XAUUSD price remains near annual highs, awaiting the US Federal Reserve interest rate decision. Its announcement and the press conference of the Federal Reserve chair may give fresh momentum to the stock price. Find out more in our XAUUSD analysis for today, 18 September 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are awaiting the US Federal Reserve interest rate decision and comments from the regulator’s chair

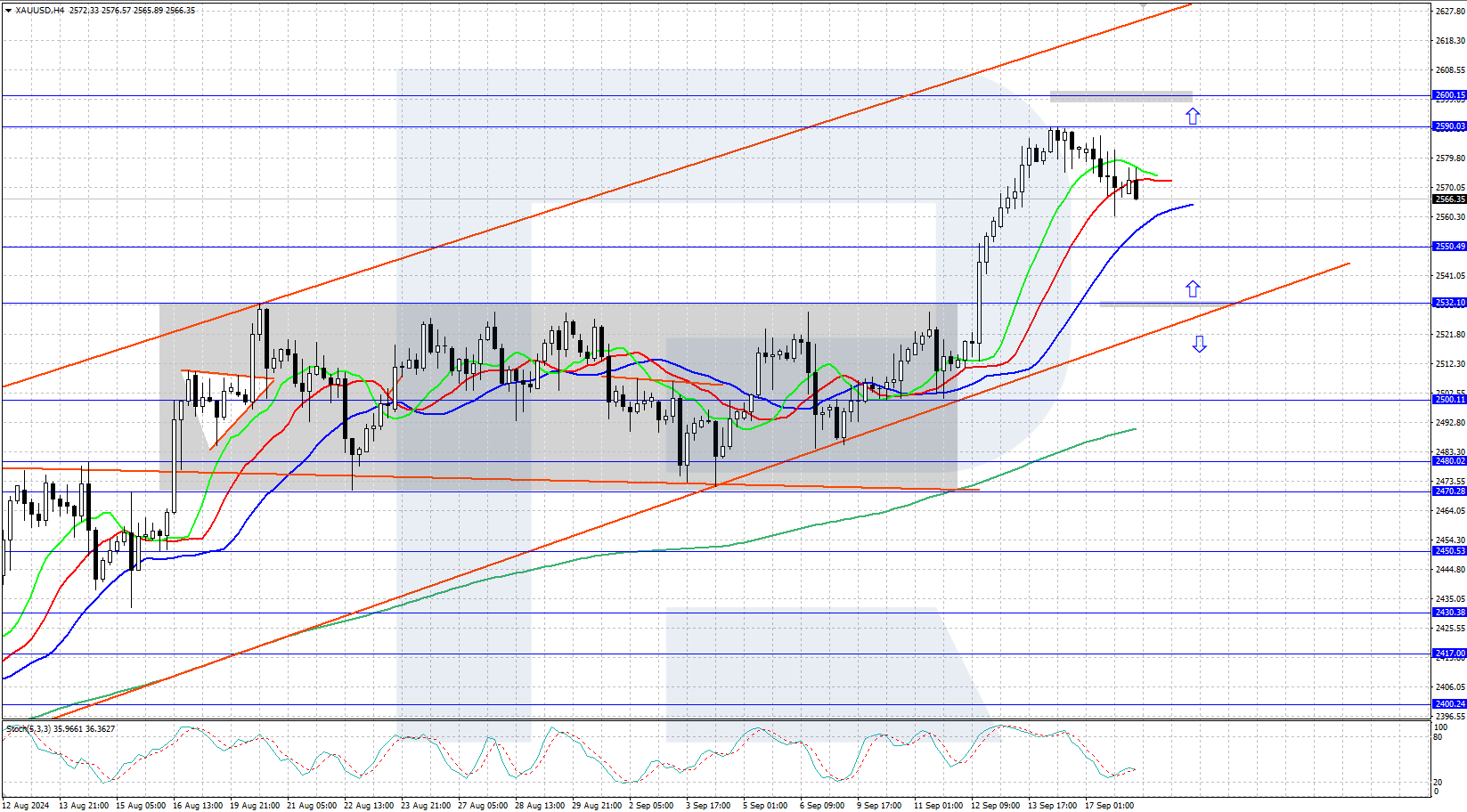

- Current trend: strong upward momentum is developing after the price exited the sideways range

- XAUUSD forecast for 18 September 2024: 2,600 and 2,532

Fundamental analysis

XAUUSD quotes are trading in a strong uptrend, supported by demand from global central banks and the beginning of the US Federal Reserve monetary policy easing. The Fed will cut interest rates for the first time today, with market participants expecting the rate to be reduced by 0.50% at once.

If market expectations are met and interest rates are lowered by 50 basis points, gold will receive a good incentive for further growth. If the reduction is only 25 basis points (which the market has already priced in), a downward correction may start. Market participants are also awaiting comments from Federal Reserve Chair Jerome Powell on further prospects for rate cuts.

XAUUSD technical analysis

The XAUUSD pair is trading within an uptrend on the daily chart, with the price currently hovering around 2,570 USD. After breaking above the sideways range last week, gold price is steadily rising, aiming for the target of the previously formed triangle pattern near 2,600 USD.

The short-term XAUUSD price forecast suggests that after the Federal Reserve rate decision, bulls will attempt to continue the upward movement and reach the 2,600 USD level. However, if the cut size and Powell’s comments disappoint market participants, bears will have the opportunity to seize the initiative with the prospect of starting a downward correction towards the crucial 2,532 USD support level.

.png)

Summary

Gold prices are rallying upwards, reaching the 2,590 USD level this week. The market will focus on the US Federal Reserve interest rate decision and Jerome Powell’s subsequent press conference.