Our analysts dedicated over 70 hours to crafting this in-depth EURUSD forecast for 2024-2026. They meticulously examined key factors shaping the pair's current and future trajectory. This analysis will be regularly updated to provide you with the latest insights for informed trading decisions.

The EURUSD pair in the first half of 2024 has been a rollercoaster of volatility, marked by sharp fluctuations within each day as economic uncertainties and central bank policies clash. Geopolitical events and macroeconomic indicators put serious pressure on the pair. What will be the forecast for EURUSD in the coming years?

In this article, we present a detailed forecast EURUSD for 2024, 2025 and 2026, analysing the key factors that will shape its direction. We have combined technical analysis, expert opinions, insights from leading banks and financial institutions, and artificial intelligence (AI) based forecasts. This will allow investors and traders to gain a deep understanding of possible EURUSD movements in the near future and make informed decisions for successful investments.

Table of contents:

- EURUSD forecast key points

- Factors affecting the EURUSD forecasts

- What happens with EURUSD in 2024?

- EURUSD current price

- Technical analysis of EURUSD for 2024

- Long-Term technical analysis of EURUSD for 2024

- Expert EURUSD forecasts for 2024

- EURUSD predictions for 2024 from AI

- Long-term EURUSD predictions from AI (2025-2026)

- Risks and considerations

- Conclusion

- FAQ

EURUSD forecast key points

The key elements that have the greatest impact on the EURUSD forecast in 2024 and longer term:

- Eurozone economic recovery. Moderate economic growth is expected in the Eurozone. According to the International Monetary Fund (IMF), growth in 2024 is projected to be 0.9%, rising to 1.5% in 2025. The region's economic recovery will be a key factor in strengthening the euro.

- Federal reserve monetary policy. The Fed's approach to inflation and interest rates will be a decisive factor for the US dollar's value. Slower interest rate cuts by the Fed compared to the ECB could lower the EURUSD exchange rate.

- Inflationary pressure. In 2024, inflation in both the Eurozone and the US is expected to decline slightly, gradually nearing target levels. Regulatory responses, including interest rate cuts, will significantly influence the movement of the EURUSD pair.

- Geopolitical risks. Geopolitical instability, particularly in the Middle East, has driven up energy prices. Supply chain disruptions and military conflicts may unpredictably affect the EURUSD exchange rate.

- EURUSD expert and AI forecasts. EURUSD forecasts are mixed: some expect the euro to strengthen, while others foresee the US dollar dominating. The forecasted range for EURUSD is between 1.0470 and 1.1300.

Key EURUSD forecast levels

Support:

- Key support at 1.0765

- Lower boundary of the long-term range at 1.0605

- Critical support if the long-term range is breached: 1.0205

Resistance:

- Nearest resistance at 1.0995

- Upper boundary of the long-term range at 1.1205

- Major resistance if the upper range is breached: 1.1585

In 2024, the EURUSD's trajectory will likely be shaped by the Eurozone's economic recovery, the monetary policies of the Fed and ECB, as well as inflationary and geopolitical factors. Forecasts remain uncertain, with a possible range between 1.0650 and 1.1700.

Factors affecting the EURUSD forecasts

Understanding the key factors that influence the EURUSD exchange rate is critical for accurate currency forecasting. Below are the main factors that will shape the direction of euro to US dollar currency pair in the coming years:

- Central bank policies. The European Central Bank (ECB) and the US Federal Reserve (Fed) have a significant impact on the EURUSD dynamics. Decisions regarding interest rates and inflation targets can dramatically shift market sentiment, leading to large-scale currency sales. A more aggressive policy from the Fed could support the US dollar.

- Economic growth and GDP data. Economic indicators from both the Eurozone and the US play a key role in shaping the EURUSD exchange rate. Strong GDP growth in the Eurozone could support the euro, while a slowdown in the US economy might weaken the US dollar. The difference in economic growth rates between the regions will define the long-term prospects for EURUSD, influencing overall market trends.

- Inflation rates. Inflation has a considerable impact on central bank decisions, which, in turn, affect national currency values. If inflation in the Eurozone rises faster than in the US, the ECB may delay cutting interest rates, pushing investors toward the US dollar.

- Political and geopolitical events. Political stability in the Eurozone and the US greatly influences EURUSD dynamics. For instance, the US presidential election could have a major impact on the currency pair, changing market expectations and investor sentiment. Energy crises and regional conflicts also add to market volatility, prompting investors to seek safer assets like the US dollar.

- Trade balances and current account deficits. The trade balance between the Eurozone and the US plays an important role in EURUSD dynamics. A widening US trade deficit could weaken the US dollar, while a growing Eurozone trade surplus would support the euro.

- Market sentiment and risk appetite. EUR to USD rate also responds to global market sentiment. Conflicts and wars can significantly affect economic growth and inflation in both the US and the Eurozone, making risk appetite and market mood important factors.

Evaluating and understanding these factors is crucial for analysing future currency movements and creating EUR to USD forecasts. By assessing the pair's movements and key events in 2024, it is clear that these forces will continue to drive the trend for several years ahead.

What happens with EURUSD in 2024?

In 2024, the EURUSD currency pair continues to trade within a narrow range, with the upper boundary at 1.1255 and the lower boundary at 1.0500. Typically, after the price moves out of such a corridor, a new trend can develop, expanding the range. Currently, the exchange rate is near the upper boundary of this prolonged sideways trend, but a strong fundamental shift is needed for it to break out. Let’s look at the factors that could push traders to move the pair beyond this range.

