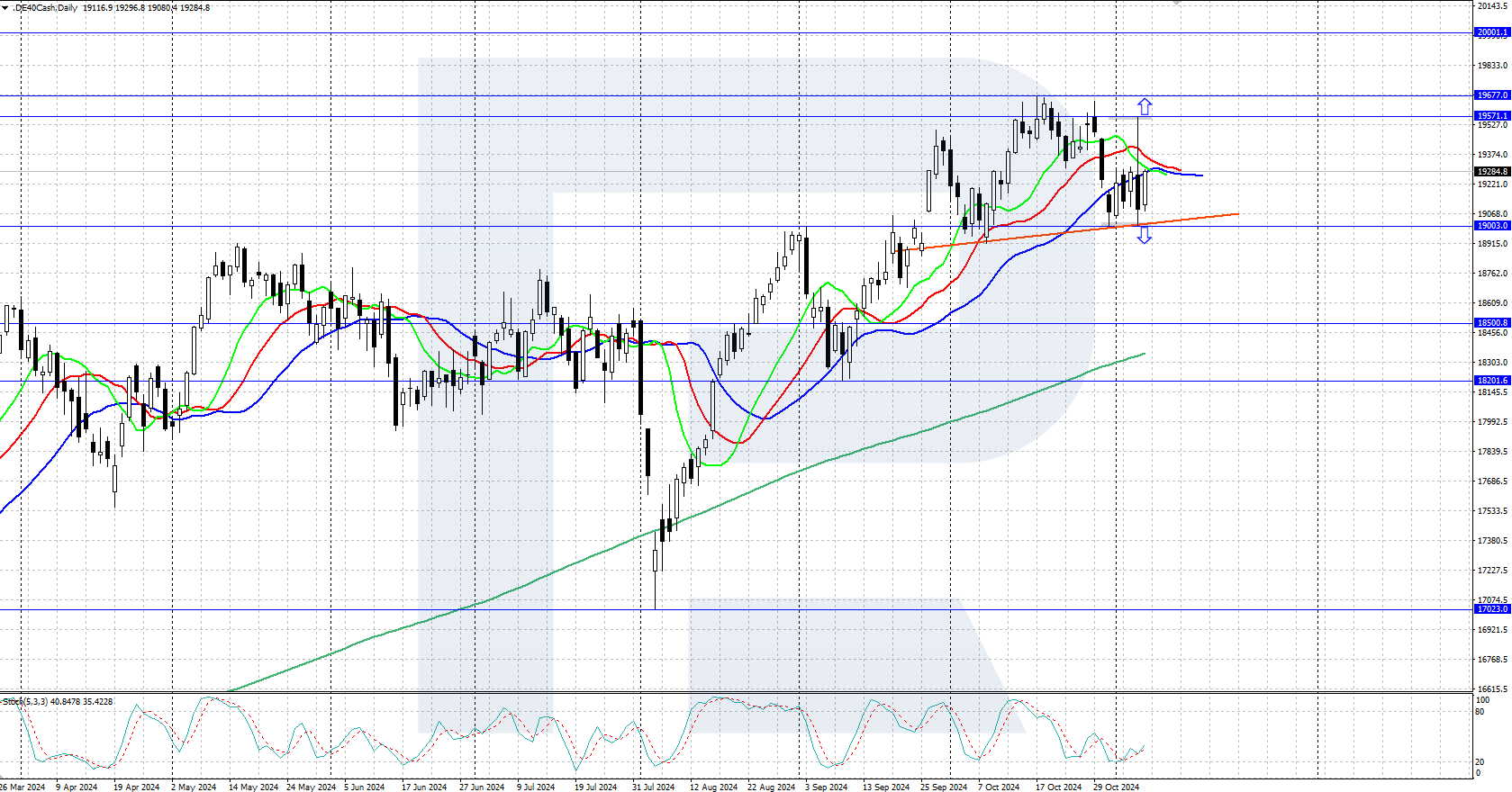

- Resistance: 19,570.0, Support: 19,000.0

- DE 40 price forecast: 18,500.0

Fundamental analysis

Germany’s industrial production fell by 2.5% month-on-month in September, below the projected 1.0% decline, following a 2.9% increase in August. Industrial production contracted by 4.6% year-on-year, a deeper drop than the 3.0% decline in August.

.png)

Source: https://tradingeconomics.com/germany/industrial-production-mom

The DE 40 reversed yesterday after rising in the morning, losing about 1.1% and closing around 19,000.0, the lowest reading in November. Traders and investors negatively assessed the possible effects of Donald Trump’s victory in the US election on the German stock market.

Market participants are concerned about the negative impact of Trump’s policies on the German economy, especially the announced tariffs on key sectors such as the automotive and chemical industries. The automotive industry is one of the most affected sectors, with BMW shares falling nearly 7.0%. Other automakers’ stocks also declined, with Mercedes-Benz down 6.7%, VW down 5.9%, and Porsche down 5.2%.

DE 40 technical analysis

The DE 40 stock index attempted to reverse upwards yesterday following the US indices but failed to break above the 19,570.0 resistance level and retraced to support around 19,000.0. The direction in which the price breaks out of the range (19,000.0-19,570.0) will determine further prospects for index movements.

.png)

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: if the price gains a foothold below the 19,000.0 support level, the index could decline to 18,500.0

- Optimistic DE 40 forecast: if the price surpasses the 19,570.0 resistance level, it could reach a new high of 19,677.0, potentially rising to 20,000.0

Summary

The DE 40 stock index started yesterday with an initial rise, following the US indices, but declined to around 19,000.0. Market participants are concerned that Donald Trump’s policy, following his US presidential election victory, may negatively impact the German economy, particularly the announced tariffs on key sectors such as the automotive and chemical industries.