Coal prices have fallen by 68% from their September 2022 peak, and uranium prices have increased by 70% over the same period. Both coal and uranium are used as raw materials for electric power generation, but unlike uranium, coal is considered a polluting energy source. Given the global trend towards environmental protection, sustained interest in uranium may persist. The US is commissioning previously abandoned nuclear plants, while major technology companies actively invest in developing the nuclear power industry. We may be at an early stage of uranium price appreciation, which could lead to an inflow of investments in uranium ETFs.

This article examines which sectors create demand for electric power, which companies invest in nuclear energy, and who may benefit from the industry’s growth. It also provides a technical analysis of The Global X Uranium (NYSE: URA) stock and forecasts for The Global X Uranium ETF at the end of 2024.

Drivers of electric power demand growth

Electric power consumption has increased substantially in the automotive and technology sectors in recent years. In the automotive industry, growth is primarily due to the rising popularity of electric vehicles. The ramp-up in EV production by companies like Tesla Inc. (NASDAQ: TSLA), NIO Inc. (NYSE: NIO), and other automakers significantly boosted demand for electric power to charge these vehicles.

The primary growth driver in the technology sector is the rapid development of cloud technologies, data centres, and artificial intelligence. Data centres used to process and store large data arrays consume vast amounts of electricity. With increased digitalisation and demand for high-performance computing, electric power consumption in this sector has risen substantially.

Demand for electric power also remains high in blockchain and cryptocurrency mining. The popularity of digital currencies surged in 2017, leading to increased activity in this segment with a rise in users, investors, and miners. Mining Bitcoin and other cryptocurrencies requires substantial computing capacity to solve complex mathematical problems directly linked to high energy consumption.

As a result, the technology sector, which already faces capacity constraints, has joined traditional electric power consumers like manufacturing companies. The green agenda discourages using pollutive raw materials to generate electricity, prompting companies to seek cleaner energy sources. All these factors are driving investments in renewable energy sources and nuclear power.

However, renewable energy sources have significant limitations: they are intermittent and require storage systems and large areas for installation. In this context, nuclear energy is coming to the forefront, as it does not have these drawbacks and does not pollute the environment.

The US government has recently shown a warmer attitude towards nuclear power. The Three Mile Island Accident at a nuclear power plant in 1979 was the most severe in the history of the US nuclear energy industry, becoming a pivotal moment for the entire industry. This disaster significantly undermined public confidence in nuclear power plants. Following the accident, the construction of new nuclear power plants stopped for decades, with many projects being put on hold. However, in 2023, it was decided to resume operations at this nuclear power plant, confirming the US government’s growing interest in the nuclear power industry and a shift to a more liberal stance.

Alphabet, Amazon, Oracle, and Microsoft invest further in nuclear power

The largest tech companies, such as Alphabet Inc. (NASDAQ: GOOG), Amazon.com Inc. (NASDAQ: AMZN), Oracle Corp. (NYSE: ORCL), and Microsoft Corporation (NASDAQ: MSFT), have recently demonstrated substantial interest in the nuclear power industry, especially regarding the transition to more environmentally sustainable and stable energy sources.

In 2023, Microsoft signed a contract with Constellation Energy (NASDAQ: CEG) to support the restart of the Three Mile Island nuclear power plant, the site of a 1979 accident. In May of the same year, Microsoft signed another contract with Helion Energy, a private startup focused on developing a commercial fusion reactor.

Alphabet has partnered with Kairos Power, a private company developing small modular reactors (SMR) with molten-salt cooling that produce safe and affordable nuclear power. Alphabet plans to power its data centres from these reactors.

In October 2024, Amazon announced three new agreements to develop small modular reactors (SMR) to meet the energy needs of its data centres. Key details include a 500 million USD investment in Xcel Energy Inc. (NASDAQ: XCEL), a company specialising in advanced nuclear technologies, aiming at generating up to 5 GW of power by 2039. In addition, Amazon signed a memorandum of cooperation with Dominion Energy, Inc. (NYSE: D) to develop an SMR project near the operating North Anna nuclear power plant in Virginia. Amazon also plans to invest in Energy Northwest’s project, exploring the feasibility of building additional nuclear reactors adjacent to the Columbia Generating Station.

While commenting on the Q2 2024 report, Oracle Corporation (NYSE: ORCL) Founder and Chief Technology Officer Larry Ellison discussed the company’s ambitious plans to build a data centre powered by small modular nuclear reactors (SMRs). The corporation secured approval to construct three SMRs, supplying up to 1 GW of power for AI-driven data processing.

Investments by leading tech firms in nuclear power are setting a general trend for the industry. The US government has also prioritised developing this sector, undertaking several significant initiatives. One key initiative involves increasing research and development funding for nuclear energy to enhance reactor safety and efficiency. Measures have also been taken to expedite the construction of new nuclear power plants and upgrade existing ones.

