Brent’s price is trading within an upward correction, supported by investor optimism amid the Federal Reserve interest rate cut. However, subsequently, the decline may still continue. Find out more in our Brent analysis for today, 19 September 2024.

Brent forecast: key trading points

- US data: the US Federal Reserve started the monetary policy easing cycle, cutting the rate by 0.5% at once

- Current trend: oil prices are undergoing an upward correction as part of the downtrend

- Brent forecast for 19 September 2024: 75.00 and 70.00

Fundamental analysis

Brent quotes are experiencing corrective growth after falling to the 68.00-68.50 USD area last week. Oil prices are supported by an upswing in the US stock market and investor optimism about the beginning of the US Federal Reserve monetary policy easing – the Fed decided to lower interest rates by 0.5% at once at its meeting that ended yesterday.

The interest rate-cutting cycle may help improve economic conditions in the country, with two more cuts expected by the end of the year. Brent quotes were also positively affected by yesterday’s data from the Energy Information Administration (EIA), which reported a decrease of 1.63 million barrels in the US oil stocks.

Brent technical analysis

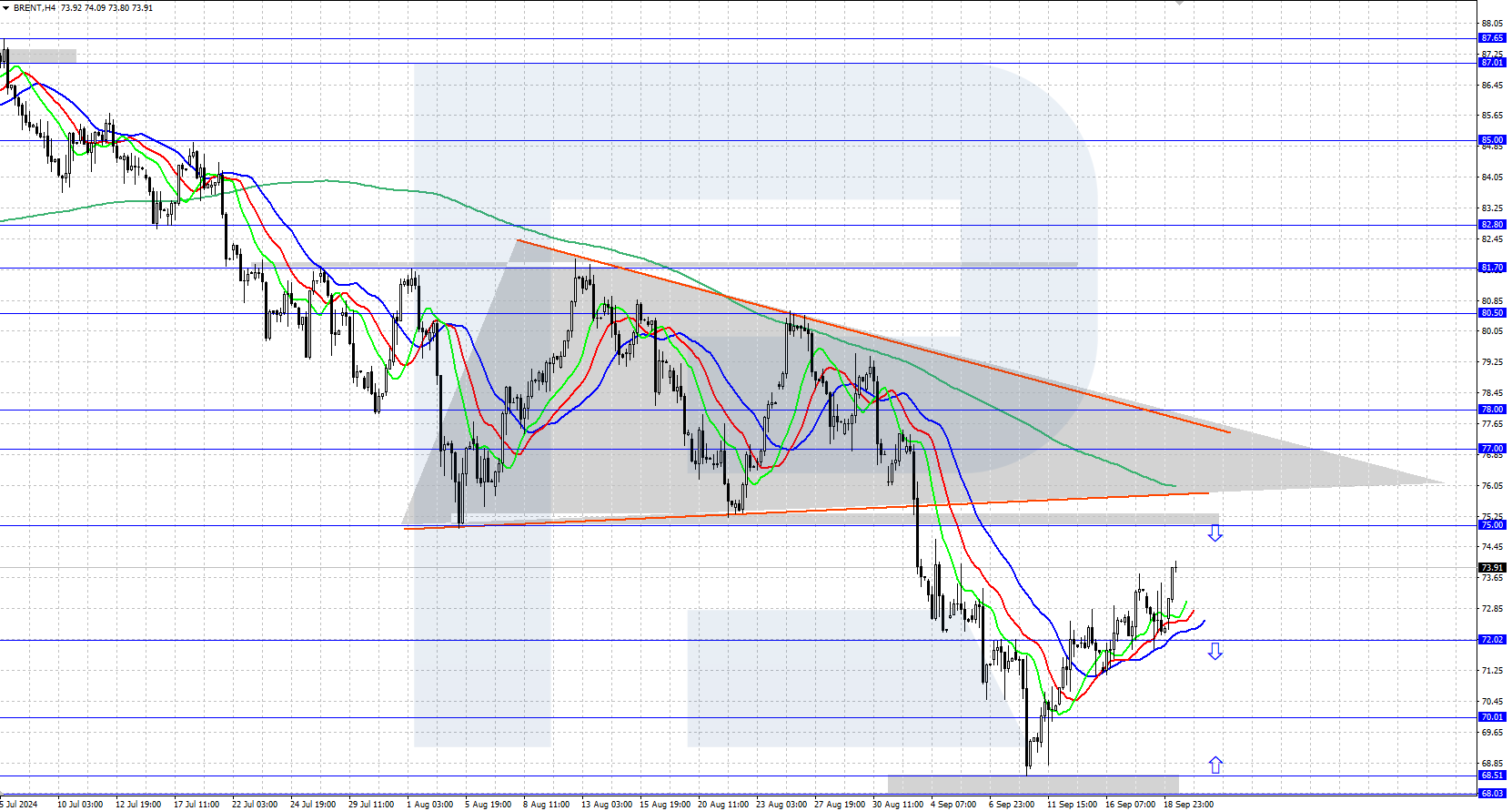

Oil continues to show moderate growth, with the quotes currently trading around 74.00 USD. A triangle pattern formed on the H4 chart last week, and the quotes broke below it, falling to the target area of 68.00-68.50 USD. The pattern’s target has been reached, with an upward correction currently underway.

The short-term Brent price forecast suggests that as long as the price is above 72.00 USD, the upward correction could continue towards the 75.00 USD resistance level. If bears push the price below 72.00 USD, a decline to the 70.00 USD support area may follow.

.png)

Summary

Oil prices are correcting after last week’s decline, rising above 73.00 USD. The optimism of market participants about the beginning of the US Federal Reserve monetary policy easing provides support for oil quotes.