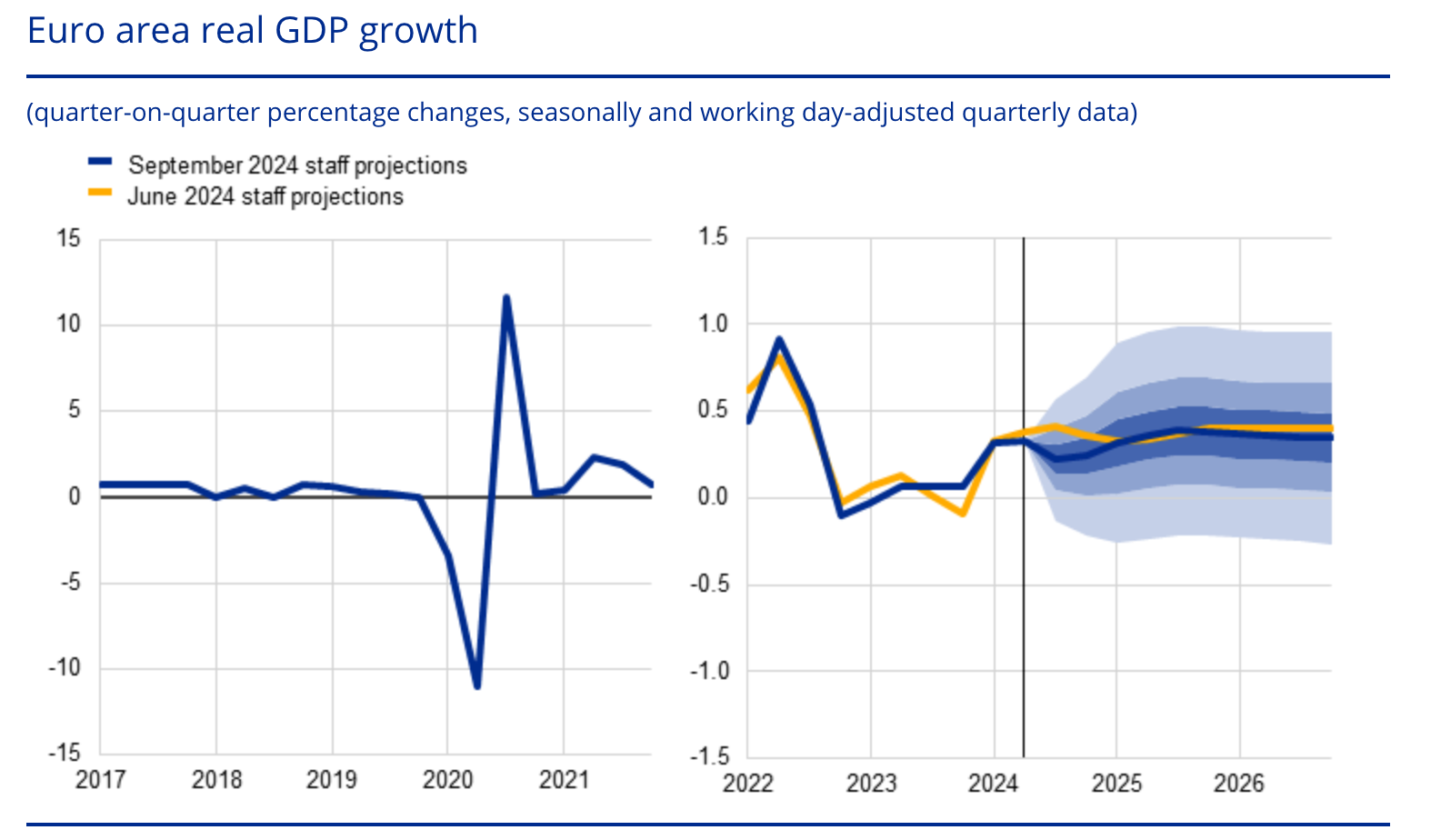

Economic growth rates in the Eurozone and the US

After post-pandemic recovery, moderate economic growth is forecasted in the Eurozone. In 2022, the region’s economy grew by 3.4%, but in 2023, it slowed to just 0.5%. According to the IMF, Eurozone growth is expected to be 0.9% in 2024, increasing to 1.5% in 2025. In contrast, the US economy grew by 3% annually in Q2 2024, while the Eurozone’s GDP increased by only 0.6% over the same period.

.png)

Source: https://www.ecb.europa.eu/

Current data suggests the Eurozone economy will grow by 0.2% in Q3, in line with Q2 growth. According to the ECB, the Eurozone’s annual real GDP growth rate will average 0.8% in 2024, reaching 1.3% in 2025 and 1.5% in 2026. However, Germany, the largest economy in Europe, showed stagnation in Q2, and its growth is forecasted at 0.8% in 2025 and 1.3% in 2026.

Comparison of ECB and Fed monetary policies

The US Federal Reserve’s stance on inflation and interest rates will be a key factor in forecasting EUR/USD. Strong US labour market data has significantly altered market expectations, sharply reducing the likelihood of the Fed cutting interest rates by 50 basis points at upcoming meetings. This report has virtually eliminated the possibility of a major rate cut in November, raising questions about whether cuts will happen at all in the near future.

Meanwhile, weak economic growth in the Eurozone and decreasing inflation, which fell below the ECB's 2% target in September, have increased expectations of a potential rate cut at the ECB’s October meeting. This could be the third rate cut this year, adding further pressure on the euro.

