The EURUSD pair has experienced a decline for the third consecutive trading day, reflecting investor sentiment towards potential policy easing by the European Central Bank (ECB). With inflation trends supporting this outlook, market participants are increasingly expecting an ECB interest rate cut in September. Our detailed EURUSD forecast provides key insights into the potential movements of this currency pair as of 3 September 2024.

EURUSD forecast: key trading points

- The EURUSD pair has reached its lowest level since mid-August

- Investors believe the ECB will continue to actively cut rates until the end of the year

- EURUSD forecast for 3 September 2024: price targets are set at 1.1007 and 1.1096

EURUSD fundamental analysis

The EURUSD rate declined to 1.1058 on Tuesday, with sell-offs continuing nonstop for the third trading day. The instrument has plunged to its lowest levels since mid-August. Investors believe that the European Central Bank will make a second consecutive decision to lower interest rates this month at a meeting scheduled for 12 September.

The likelihood of an interest rate cut has increased after the eurozone’s new inflation reports were released. A preliminary estimate shows that inflation in the region fell to 2.2% in August, marking the lowest level since July 2021. The core consumer price index declined to 2.8% after holding at 2.9% for three months.

The market believes the ECB could reduce interest rates two or three more times by the end of the year. The EURUSD forecast suggests continued pressure on the euro rate.

EURUSD technical analysis

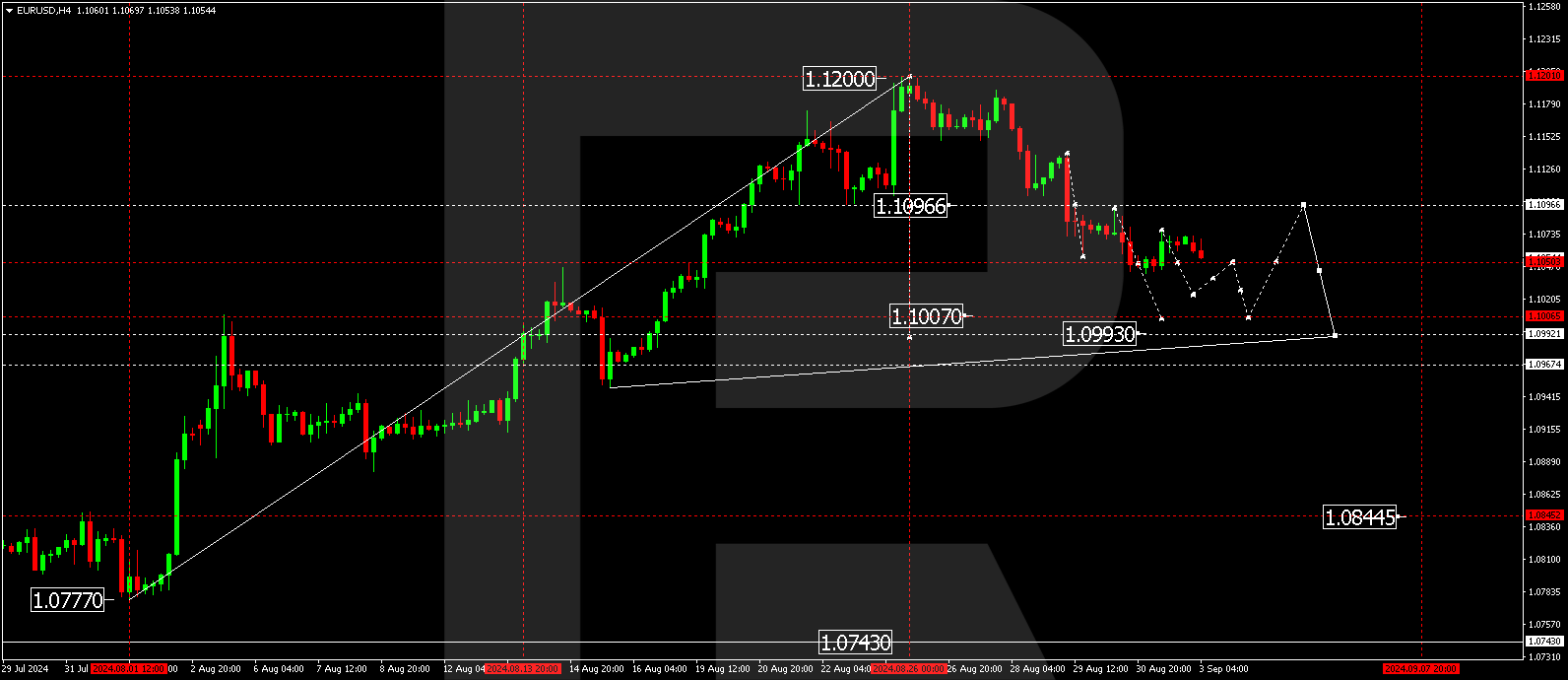

The EURUSD H4 chart shows that the market has formed a consolidation range around 1.1050 and extended it to 1.1076. The price is expected to decline to 1.1050 and break below the range today, 3 September 2024, expanding the wave towards 1.1025. A breakout below the 1.1050 level may signal a continuation of the trend towards 1.1007, the local estimated target. After reaching this level, the EURUSD rate could correct towards 1.1096 (testing from below). After reaching this level, the EURUSD rate might see a corrective move towards 1.1096, potentially testing this level from below, before resuming its downward trajectory targeting 1.0990 as the initial estimated target.

.png)

Summary

The pair remains under significant selling pressure, with the market's focus on the upcoming ECB meeting. EURUSD technical analysis and today’s EURUSD forecast suggest a potential decline to 1.1007, followed by a corrective move towards 1.1096. Given the current market conditions and the economic outlook, the EURUSD prediction continues to favor a bearish trend in the near term.