The NZDUSD pair maintains its strength on Friday. Yesterday’s US statistics may prompt adjustments. More details in our analysis for 1 November 2024.

NZDUSD forecast: key trading points

- The NZDUSD pair halted its decline

- The market awaits US employment data and considers the risks of the upcoming presidential election

- NZDUSD forecast for 1 November 2024: 0.6006 and 0.6030

Fundamental analysis

The NZDUSD rate is hovering around 0.5974 on Friday.

Today, the US will release significant labour market statistics for October. The data will show how resilient this sector is. Subsequently, the focus will shift to the US presidential election scheduled for next week.

The New Zealand dollar remains under pressure due to the Reserve Bank of New Zealand’s soft stance. With inflation returning to the RBNZ’s target range, the market has grown confident that interest rate cuts will continue. The rate is currently at 4.75% and may decrease to 3.14% by the end of 2025.

The NZDUSD forecast is neutral.

NZDUSD technical analysis

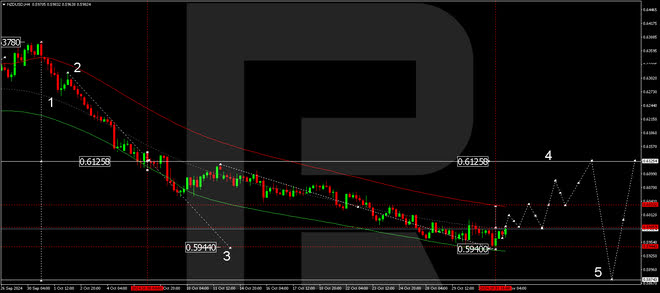

The NZDUSD H4 chart shows that the market has reached the local target of the downward wave at 0.5940. A growth impulse towards 0.5983 has formed today, 1 November 2024. Considering a potential correction of this impulse towards 0.5961 is pertinent. A growth wave is expected once the correction is complete, aiming for 0.6006 as the local target.

The Elliott Wave structure and wave matrix for the NZDUSD rate, pivoting at 0.6125, technically confirm this scenario. The market has reached the target of the third downward wave and has begun to develop a corrective wave after receiving support at the lower boundary of the price envelope. Today, the market is hovering around the central line of the price envelope, with consolidation likely to form around this line. A breakout above the consolidation range could see the correction continue towards the upper boundary of the price envelope.

.png)

Summary

The NZDUSD pair halted its decline but remains under pressure due to the fundamental environment. Technical indicators in today’s NZDUSD forecast suggest that the corrective wave could continue towards the 0.6006 and 0.6030 levels.