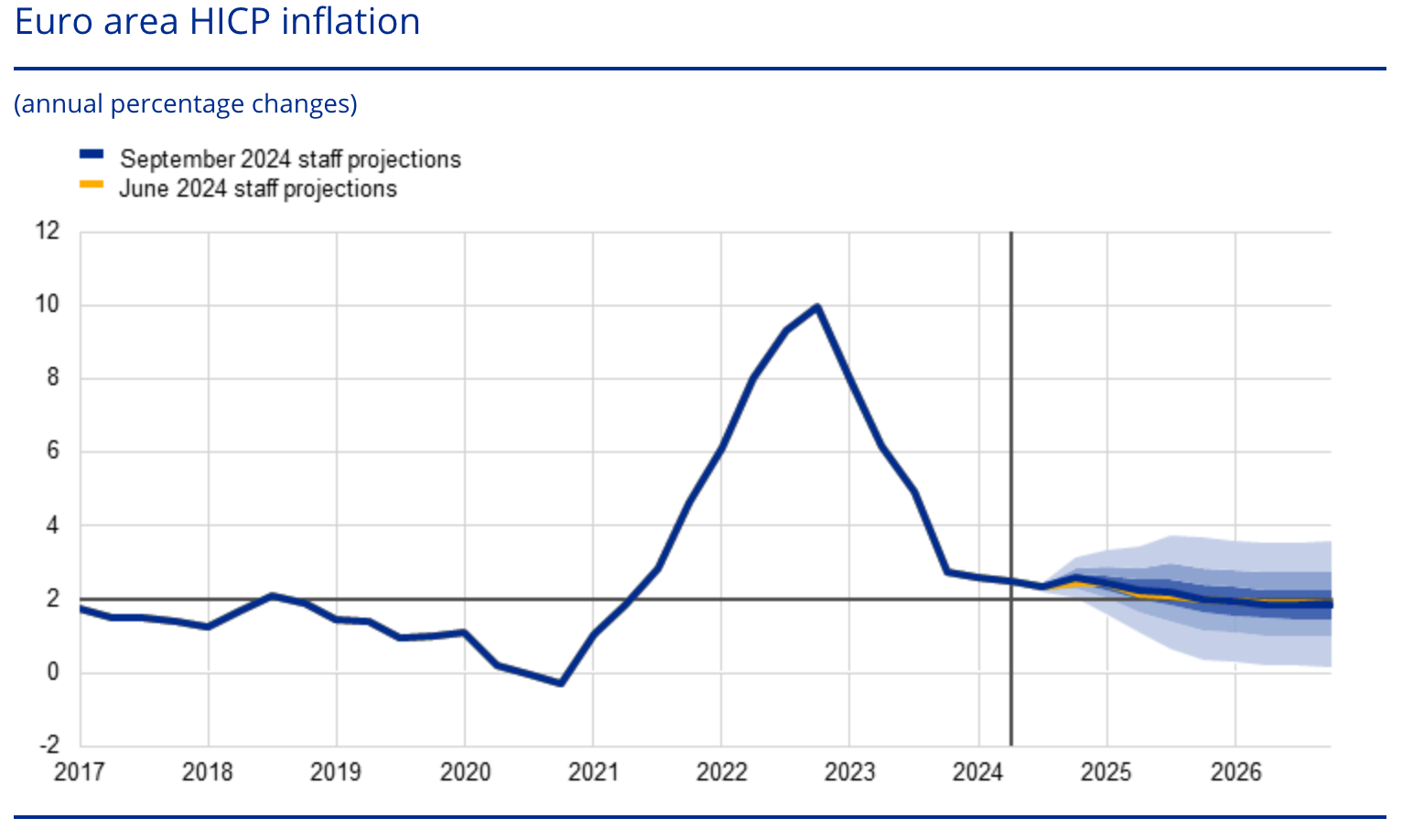

Inflation levels

As mentioned earlier, inflation has a direct influence on central bank interest rate decisions. The ECB forecasts a temporary rise in inflation in the Eurozone in Q4 2024, followed by a gradual decrease. Inflation is expected to return to the ECB’s 2% target by the end of 2025. Major inflationary drivers include changes in energy and service prices.

.png)

Source: https://www.ecb.europa.eu/

In September 2024, consumer prices in the Eurozone rose by only 1.8% year-over-year, marking the first time since June 2021 that inflation fell below the ECB’s target. This drop in inflation could prompt the European regulator to accelerate rate cuts, negatively impacting the euro.

Trade balances and current account deficits

In August 2024, the US trade deficit decreased by 10.8%, reaching 70.4 billion USD. Meanwhile, Germany, the Eurozone's largest economy, saw its foreign trade surplus rise to the highest level since May, reaching 225 billion euros. The widening US trade deficit could weaken the US dollar, while the increasing trade surplus in the Eurozone could support the euro.

Impact of geopolitical risks

Geopolitical tensions, particularly in the Middle East, remain a factor that could increase market volatility. The ongoing conflict between Israel and Lebanon, for example, could have a significant impact on economic growth and inflation in the Eurozone, especially if pressure on energy prices continues to rise.

Since the onset of the conflict, the price of Brent crude oil and European natural gas increased by approximately 9% and 34%, respectively, at their peak. The World Bank warned in its quarterly report last week that if the conflict escalates, crude oil prices could exceed 150 USD per barrel. As a result, this geopolitical tension could negatively affect the euro.

