The USDCAD rate is rising, reaching the upper boundary of a long-term range. Discover more in our analysis for 30 October 2024.

USDCAD forecast: key trading points

- US job openings in September 2024 decreased by 418,000 to 7.443 million

- The US Consumer Confidence Index rose to 108.7 points in October, beating analysts’ forecasts

- Canada’s wholesale sales increased by 0.9% amid growing demand for motor vehicles and their spare parts

- USDCAD forecast for 30 October 2024: 1.3933 and 1.3839

Fundamental analysis

The USDCAD rate has risen for the fifth consecutive week, reaching a critical resistance level at 1.3930, which has remained unbroken since October 2022. The US dollar remains strong amid the increasing prospects of Donald Trump’s potential presidency and the expectation of a less aggressive Federal Reserve policy on interest rate cuts.

The JOLTS report shows a weakening of the US labour market, with job openings at their lowest level since January 2021 amid increasing layoffs. Job openings declined by 418,000 in September 2024 to 7.443 million, from a revised August reading of 7.861 million and below the market forecast of 7.990 million.

The US Consumer Confidence Index rose to 108.7 points in October, marking the most substantial increase since March 2021. Experts expected growth to reach 98.9 points. Analysts note that, despite positive dynamics in October, the index remains within the same range for two years. At the same time, all five index components improved, which may support the US dollar as part of the USDCAD forecast.

According to preliminary data, Canada’s wholesale sales increased by 0.9% month-on-month in September 2024, following a 0.6% decline in August. Growth was primarily driven by increased sales in the motor vehicles and spare parts sector, agriculture, and the chemical industry.

USDCAD technical analysis

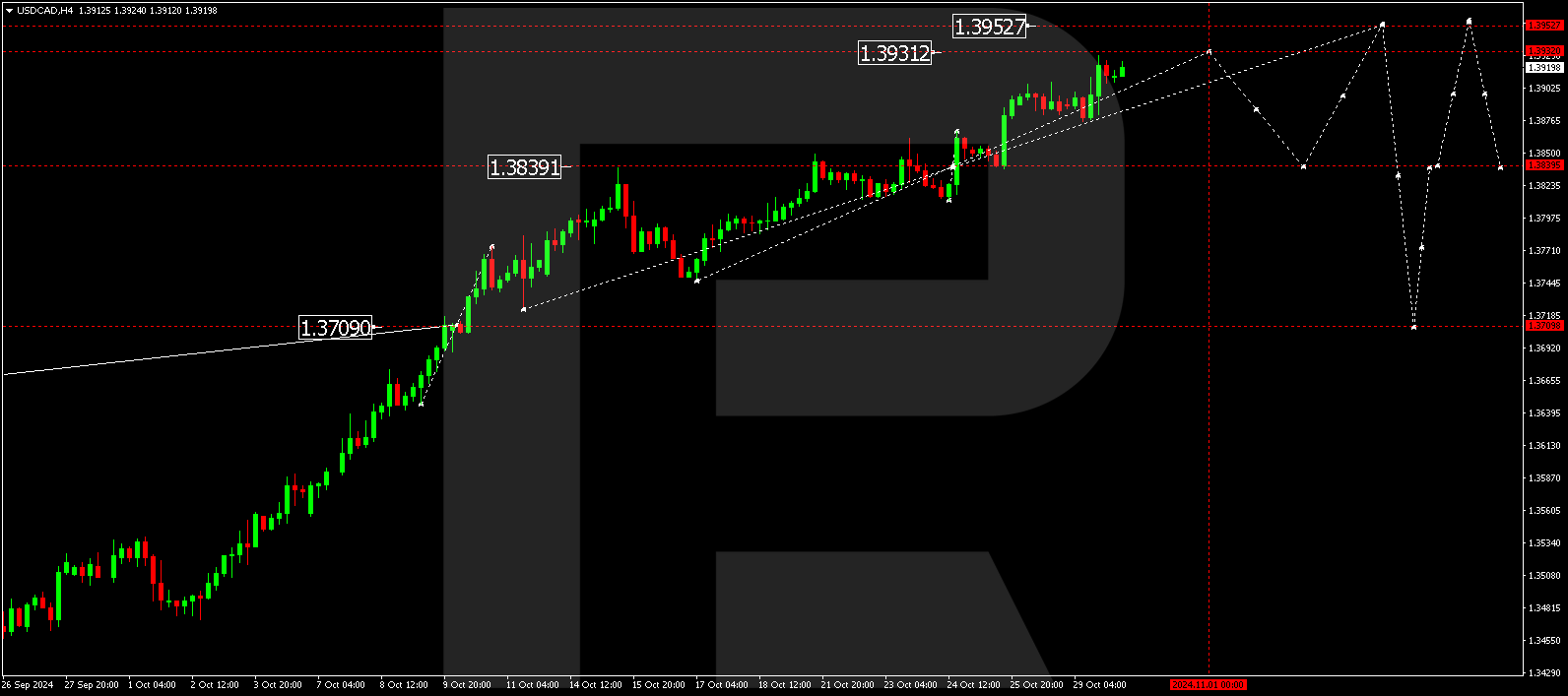

The USDCAD H4 chart shows that the market has formed a consolidation range around 1.3838 and, breaking above it, continues its momentum towards 1.3933. The price is expected to reach this target level today, 30 October 2024. Following this, a potential correction towards 1.3839 may occur, after which another growth wave in the USDCAD rate could target 1.3953 as a local high. A more substantial correction towards 1.3710 might follow later, with the initial correction target at 1.3839.

.png)

Summary

The USDCAD rate continues to rise, supported by a strong US dollar amid political developments and a less aggressive Federal Reserve stance. Meanwhile, reports indicate a weakening US labour market alongside improved consumer confidence, while Canada records increased wholesale sales. Technical indicators in today’s USDCAD forecast suggest that the growth wave could continue towards 1.3933, followed by a correction towards 1.3839.