Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 29 October - 1 November 2024.

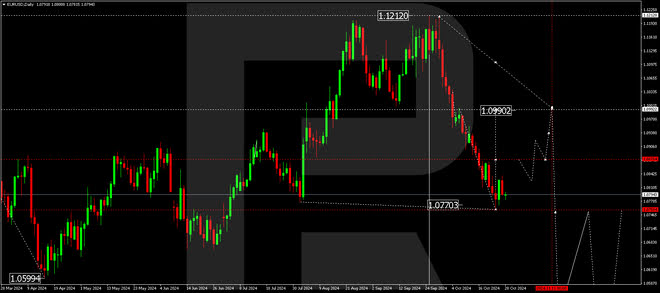

EURUSD forecast

The EURUSD pair has completed a downward wave, reaching 1.0760. After hitting this level, the price completed the first upward impulse towards 1.0833. The correction of this impulse is expected to end at 1.0780 today, with a broad consolidation range forming at the lows of the downward wave. Once the correction is complete, another growth wave is expected to develop, aiming for 1.0880 and potentially continuing to 1.0990.

.png)

USDJPY forecast

The USDJPY pair has nearly reached the local target of the upward wave. A consolidation range is expected to form at the current highs. With a breakout below the range, the price could decline to 148.33 (testing from above). Subsequently, a new growth wave might start, aiming for 155.00. The entire upward structure is considered a corrective wave within the previous downward wave towards 139.70. Once the price reaches the 155.00 level, the downtrend could continue towards 137.77.

.png)

GBPUSD forecast

The GBPUSD pair has completed a downward wave, reaching 1.2908. The upward impulse towards 1.2979 and the subsequent correction towards 1.2939 are over, practically outlining the boundaries of a consolidation range at the lows of the downward wave. Another upward wave is expected to start today, aiming for 1.3040. Alternatively, a breakout above the consolidation range could develop a corrective wave, with the correction target at 1.3170. Once the correction is complete, a new downward wave could start, aiming for 1.2820.

.png)

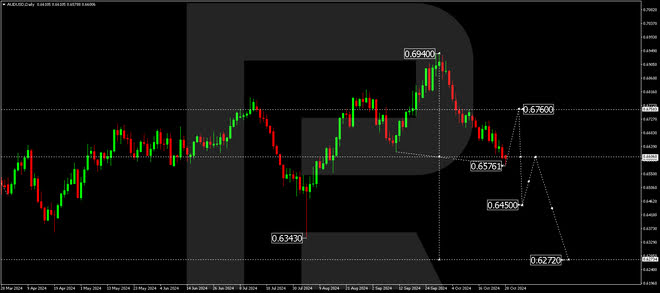

AUDUSD forecast

The AUDUSD pair has completed a downward wave, reaching 0.6576. Today, an upward wave could develop, targeting 0.6666 and potentially extending the correction towards 0.6760. Once the correction is complete, considering the beginning of a new downward wave towards 0.6570 and potentially further towards the local target of 0.6450 will be appropriate.

.png)

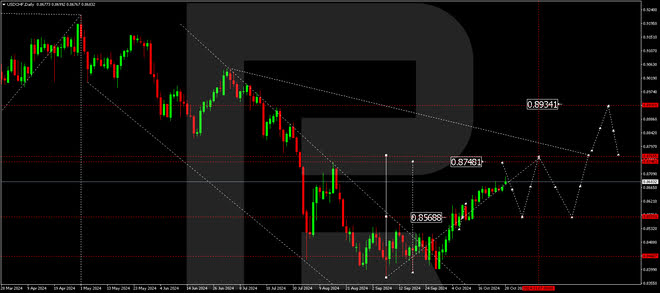

USDCHF forecast

After breaking above the 0.8570 level, the USDCHF pair maintains its upward momentum towards the local target of 0.8748. Once the price hits this level, a correction towards 0.8570 (testing from above) is expected to start. Subsequently, a new upward wave is expected to develop, aiming for 0.8767 as the initial main target.