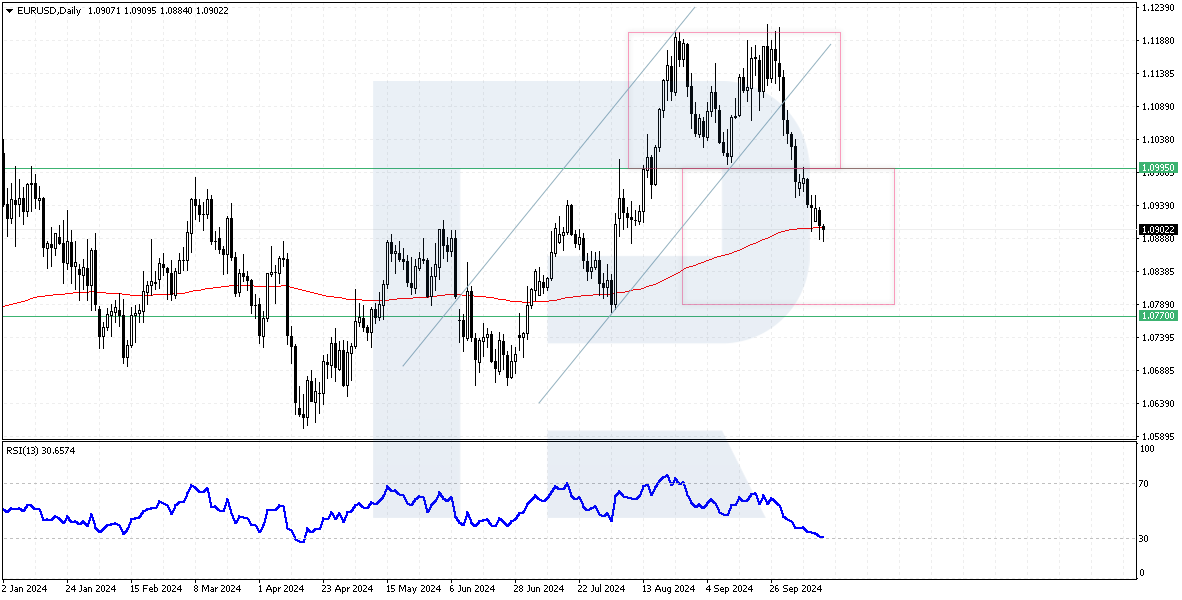

Technical analysis of EURUSD for 2024

Let’s examine the daily chart of the EURUSD currency pair. In this analysis, we will evaluate the nearest support and resistance levels, look at chart patterns, and apply several indicators.

As we can see, the price is now below the 1.0995 support level. The next key support for euro buyers is around 1.0770. Despite the price testing the 200-day Exponential Moving Average (EMA), which indicates an upward trend for the pair, there are risks of further declines toward the next support level.

.png) An important signal supporting this scenario is the break of the lower boundary of the double-top reversal pattern. The lower boundary of the pattern, which is at 1.0995, served as strong support for buyers. After the break, this level was tested from below, indicating its significance. The target for the pattern’s completion is around the 1.0795 level.

An important signal supporting this scenario is the break of the lower boundary of the double-top reversal pattern. The lower boundary of the pattern, which is at 1.0995, served as strong support for buyers. After the break, this level was tested from below, indicating its significance. The target for the pattern’s completion is around the 1.0795 level.

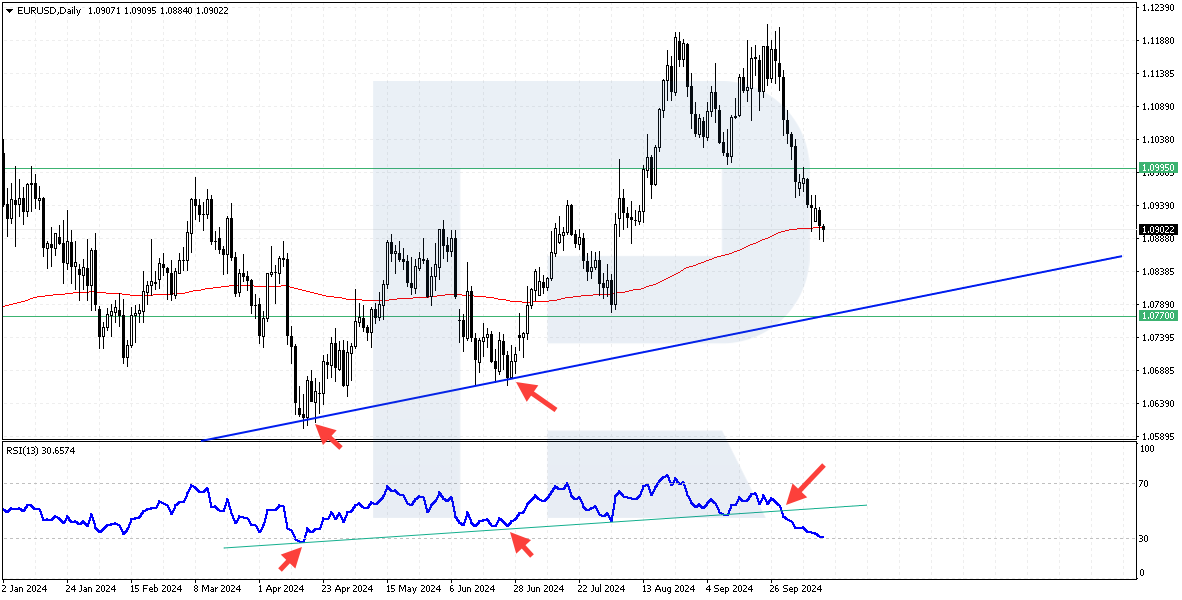

.png) Additionally, a further signal for a potential decline in EURUSD is the break of the upward trendline on the Relative Strength Index (RSI). Notably, this break occurred on October 1, 2024, while the price is still above the trendline on the price chart. The RSI indicator may be giving an early signal. In this case, the realisation of the signal could lead to EURUSD falling to the 1.0740 mark, which would also confirm the break of the trendline on the EUR/USD price chart.

Additionally, a further signal for a potential decline in EURUSD is the break of the upward trendline on the Relative Strength Index (RSI). Notably, this break occurred on October 1, 2024, while the price is still above the trendline on the price chart. The RSI indicator may be giving an early signal. In this case, the realisation of the signal could lead to EURUSD falling to the 1.0740 mark, which would also confirm the break of the trendline on the EUR/USD price chart.

.png)

A negative option for sellers could be an aggressive rise in the price, for example, in the case of revision of expectations regarding the reduction of the interest rate of the Federal Reserve from 25 basis points to 50 points. If buyers manage to gain a foothold above 1.1015, it will indicate another breakdown of the lower boundary of the ‘Double Bottom’ pattern and the probable cancellation of the implementation of this pattern. In this scenario, EURUSD is likely to rise and test 1.1205.

