XAGUSD is trading within a downward correction after failing to break above the 35.00 USD level. The trend remains upward, with growth likely to resume soon. Find out more in our XAGUSD analysis for today, 31 October 2024.

XAGUSD forecast: key trading points

- Market focus: market participants are awaiting Friday’s US labour market statistics, including nonfarm payrolls and the unemployment rate

- Market focus: US ADP employment data exceeded forecasts

- Current trend: correcting within an uptrend

- XAGUSD forecast for 31 October 2024: 34.00 and 33.00

Silver fundamental analysis

The XAGUSD pair continues to trade in an uptrend, reaching another annual high of 34.86 USD last week. Silver quotes are supported by increased global demand for the metal and the weaker position of the US dollar amid the onset of the US Federal Reserve interest rate-cutting cycle.

Yesterday’s US employment data from Automatic Data Processing Inc. (ADP) came in above forecasts, showing gains of 233,000 jobs compared to the expected 115,000. As a result, the US dollar strengthened slightly against Silver, bolstered by statistics.

However, this temporary strengthening of the US dollar is within the current correction. Once it is complete, Silver prices are expected to resume growing. Market participants are awaiting a crucial batch of US labour market statistics tomorrow, including nonfarm payrolls and the unemployment rate.

If data exceeds forecasts, a correction in XAGUSD could continue. Conversely, if the data is below expectations, the correction may conclude, allowing prices to resume growth, potentially reaching an annual high of 34.86 USD.

XAGUSD technical analysis

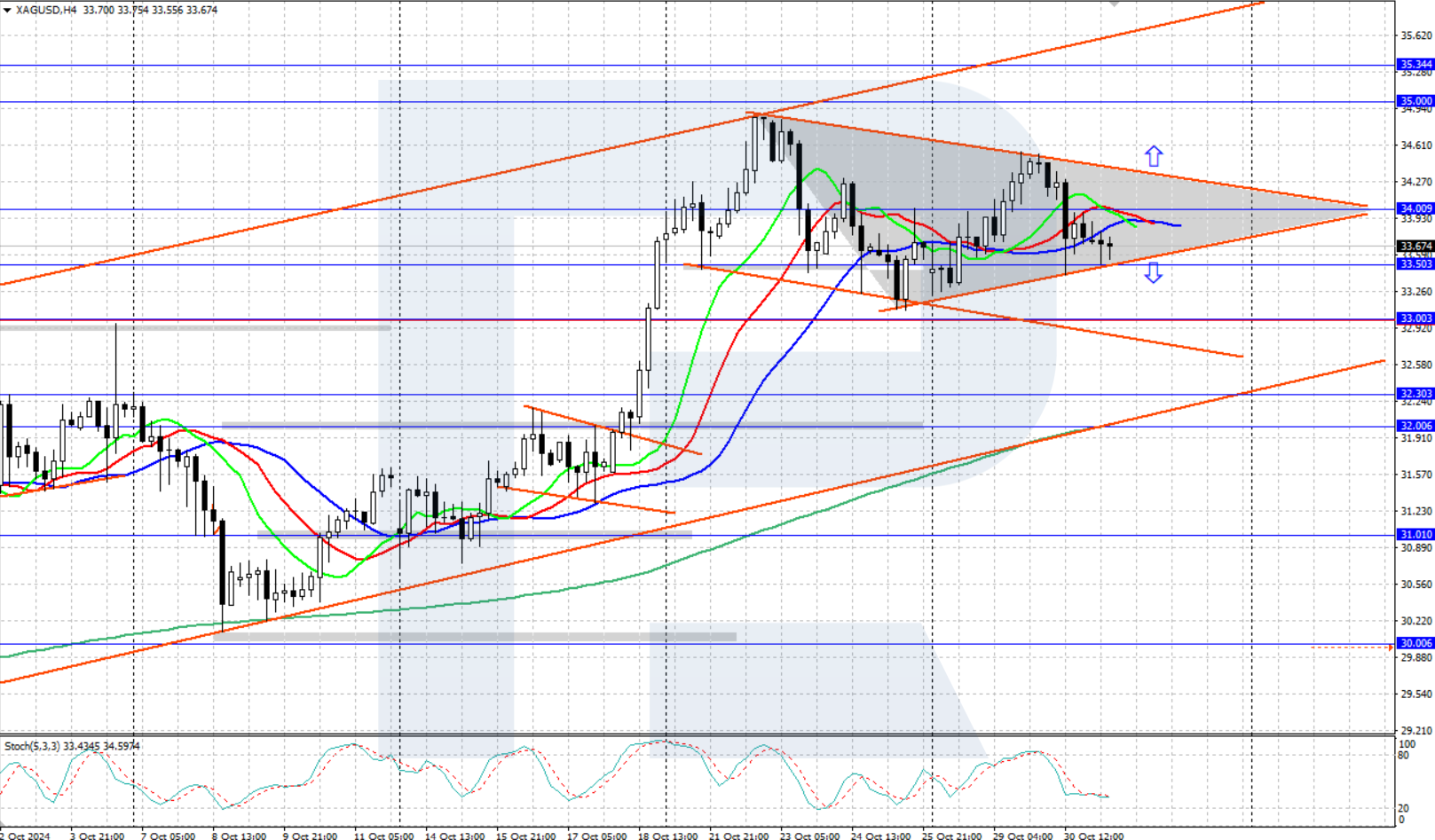

On the H4 chart, Silver prices are in a downward correction while remaining within an ascending price channel. A triangle technical pattern is forming. After the correction and the pattern are established, asset prices are expected to continue upward towards around 35.00 USD.

The short-term XAGUSD price forecast suggests that if bulls push prices above 34.00 USD, a further rise to the annual high of 34.86 USD could follow. Conversely, if bears push prices below the 33.50 USD support level, the decline could continue towards 33.00 USD.

.png)

Summary

Silver (XAGUSD) prices continue to correct after reaching an annual high of 34.86 USD last week. On Friday, US employment statistics, including nonfarm payrolls and the unemployment rate, could drive the pair’s further movements.