Decreased unemployment in Japan and increased consumer confidence in the US support the strength of the US dollar. Discover more in our analysis for 29 October 2024.

USDJPY forecast: key trading points

- Japan’s unemployment rate: previously at 2.5%, currently at 2.4%

- US job openings: previously at 8.040 million, currently at 7.980 million

- The US Consumer Confidence Index: previously at 98.7%, projected at 99.5%

- USDJPY forecast for 29 October 2024: 154.11 and 155.20

Fundamental analysis

Japan’s unemployment rate is characterised by consistently low levels, especially compared to other developed countries. This phenomenon is attributed to several factors:

Ageing population: Japan is facing a demographic crisis, with its population ageing and shrinking, leading to lower competition for jobs. As employees retire, the demand for workers remains high, supporting a low unemployment rate

Employment policy and corporate culture: Japan has traditionally followed a lifetime employment system in large corporations, contributing to stable employment. Although this system has weakened in recent decades, many companies still adhere to long-term employment practices

Restricted employment market and low job mobility: workers in Japan are less inclined to change jobs, and companies tend to be cautious about hiring, resulting in a stable labour market with low employee turnover. This stability helps maintain a low unemployment rate

Government employment support: the Japanese government actively promotes employment programs for the unemployed, retraining initiatives, and workforce support, especially for young professionals and women, which also contributes to reducing the overall unemployment rate

Fundamental analysis for 29 October 2024 shows that Japan’s actual unemployment rate was below forecast, reaching 2.4%, a 0.1% decrease from the previous reading.

The US JOLTS job openings report, a positive factor for the US dollar, provides a monthly summary of job vacancies across trade, manufacturing, and office services. This indicator shows the number of unfilled positions on the last working day of the month.

Published by the US Bureau of Labor Statistics, the report is based on the Job Openings and Labour Turnover Survey (JOLTS), where employers estimate the number of employees, vacancies, hires, and resignations. These data are analysed and published monthly, with a breakdown by industry and region.

The forecast for 29 October 2024 suggests that actual job openings may decrease to 7.980 million; a fall in unemployment remains a positive factor for the US dollar.

The Consumer Confidence Index reflects consumers’ confidence in the current economy. It is one of the leading indicators of consumer spending, which forms a significant part of economic activity. A high index points to optimism among consumers, and the forecast suggests that it may rise to 99.5%, indicating positive consumer sentiment.

USDJPY technical analysis

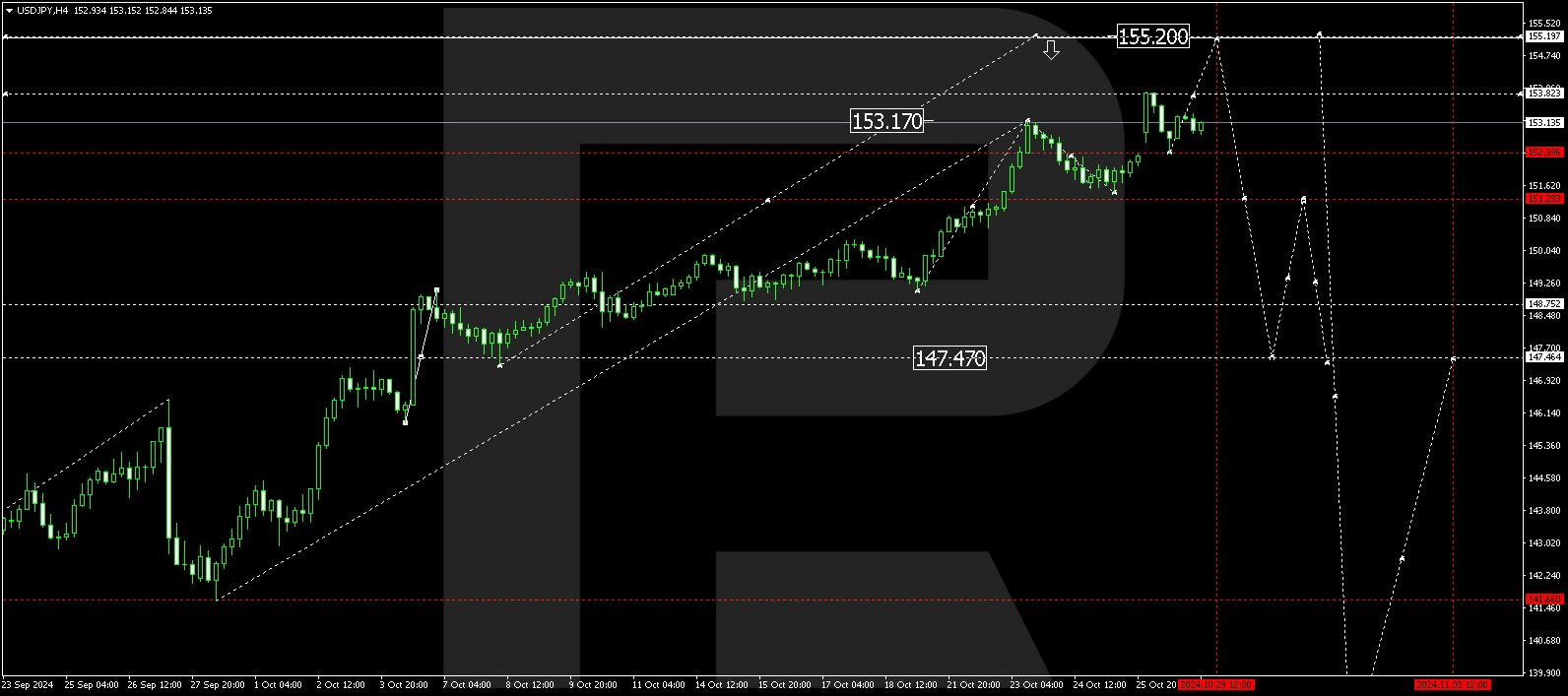

The USDJPY H4 chart shows that the market has technically returned to the 152.39 level (testing from above). A consolidation range continues to develop above this level today, 29 October 2024. If the USDJPY rate breaks above the range, the growth wave could extend to 155.20. In the event of a downward breakout, a more substantial correction could begin, aiming for 147.47, with the initial correction target at 151.28.

.png)

Summary

Alongside the USDJPY technical analysis for today’s USDJPY forecast, a decrease in job openings and increased consumer confidence suggest that the growth wave could continue towards the 154.11 and 155.20 levels.