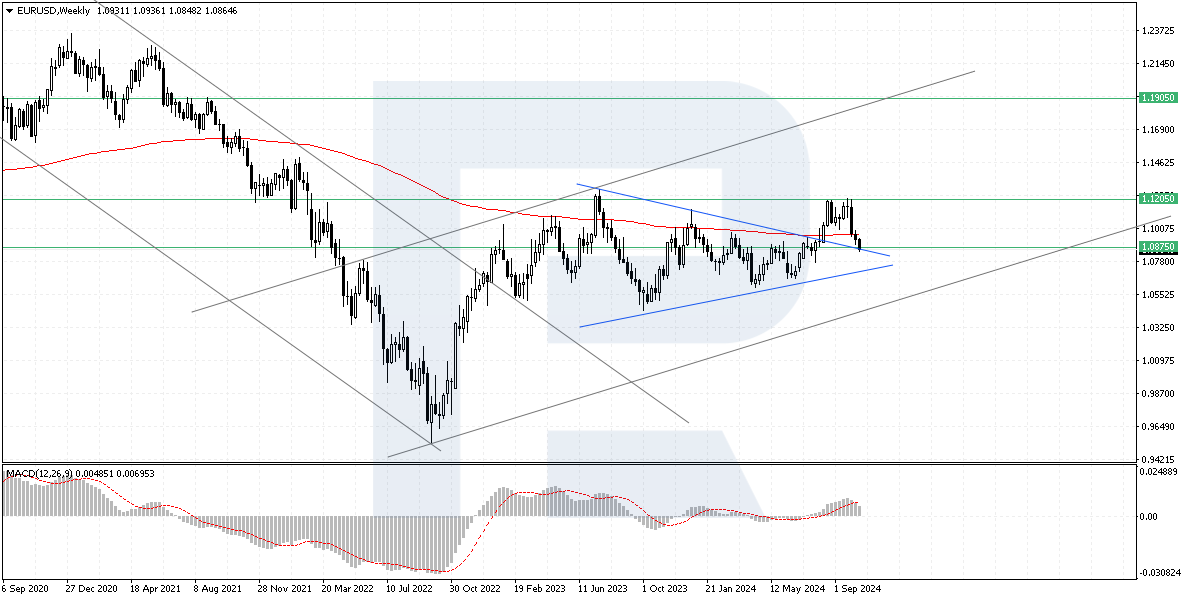

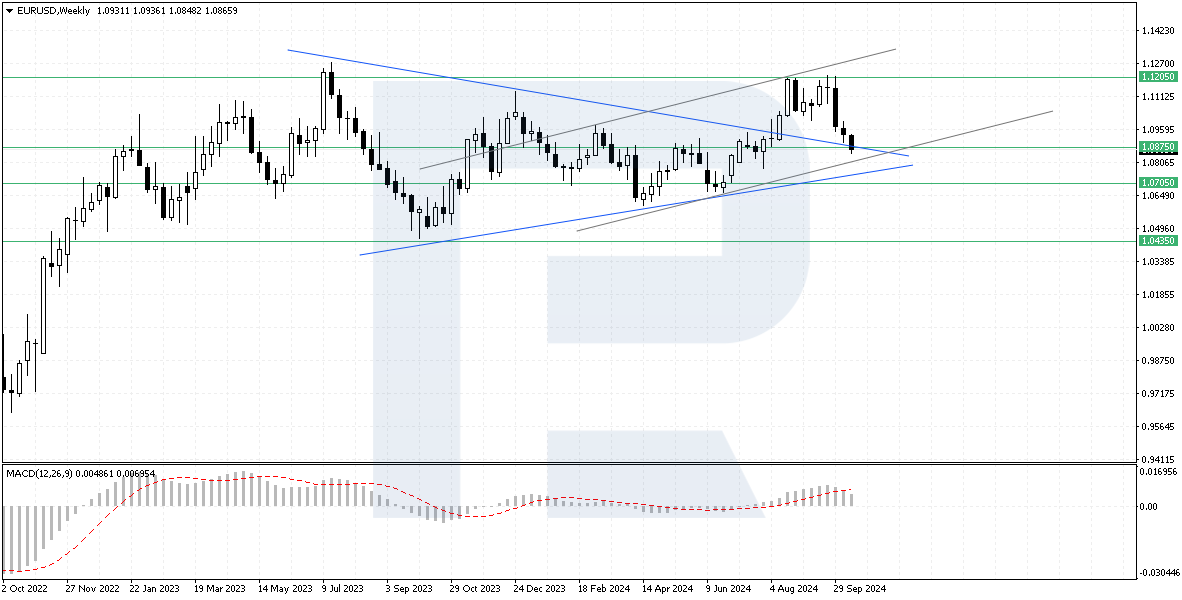

Long-term technical analysis of EURUSD for 2024

To develop a longer-term EURUSD forecast, we will examine the weekly chart of the pair. We will apply technical analysis tools, highlight three possible scenarios, and note key levels on the EURUSD weekly chart. This will help assess the potential movements of the pair over a longer time horizon.

Potential long-term scenarios for 2024

Bullish scenario:

One key observation is the formation of a large Triangle pattern, which began on July 16, 2023. This pattern can indicate either a trend reversal or continuation. In this case, the upper boundary of the pattern was broken on August 11, 2024, driven by a more aggressive rate-cutting policy from the Fed, leading to the breakout. The target for the completion of this triangle pattern is the 1.1905 level. However, a downward correction is currently developing, and it is likely that the price will test the upper boundary of the triangle near 1.0875 before resuming its upward movement.

.png)

A key confirmation for buyers would be a rebound from the upper boundary of the triangle, followed by a break above the 1.1205 resistance level. A sustained breakout above this resistance would act as a catalyst for further gains toward the 1.1905 mark.

Bearish scenario:

A strong signal for a potential downward move would be a robust US labour market report, which could lead to the Fed maintaining a more restrictive stance on interest rates. If this happens, the pair could reverse from the key resistance level of 1.1205, causing EURUSD to decline.

