ECB officials’ speeches, US initial jobless claims, and the GDP data release could heat today’s market. Find out more in our EURUSD analysis dated 29 August 2024.

EURUSD forecast: key trading points

- A speech by European Central Bank official Isabel Schnabel

- A speech by European Central Bank official Philip R. Lane

- The Eurogroup meeting

- US initial jobless claims: previously at 232,000, projected at 232,000

- Q2 US GDP: previously at 1.4%, projected at 2.8%

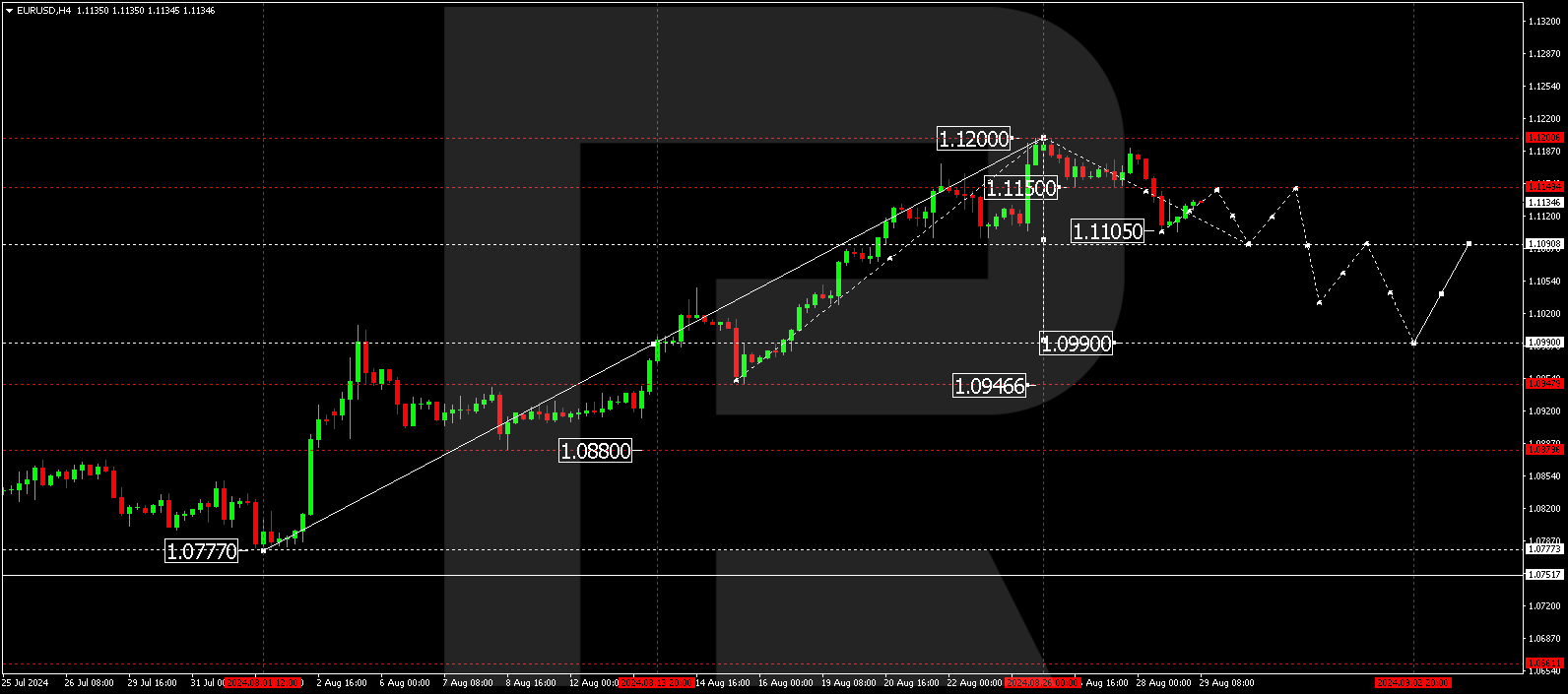

- EURUSD forecast for 29 August 2024: 1.1090 and 1.1150

Fundamental analysis

The EURUSD analysis for 29 August 2024 shows that the market is awaiting a large set of economic news and data from the eurozone, including speeches by ECB officials, Schnabel and Lane, and the Eurogroup meeting. ECB officials’ speeches often indicate future monetary policy and economic expectations, and increased market volatility can be expected during them.

A set of data, including US initial jobless claims, will be released after the US trading session opens. A preliminary forecast suggests that the figure will remain flat at 232,000, which may support the US dollar’s strength against the euro.

GDP is the aggregate value of all goods and services produced in a country. Only end products are considered, excluding the production of raw materials.

The euro to US dollar forecast for 29 August 2024 suggests a 2.8% increase in US GDP, double the previous reading. If actual data aligns with expectations, the EURUSD rate could decline markedly.

EURUSD technical analysis

The EURUSD H4 chart indicates that the price has broken below the 1.1150 level and continued its downward trend to 1.1105. It's possible that today, 29 August 2024, the EURUSD price might rise again to retest the 1.1150 level from below. Following this, a third decline is expected in the forecast, targeting at least 1.1090 initially. This marks the completion of a comprehensive first downward wave. After hitting 1.1090, the price is anticipated to rebound towards 1.1150.

.png)

Summary

Today's anticipated speeches, along with the US data releases and major news, might increase market volatility and shape the near-term trajectory of the EURUSD pair. The today's detailed EURUSD forecast suggests that the currency pair could experience a dip to 1.1090 followed by a corrective rise to 1.1150, influenced by both fundamental and technical factors.