.png)

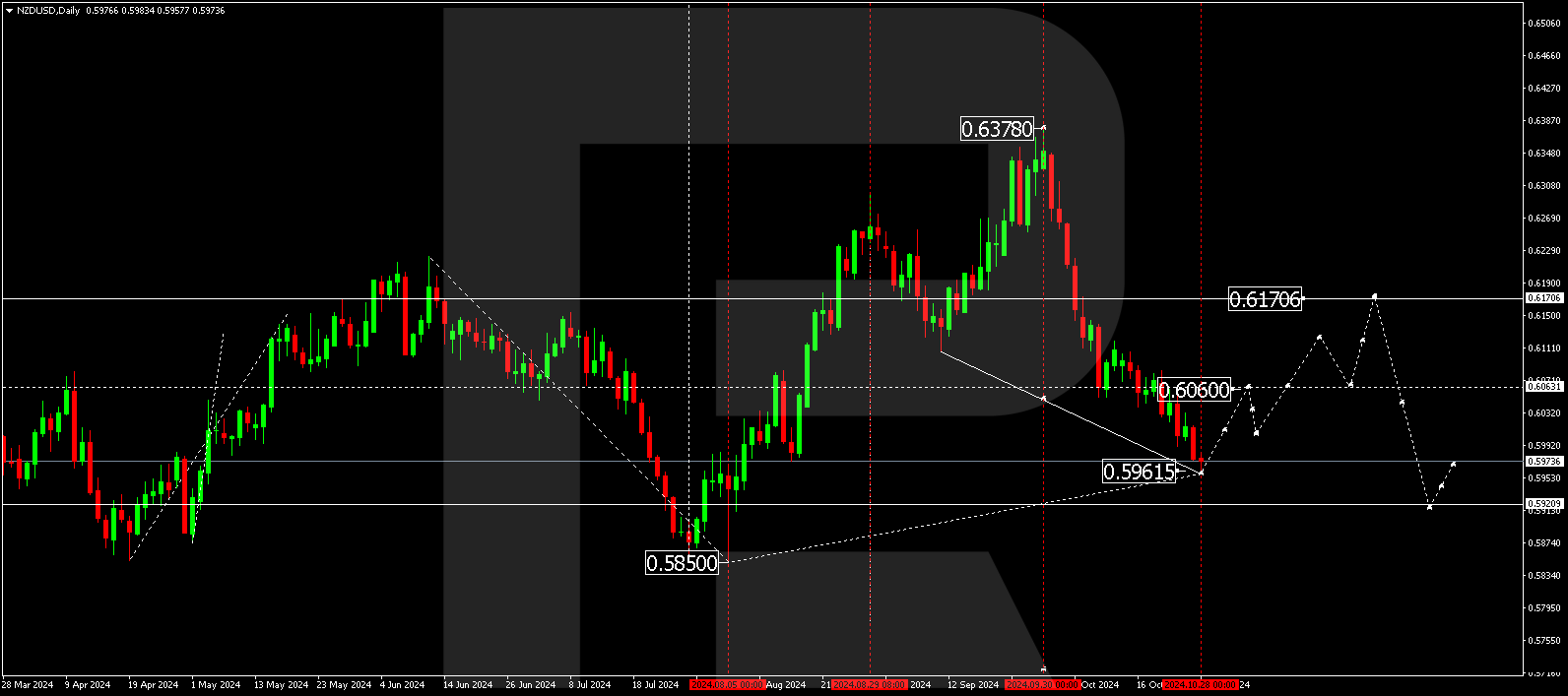

NZDUSD forecast

The NZDUSD pair has completed a downward wave, reaching 0.5962. A consolidation range is forming at the lows of a downward wave today. With an upward breakout, a correction could start, aiming for 0.6170. Once the correction is complete, the price could decline to 0.5920, potentially continuing towards the local target of 0.5800.

.png)

USDCAD forecast

The USDCAD pair has formed a consolidation range around 1.3838 and could continue its upward trajectory towards 1.3926 once it breaks above it. After the price reaches this level, it may be worth considering a correction towards 1.3740, the first target.

.png)