.png)

The first key support for sellers would be the upper boundary of the Triangle pattern. A break below the 1.0875 level could signal a return of prices within the triangle, leading to a decline toward the lower boundary at 1.0705. A breach of this level could trigger a further drop to 1.0435. This scenario is possible if expectations of a slower Fed rate cut and weak Eurozone economic data persist.

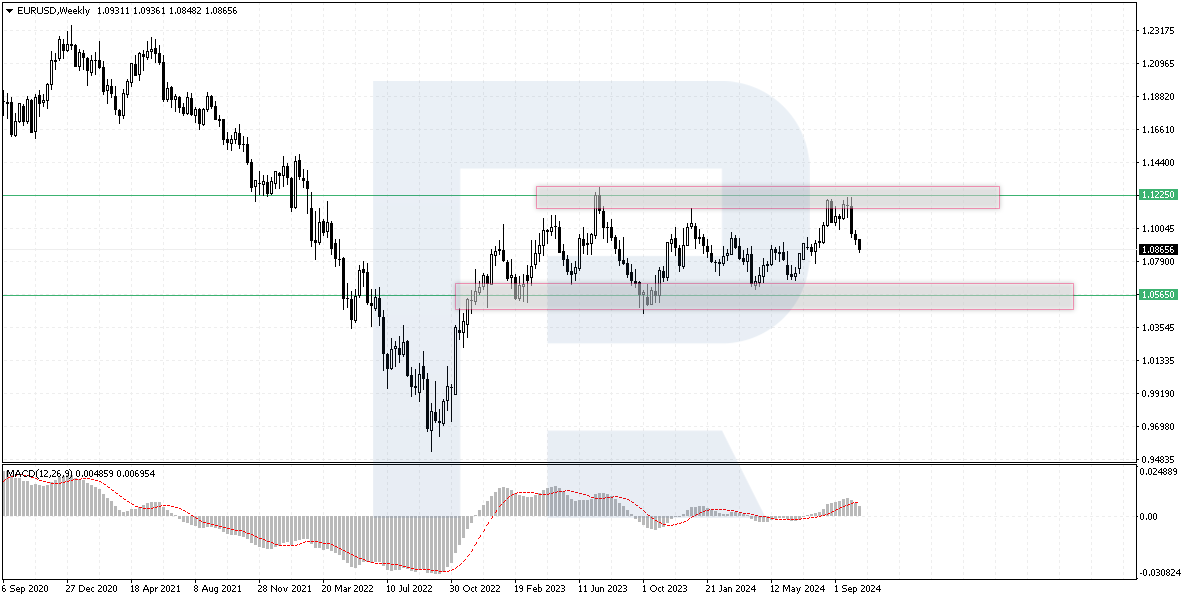

Sideways scenario:

The upward trend that started in early 2023 ended, and since then, EURUSD has been moving within a sideways range, with an upper boundary at 1.1225 and a lower boundary at 1.0565. The pair has tested both the upper and lower boundaries of this range. In September 2024, the price rebounded from the upper boundary, and it is likely that the pair could head towards the lower boundary once again.

.png)

In this scenario, EUR/USD pair may continue moving within this range for some time, assuming a relative balance in economic data and a general easing of monetary policy by both the Fed and the ECB.

Long-term resistance and support levels

Key support levels:

- 1.0765: A critical support level for buyers, located in the middle of the range. A break below this level could indicate selling pressure.

- 1.0605: The lower boundary of the range, and a breach of this level could lead to a sustained downward trend for the EUR to USD pair.

- 1.0205: A key support level for sellers after a break below the lower boundary, marking the first significant hurdle for a continued downward move.

Key resistance levels:

- 1.0995: The nearest resistance level, which represents the lower boundary of the Double Top reversal pattern. A break above this level by buyers would invalidate the pattern.

- 1.1205: The upper boundary of the range, and a breach of this level could signal the beginning of a new bullish trend for EURUSD.

- 1.1585: The next resistance level for buyers following a breakout from the range, marking the first significant obstacle for a potential upward trend.

Expert EURUSD forecasts for 2024

Forecasts for EURUSD in 2024 from leading financial institutions provide valuable insights for traders and investors who may not have the time for their own analysis. These EURUSD predictions are based on assessments of macroeconomic data, monetary policy, and market sentiment. Below are expert opinions from banks and financial companies regarding possible EURUSD movements in 2024.

- European Central Bank (ECB): the ECB predicts a stable EURUSD around the 1.09 mark, influenced by an anticipated economic slowdown in the Eurozone and moderate inflation. A consistent, tight monetary policy is expected to support the euro.

- ING: projects EURUSD to experience volatility around the 1.10 level. Key influences include ECB and Federal Reserve policy decisions, with potential downward pressure from slower economic growth in the Eurozone.

- Mitsubishi UFJ Financial Group (MUFG): foresees initial downward pressure on EURUSD due to inflation and the energy crisis in Europe, with a recovery to about 1.12 by the end of the year as the US economy slows and the Fed possibly cuts rates more aggressively.

- Scotia Bank: anticipates EURUSD will remain around 1.09, with factors like geopolitical tensions and economic volatility in the energy market playing a significant role.

- Wells Fargo: expects EURUSD to rise to 1.12 by year-end, helped by a potential mild recession in the US and a softer monetary policy from the Fed. However, political instability in the Eurozone and energy market shocks could limit gains.

- Erste Group: predicts a climb to 1.13 for EURUSD, despite a slowdown in the Eurozone’s economic activity and declining inflation. The EURUSD analysis highlights the impact of high energy prices and weak demand in the services sector.

EURUSD predictions for 2024 from AI

In addition to forecasts from financial institutions, AI-based predictions for EUR/USD in 2024 are becoming more prevalent. These models leverage modern forecasting algorithms, historical data, and machine learning methods to create more accurate forecasts. While AI cannot account for sudden events, such as unexpected labour market improvements in the US, it offers a statistically grounded approach to analysing future trends. Below are EUR/USD predictions for 2024 from leading AI platforms, highlighting the growing importance of technology in forecasting. All quotes listed are as of 23 October 2024.

