The US Tech stock index is in an uptrend; following weak labour market data, it is highly likely to reach a new all-time high. The US Tech forecast for next week is cautiously optimistic.

US Tech forecast: key trading points

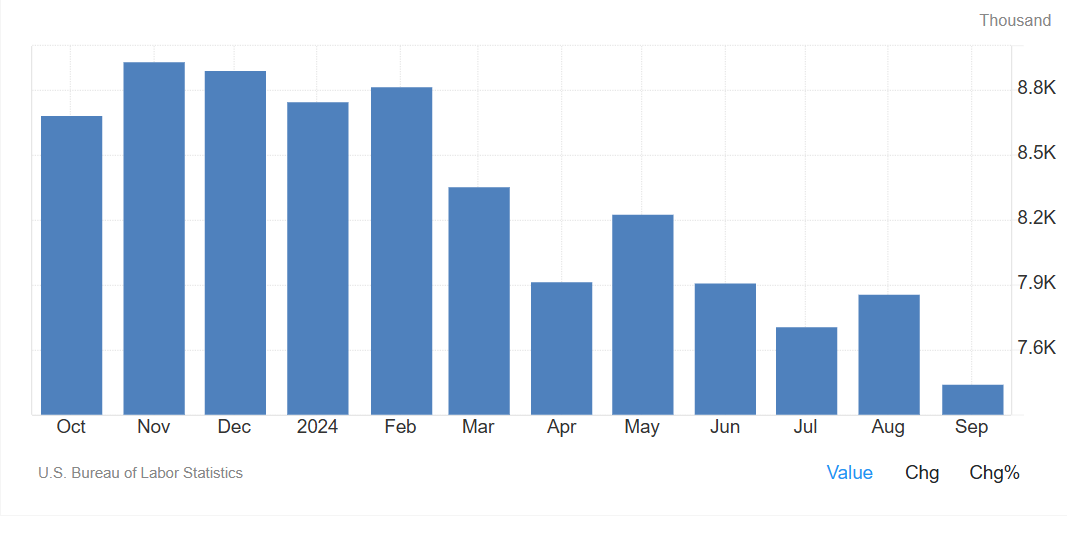

- Recent data: the JOLTS (Job Openings and Labor Turnover Survey) reported job openings at 7.443 million in September

- Economic indicators: the JOLTS reflects the number of unfilled US positions in September

- Market impact: alongside inflation, the labour market is a key indicator for the US Federal Reserve to determine future monetary policy