How uranium prices have changed over the past 15 years

Given the interest of large corporations in nuclear power and the steps taken by the US government, it is clear that demand for uranium as nuclear fuel will continue to rise. Other countries are also taking steps to ensure their energy security and are increasingly considering nuclear energy, which is environmentally friendly and capable of fully meeting the economy’s energy needs. The chart below shows how uranium prices have changed over the past 15 years.

.png) Analysis and forecast for Global X Uranium ETF for 2024-2025

Analysis and forecast for Global X Uranium ETF for 2024-2025

The chart shows that uranium prices began rising in 2018, ultimately surpassing a 13-year high. In 2024, prices surged sharply, signalling growing demand for this fuel type.

Who are the key beneficiaries of nuclear power development?

Nuclear power development benefits uranium mining companies and companies involved in the construction of nuclear power plants. Firms developing small modular nuclear reactors (SMR) are seeing particular demand for their services. As nuclear power expands, the following issuers could significantly increase their revenue:

- JSC National Atomic Company Kazatomprom (LSIN: KAP): this is the world’s largest uranium mining company, and it is based in Kazakhstan. It is involved in natural uranium exploration, mining, processing, and sales, meeting a significant share of global demand. The company controls numerous uranium deposits in Kazakhstan, enabling it to maintain high output volumes, making the country a leading player in the global uranium market

- Cameco Corp. (NYSE: CCJ): one of the world’s largest uranium producers based in Canada. The company mines, processes, and sells uranium, supplying nuclear power plants worldwide. Cameco owns several large uranium deposits in Canada and Kazakhstan and controls significant processing facilities

- Uranium Energy Corp (NYSE: UEC): a US company involved in uranium mining and exploration for nuclear power. It develops major projects in Texas and Wyoming based on in-situ recovery (ISR) technology, considered an efficient and environmentally cleaner mining method. UEC also actively operates in Paraguay and Canada. The company owns one of the largest uranium reserves in the US

- Constellation Energy (NASDAQ: CEG): the largest US nuclear power plant operator, which separated from Exelon in 2022. The company generates over 20% of the country’s zero-carbon energy, focusing on nuclear power and renewable sources. Constellation actively promotes SMR projects and has signed contracts with major corporations (Amazon, Microsoft) to supply their data centres with clean energy

- Dominion Energy (NYSE: D): one of the largest US energy companies, producing and distributing electric power and natural gas. Dominion invests in renewable power projects, such as solar and wind generators, and operates nuclear power plants. It collaborates with Amazon on small modular reactors (SMR).

- Oklo Inc. (NYSE: OKLO): a US startup developing next-generation compact nuclear reactors that run on reprocessed nuclear fuel (metallurgic uranium). These reactors are designed for use in remote areas and small-scale grids, with a focus on sustainable and clean energy

- NuScale Power (NYSE: SMR): a company focused on developing SMRs. Their technology aims to produce nuclear power more safely and economically, making them in demand for decarbonising energy infrastructure around the world

- BWX Technologies (NYSE: BWXT): a US company specialising in developing and producing nuclear components and reactors for the defence, space, and commercial industries. The company is actively involved in the development of advanced nuclear technology, including SMRs, and plays a key role in providing energy and defence infrastructure for the US

Investing in each of these companies to benefit from nuclear power development requires substantial capital. Given this context, investing in the Global X Uranium ETF appears attractive. The corporation provides investors with access to a broad array of companies involved in uranium exploration and the production of nuclear components. The ETF comprises companies specialising in uranium exploration, mining, processing, and equipment production for the nuclear power industry.