- Wallet Investor: anticipates a moderate weakening of the EURUSD, projecting a 2024 year-end target of 1.0780.

- Coin Index: offers a pessimistic view with the pair potentially peaking at 1.0807 and dropping to around 1.0748 by November 2024.

- Long Forecast: sees a bearish trend with EURUSD potentially falling to 1.0680 by the end of the year, influenced by strong US economic performance and high interest rates.

- Panda Forecast: provides an optimistic scenario, forecasting EURUSD to rise to 1.1276 by year-end based on macroeconomic indicators like inflation, GDP growth, and interest rate differentials.

Long-term EURUSD expert forecasts 2025-2026

The movement of the EURUSD currency pair over the long term (2025-2026) will continue to be influenced by a combination of macroeconomic factors, central bank policies, and geopolitical events. While short-term developments, such as interest rate cuts, may dominate the outlook for 2024, expert forecasts for 2025 and 2026 focus on broader trends. These include economic growth trajectories, inflation control, and shifts in the monetary policies of the ECB and the Fed. Below are long-term forecasts from key financial institutions.

ECB

The ECB’s outlook for 2025 and 2026 will largely depend on how well it manages inflation control and supports growth within the Eurozone. If inflation continues to decline, the ECB may shift toward a more accommodative monetary policy by 2025, focusing on economic growth and employment rather than inflation control.

- 2025 outlook: The ECB is expected to adopt a more stimulative policy by 2025, which could lead to a temporary weakening of the euro, but at the same time support Eurozone economic growth. EURUSD may trade near 1.10, as the Fed may also ease its monetary policy, levelling the playing field for both currencies.

- 2026 outlook: By 2026, the ECB may focus on Europe’s economic recovery amid lower energy prices. This could lead to euro appreciation, especially if the US economy slows. Experts predict that EURUSD will likely stay near 1.10.

ING

ING’s long-term forecast for EURUSD suggests that the euro may start recovering in 2025 and 2026, as the Eurozone economy stabilises and both the ECB and Fed complete their tightening cycles.

- 2025 outlook: ING maintains a forecast for EURUSD at around 1.10 in 2025, noting that at current levels, EURUSD is not far from its medium-term fair value. Monetary, fiscal, and trade policies in the US for 2025 remain highly uncertain.

- 2026 outlook: By 2026, ING sees modest potential for further euro gains if the US economy enters a slowdown or mild recession. In this scenario, EURUSD may stabilise above 1.10, as confidence in the Eurozone economy grows.

MUFG

MUFG’s long-term outlook for EURUSD remains bullish, though the euro’s gains are expected to be moderate due to ongoing challenges in Europe, such as demographic changes and the need for structural economic reforms.

- 2025 outlook: MUFG expects EURUSD to stabilise at 1.16 by the end of 2025. The euro will be supported by lower inflation pressures and a neutral ECB policy. However, the US dollar may continue to resist significant weakening due to its status as a global reserve currency and safe-haven asset.

- 2026 outlook: MUFG forecasts further euro appreciation in 2026 if the US economy slows and the Eurozone demonstrates consistent recovery. EURUSD could exceed 1.16, potentially reaching 1.18, although significant gains will be limited by structural weaknesses in the European economy.

Wells Fargo

Wells Fargo offers a more bearish forecast for EURUSD in 2025-2026. Their analysis suggests that structural problems in both the US and Europe will keep the pair in a narrow range.

- 2025 outlook: Wells Fargo expects EURUSD to remain within a range of 1.06-1.11 in 2025. While the ECB’s policies may support the euro, slow growth in the Eurozone will limit the currency’s upside potential.

- 2026 outlook: In 2026, Wells Fargo predicts moderate US dollar strengthening, which could push EURUSD down to 1.04. They emphasise long-term challenges in both economies, such as slowing productivity growth, which could hinder significant currency revaluation.

Erste Group

Erste Group expresses cautious optimism regarding the long-term prospects of the EURUSD currency pair. The recent decision by the US Federal Reserve to cut interest rates by 50 basis points had little impact on the exchange rate, as the market had largely anticipated this move. However, pressure on the US dollar is expected to persist as further rate cuts by the Fed are anticipated.

- 2025 outlook: Erste Group expects a slight increase in the EUR/USD exchange rate, testing the 1.14 mark in 2025, driven by improving economic conditions in Europe. The euro may gain support from increased investor confidence if inflation remains under control and energy prices stabilise.

- 2026 outlook: By 2026, Erste Group predicts that the euro could strengthen further, reaching levels of 1.15 and above, assuming a weakening of the US dollar and continued economic recovery in the Eurozone. They emphasise that geopolitical stability and energy security will be key factors influencing the euro's strength.

Summary table of long-term expert forecasts

| Company / Date | 1Q 2025 | 2Q 2025 | 3Q 2025 | 4Q 2025 | 1Q 2026 |

|---|---|---|---|---|---|

| ECB | 1.10 | - | - | - | 1.10 |

| ING | 1.10 | 1.10 | 1.10 | 1.10 | 1.10 |

| MUFG | 1.14 | 1.15 | 1.16 | - | - |

| Wells Fargo | 1.11 | 1.10 | 1.10 | 1.06 | 1.04 |

| Erste Group | 1.14 | 1.14 | 1.15 | - | - |

Long-term EURUSD predictions from AI (2025-2026)

AI-based models offer a different perspective on long-term forecasts for the EURUSD pair by utilising complex algorithms to analyse historical data, macroeconomic trends, and technical patterns. Although these models are not immune to unpredictable events, they provide data-driven insights into potential movements of the EURUSD pair over 2025-2026. Let's take a closer look at forecasts from well-known AI platforms for the next two years. All quotes listed are as of 23 October 2024.