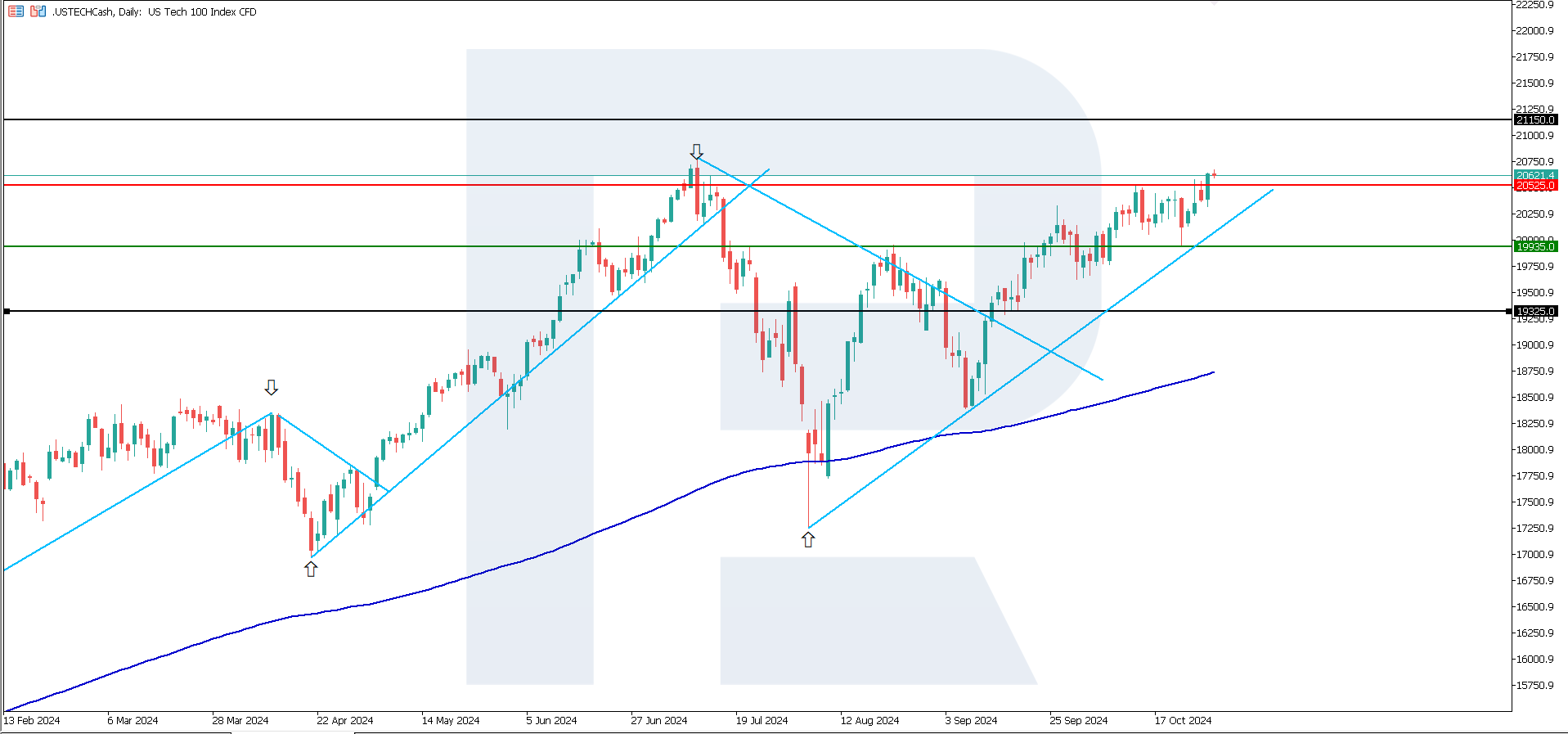

- Resistance: 20,525.0, Support: 19,935.0

- US Tech price forecast: 21,150.0

Fundamental analysis

The decrease in job openings relative to expectations and previous readings shows that demand for labour has declined. This may indicate a cooling in the labour market, which, in turn, points to a potential economic slowdown.

.png)

Source: https://tradingeconomics.com/united-states/job-offers

The market may view the decrease in JOLTS job openings as a signal that the Federal Reserve may accelerate the pace of interest rate cuts as the labour market shows signs of cooling. Overall, this is favourable for the stock market, especially for the technology sector, which is sensitive to interest rates.

In the short term, technology stocks may benefit from this data as a potential slowdown in interest rate growth, combined with high consumer confidence, enhances their attractiveness. Lower interest rates make future cash flows more valuable, which is especially important for tech companies focused on long-term growth. The US Tech index forecast is moderately optimistic.

US Tech technical analysis

The uptrend in the US Tech index continues and gains momentum. The price has broken above the 20,525.0 resistance level. According to technical analysis on the US Tech index, if the quotes hold above this level, they will likely reach another all-time high in the short term. There are no indications of a reversal to a downtrend.

.png)

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 19,935.0 support level could push the index down to 19,325.0

- Optimistic US Tech forecast: if the price consolidates above the breached resistance level at 20,525.0, it could rise to 21,150.0

Summary

The number of JOLTS (Job Openings and Labor Turnover Survey) job openings was 7.44 million in September, below analysts’ forecasts of 7.98 million. This may indicate a cooling labour market, which, in turn, could point to a potential economic slowdown. In the short term, this fact may prompt the US Federal Reserve to cut interest rates more aggressively, positively affecting the stock market.