The USDJPY pair is experiencing a slight correction on Friday after two consecutive days of gains. To understand the latest market movements, delve into our analysis for 30 August 2024.

USDJPY forecast: key trading points

- Japan's unemployment rate for July 2024 increased to 2.7%.

- Core CPI in Tokyo rose by 2.4% in August 2024

- Japan's industrial production grew by 2.8% in July 2024, rebounding from a significant decline

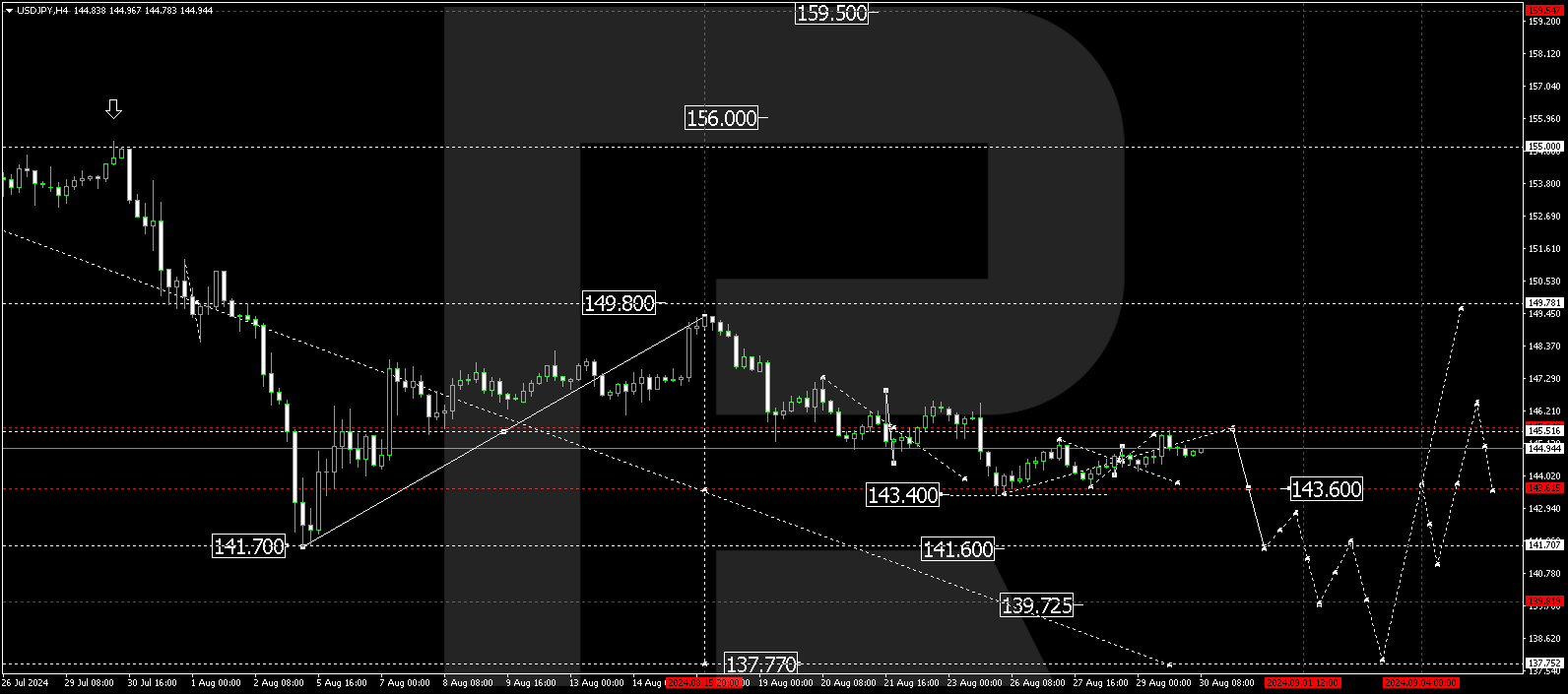

- USDJPY forecast for 30 August 2024: 141.60, 139.70, and 137.77

Fundamental analysis

The USDJPY rate was buoyed by recent US GDP and Initial Jobless Claims data, alleviating recession concerns and bolstering the USD. Concurrently, Japan's economic data fuelled expectations of a potential BoJ interest rate hike, which could strengthen the yen within today's USDJPY forecast.

Japan's unemployment rate increased to 2.7% in July 2024, up from 2.5% in June, marking the highest level since August 2023.

Tokyo's core consumer price index rose at an annualised rate of 2.4% in August 2024, marking the fourth consecutive month of acceleration and surpassing market expectations of a 2.2% increase.

Retail sales in Japan grew at an annualised rate of 2.6% in July 2024, slowing from June's 3.8% rise and falling short of the anticipated 2.9% growth.

Japan's industrial production expanded by 2.8% in July 2024, recovering from a sharp -4.2% decline. However, this growth fell short of the forecasted 3.3% (according to preliminary data).

USDJPY technical analysis

On the H4 chart, the USDJPY outlook shows the pair reaching 145.50 in a recent upward move. As of 30 August 2024, there is a potential signal for a downside move towards the 143.80 level, keeping the market within a consolidation range. Should the market break below this range, the USDJPY forecast anticipates continuing the downward wave, targeting 141.60, 139.70, and 137.77. The 137.77 level remains a key target in the USDJPY prediction for an ongoing downward trend.

.png)

Summary

In summary, the USDJPY analysis highlights how macroeconomic data from both the US and Japan continue to impact the pair. However, growing investor confidence in a tighter monetary policy from the BoJ may lead to a stronger yen. Today's USDJPY forecast and signals suggest the potential for a decline towards the 141.60, 139.70, and 137.77 levels. Stay updated with the latest USDJPY news to make informed trading decisions.