Wallet Investor

The AI model from Wallet Investor forecasts a gradual strengthening of the US dollar against the euro in 2025-2026. The prediction is based on assumptions of inflation stabilisation and sustained economic growth in the US.

- 2025 outlook: According to the model, the EURUSD rate may decrease from 1.0780at the start of the year to 1.0520 by the end of 2025. This will be driven by improvements in the US economy and a possible pause in Fed rate cuts.

- 2026 outlook: Wallet Investor expects further strengthening of the dollar. The EURUSD rate is predicted to start 2026 at 1.0520 and fall to 1.0260 by the end of the year. The main drivers of this trend are the ongoing recovery of the US labour market and a more neutral monetary policy by the Federal Reserve compared to the ECB.

Coin Index

The Coin Index model offers a more aggressive long-term forecast, predicting that the EURUSD pair will begin to decline sharply as early as 2025, with a steep fall by the end of 2026.

- 2025 outlook: The AI model forecasts that EURUSD could reach a maximum of 1.0812 in 2025, with a minimum value of 0.9786.

- 2026 outlook: The decline is expected to continue in 2026, with a maximum rate of 0.9788 before the pair drops to 0.8486. Based on Coin Index's data, the EURUSD pair may remain in a downward trend over these two years.

Long Forecast

Long Forecast offers a more bullish outlook for EURUSD, with minor corrections, suggesting that the US dollar will maintain its strength due to its status as a global safe-haven currency and the resilience of the US economy. However, in some cases, the dollar may start to lose ground against the euro.

- 2025 outlook: Long Forecast expects EURUSD to start 2025 at 1.0680 and finish the year at 1.0880. Global economic uncertainty and geopolitical risks will continue to push investors toward the US dollar, but its influence may weaken as the Eurozone recovers.

- 2026 outlook: The model predicts moderate euro strengthening within an upward channel. EURUSD is expected to start 2026 at 1.0880 and finish at 1.1460, continuing to gain strength as the European economic situation stabilises.

Panda Forecast

Panda Forecast offers a more optimistic outlook for EURUSD, expecting the euro to strengthen in the long term due to Eurozone economic growth and the Federal Reserve's transition to a more neutral monetary policy.

- 2025 outlook: According to Panda Forecast’s AI model, EURUSD may reach 1.0710 by mid-2025, ending the year around 1.0706. The drivers of this growth will be the steady development of the Eurozone economy and easing inflationary pressures.

- 2026 outlook: In 2026, the model predicts further euro strengthening, with potential gains up to 1.3000 or higher. Key factors for this growth include improving investor sentiment in the Eurozone and weakening of the US dollar as global risk appetite increases.

Summary table of long-term AI forecasts

| AI model / Date | 2025 | 2026 |

|---|---|---|

| Wallet Investor | 1.0520 | 1.0260 |

| Coin Index | 0.9768 - 1.0812 | 0.8486 - 0.9788 |

| Long Forecast | 1.0880 | 1.1460 |

| Panda Forecast | 1.0706 | 1.3000 |

Risks and considerations

When forecasting EURUSD over several years, it is important to consider various risks and factors that could affect the accuracy of predictions. While expert opinions from leading financial companies and AI models offer valuable insights, unforeseen events can significantly alter the currency pair's direction. Below are key risks and considerations to keep in mind when evaluating the EURUSD outlook for 2024-2026.

- Geopolitical instability. Geopolitical risks are one of the most unpredictable factors that can impact the currency market. Events like political upheavals, trade wars, and conflicts—especially in key regions—can disrupt economic growth, affect investor sentiment, and trigger volatility in the EURUSD pair.

- Central Bank policy divergence. The monetary policies of the European Central Bank (ECB) and the US Federal Reserve (Fed) will play a key role in shaping the future course of EURUSD. However, these policies may change based on new economic data, inflation, and the pace of economic growth. If the Fed adopts a more dovish stance while the ECB remains hawkish, it could lead to a decline in the EURUSD pair.

- Inflationary pressures. Persistent high inflation remains a challenge for both the Eurozone and the US, though inflation is nearing central bank target levels. However, if inflationary pressures rise, central banks may be forced to take more aggressive measures, such as raising interest rates, which could significantly impact EUR/USD forecast. If inflation unexpectedly surges, particularly in the Eurozone, the ECB may be forced to tighten monetary policy more than anticipated, which could lead to a sharp drop in EURUSD.

- Global economic slowdown. A global economic slowdown caused by a recession, supply chain disruptions, or slowdowns in major economies like China could affect both the Eurozone and the US. A global economic downturn may strengthen the US dollar, as investors seek safe-haven assets.

- Energy crisis and supply chain disruptions. The Eurozone’s reliance on external energy sources makes it vulnerable to energy shocks and supply chain disruptions. If the energy crisis worsens, especially due to geopolitical tensions or market imbalances, it could negatively impact the euro. Rising energy prices or shortages could undermine the Eurozone’s economy, weakening EURUSD.

- Technological disruptions and AI integration. As AI models become more integrated into financial forecasts and trading, they could influence market behaviour in new and unpredictable ways. While AI helps identify patterns and trends, its use in decision-making processes could increase volatility if market participants react en masse to AI-generated forecasts.

Conclusion

The EURUSD currency pair is poised for significant changes from 2024 to 2026, with both bullish and bearish scenarios possible. Forecasts from various financial institutions emphasise the critical role of economic policy and inflation expectations in determining EURUSD trends.

Some analysts suggest that the pair will remain in a range between 1.0500 and 1.1000, while others predict a potential rise to 1.1500. Meanwhile, several AI models signal that EUR to USD price could fall below 0.9000 by 2026. However, risks such as geopolitical instability and inflationary pressures may have a significant influence on the pair’s future movements.

In general, EURUSD dynamics will depend on a variety of factors, including central bank actions and overall economic conditions in both the US and the Eurozone.

The article updated on 23 October 2024.