Technical analysis and forecast for The Global X Uranium ETF shares

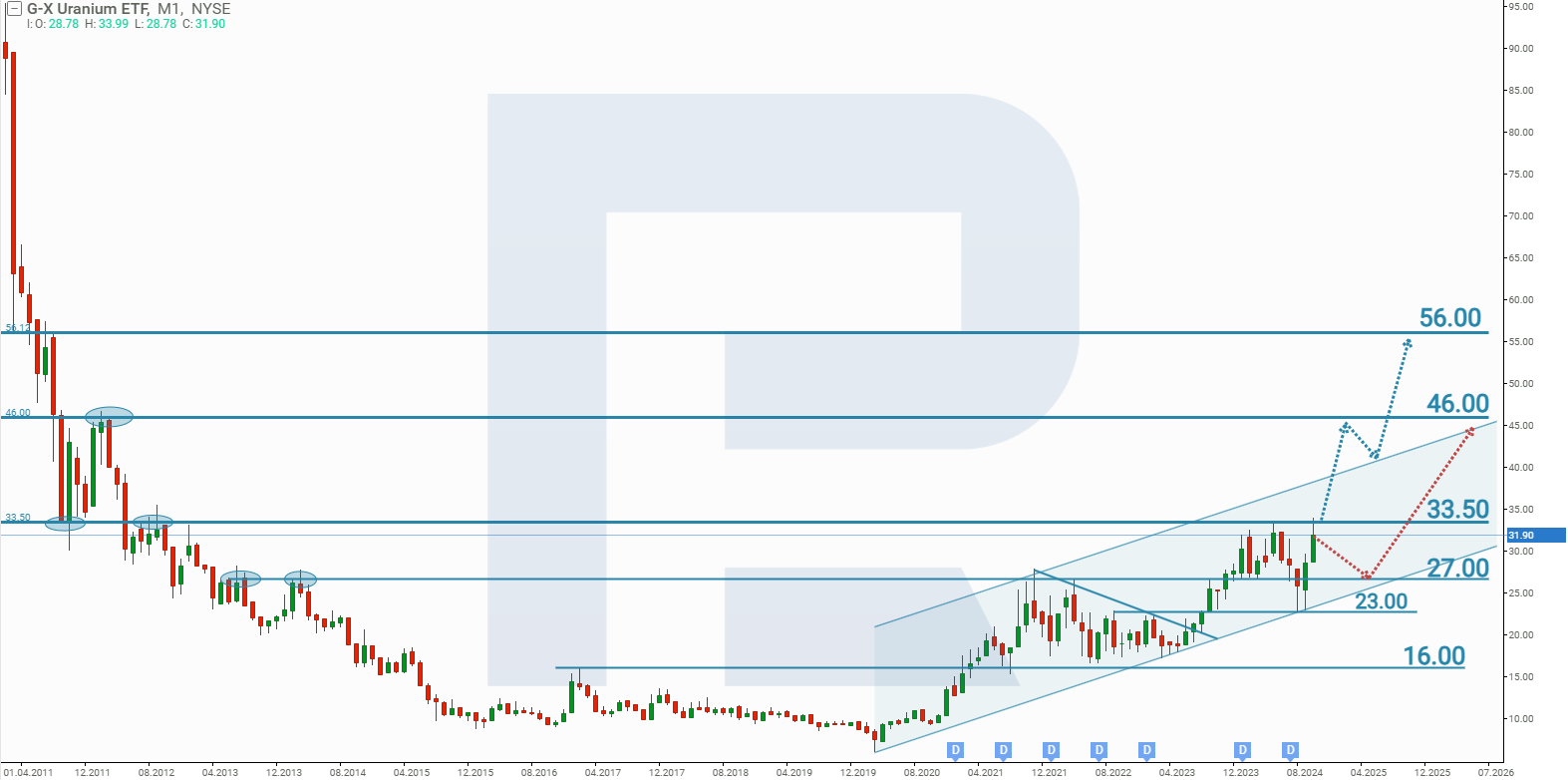

Global X Uranium ETF quotes have dropped by 94% from their February 2011 peak by March 2020. The reason could be excessive optimism surrounding renewable energy sources. However, when it became clear that renewables could not satisfy the growing power demand, all eyes were again turned to nuclear power. As a result, uranium prices began to rise in 2020, with inflows into Global X Uranium ETF increasing, positively affecting the company’s stock price.

The value of Global X Uranium ETF shares skyrocketed by over 460% from March 2020 to October 2024. This growth was interspersed with protracted corrections, enabling the price to continue its upward trajectory. Based on the current performance of Global X Uranium shares, two forecasts for Global X Uranium ETF stock for 2024 and 2025 can be considered.

The main forecast for Global X Uranium ETF shares suggests that the price could correct towards the 27 USD support level and rebound before rising to 45 USD. The decline to 27 USD is being considered as uranium prices have gained 50% over the past two months without significant corrections. Ultimately, Global X Uranium ETF shares are expected to rise gradually and reach the main target of 45 USD in 2025.

A more optimistic outlook for Global X Uranium ETF shares implies an aggressive rise, with the price breaking above the 33.50 USD resistance level and subsequently targeting the next resistance at 46.00 USD. However, this will only be a short stopover before moving to the main growth target of 56 USD. If this forecast materialises, the price might reach this level by the end of 2024 or the beginning of 2025.

Summary

The growing interest in developing nuclear energy can be attributed to its potential as a stable and environmentally “clean” energy source. Renewable sources (such as solar and wind power) offer advantages in reducing carbon emissions; however, their reliance on weather conditions and the need for substantial land areas to install infrastructure pose certain limitations. These sources cannot always ensure stable energy supplies, especially during peak consumption periods or under adverse weather conditions.

In contrast, nuclear energy enables consistent electricity generation, regardless of the time of day or external factors. Modern technologies, including small modular reactors, and initiatives to enhance nuclear plant safety are making this type of power generation increasingly “clean” and reliable. It has the potential to meet the energy demands of industrialised countries and accelerate their transition to a low-carbon economy. Nuclear energy presently appears to be an attractive solution for ensuring energy system stability while simultaneously minimising carbon emissions.

Given nuclear energy's promising future, it is reasonable to anticipate that investment flows into the Global X Uranium ETF will exceed the levels seen in 2011, indicating that the shares retain significant growth potential.

The sector first gained attention in 2022 with an article titled “How to Profit from Growing Uranium Prices,” when the shares of uranium mining companies had yet to demonstrate significant growth. Since then, the motivations to invest in nuclear energy have only multiplied.