Rising eurozone figures and speeches by ECB officials are bolstering the euro. Find out more in our analysis for 4 November 2024.

EURUSD forecast: key trading points

- The eurozone’s manufacturing PMI: previously at 45.0, projected at 45.9

- A speech by a member of the Supervisory Board (ECB representative), Elizabeth McCaul

- A speech by European Central Bank official Frank Elderson

- EURUSD forecast for 4 November 2024: 1.0935 and 1.0966

Fundamental analysis

The manufacturing PMI evaluates the activity of purchasing managers in the industrial sector. It reflects the state of the industrial sector and the dynamics of manufacturing processes in the country. Traders closely monitor changes in this index, as purchasing managers are the first to receive information about their companies’ performance. This makes the PMI a crucial measure of the overall economic situation. Readings above 50.0 points indicate industrial growth, while values below 50.0 points suggest a downturn.

The forecast for 4 November 2024 shows that the eurozone’s manufacturing PMI could rise to 45.9, thereby strengthening the euro against the US dollar.

Following the release of statistics and indices, ECB officials McCaul and Elderson will deliver speeches, and their statements and comments will provide additional support for the euro.

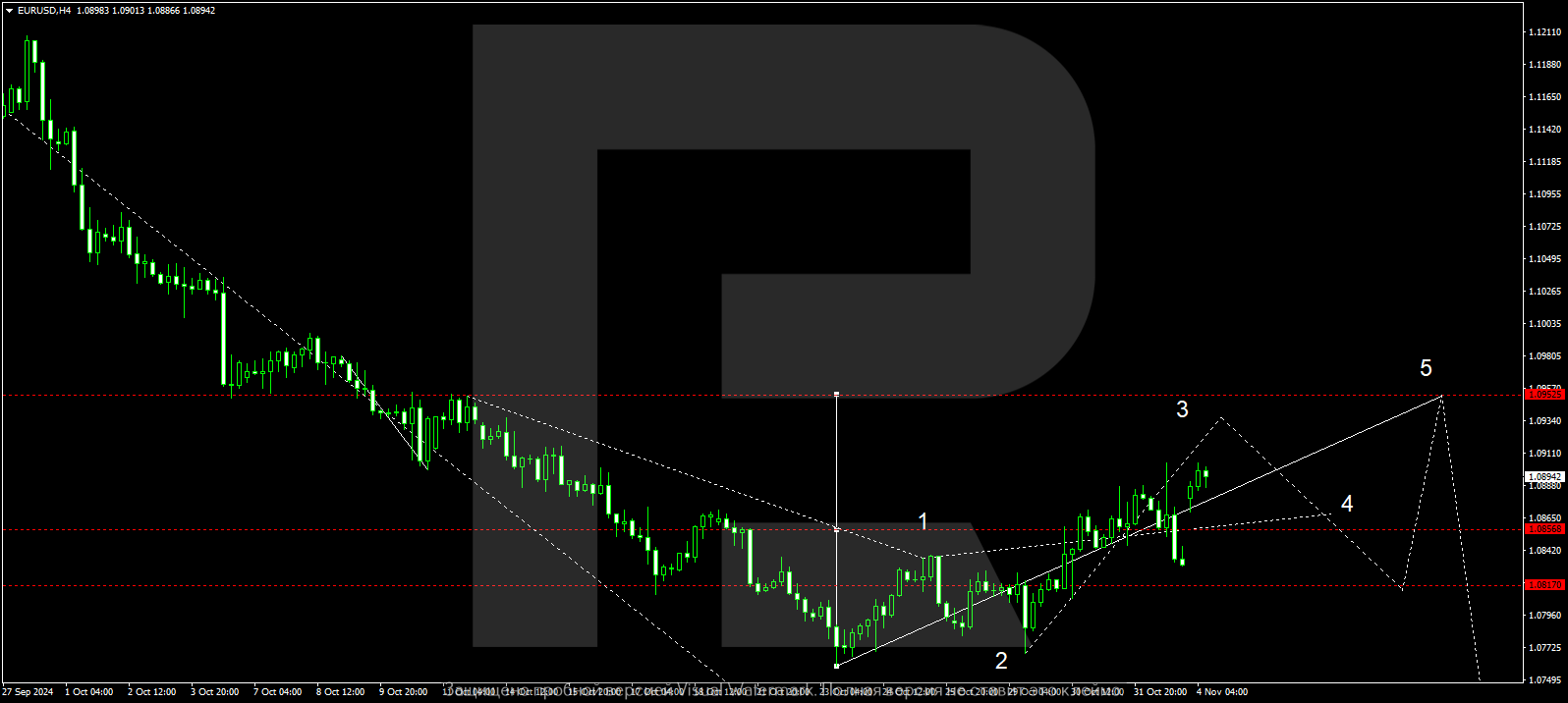

EURUSD technical analysis

The EURUSD H4 chart shows that the market has received support at 1.0831 and continues its upward momentum. A consolidation range has formed around 1.0836, with the price expected to break above the range today, 4 November 2024. A breakout of the 1.0900 level will open the potential for a wave towards 1.0935, the local target. After reaching this level, the EURUSD rate could undergo a correction towards 1.0866 (testing from above). Subsequently, another corrective wave might develop, aiming for 1.0966.

The Elliott Wave structure and wave matrix, with a pivot point at 1.0855, technically confirm this scenario. This level is considered crucial for a corrective wave in the EURUSD rate. The market is forming a consolidation range around the central line of a price envelope. A potential breakout above this range towards 1.0935 is anticipated today. After reaching this level, the price could decline to 1.0866 – the envelope’s central line (testing from above). Subsequently, a growth wave might develop, targeting the upper boundary of the price envelope.

.png)

Summary

Alongside technical analysis for today’s EURUSD forecast, statements from the European Central Bank officials suggest that the growth wave could continue towards the 1.0935 and 1.0966 levels.