The release of Switzerland’s CPI and GDP data and the US PMI data may help the US dollar strengthen its position. This analysis, dated 3 September 2024, focuses on the USDCHF forecast, providing insights, signals, and predictions based on current news and market outlook.

USDCHF forecast: key trading points

- Switzerland’s Consumer Price Index (m/m) for August: previously at -0.2%, projected at 0.1%

- Switzerland’s GDP (q/q): previously at 0.5%, projected at 0.5%

- US manufacturing PMI: previously at 49.6, projected at 48.0

- USDCHF forecast for 3 September 2024: 0.8572

Fundamental analysis

The upcoming release of Switzerland’s Consumer Price Index (CPI) and GDP data, along with the US PMI figures, are critical indicators that could influence the USDCHF pair. A deeper dive into these factors reveals their potential impact on the USDCHF outlook.

The Consumer Price Index reflects the dynamics of consumer prices for goods and services. Investors view a higher-than-expected reading as a positive factor for economic health, while a weaker-than-expected reading is considered negative. For August, Switzerland’s Consumer Price Index (m/m) is projected to return to positive territory. The previous reading was -0.2%, while a forecast for 3 September 2024 is optimistic, suggesting 0.1%. If the actual CPI surpasses expectations, it may lead to Swiss franc appreciation, potentially putting downward pressure on the USDCHF rate.

GDP reflects the aggregate value of all goods and services produced in a country (only end products are considered, excluding the costs of raw materials). Switzerland releases quarterly GDP changes in percentage terms, demonstrating the economy’s comprehensive dynamics.

On the other hand, Switzerland’s GDP represents the total economic output and is a crucial indicator of economic health. The GDP forecast remains steady at 0.5% for Q3 2024. Any deviation from this figure could significantly impact the USDCHF prediction. A stronger GDP could bolster the Swiss franc, while a weaker reading could provide further support for the US dollar, leading to a rise in the USDCHF rate.

The US manufacturing PMI evaluates the activity of purchasing managers in the industrial sector, reflecting the state and the dynamics of industrial processes.The forecast for September is a decrease to 48.0, down from 49.6. A lower PMI indicates contraction, which could weaken the US dollar. However, if the actual PMI comes in higher than expected, it could offer a signal of strength for the USD, influencing the USDCHF pair towards an upward trend.

USDCHF technical analysis

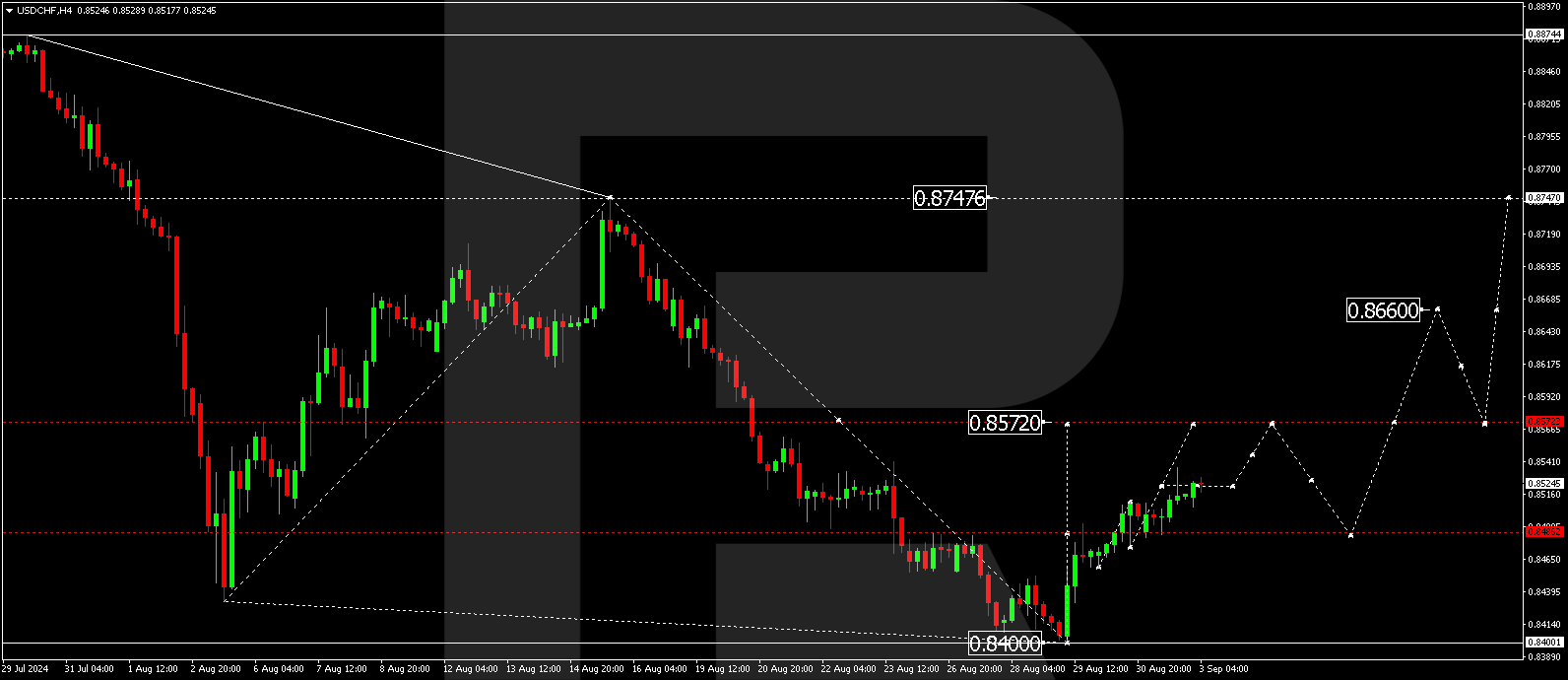

The USDCHF technical outlook for 3 September 2024 indicates a potential continuation of the recent upward movement. The USDCHF H4 chart shows that the market has completed a growth impulse, reaching 0.8486. A consolidation range has formed around this level. The market broke above the range today, 3 September 2024. A breakout above the 0.8500 level may signal further growth. The potential for further movement towards the first target of 0.8572 is open. Once the price reaches this level, a corrective phase could follow, aiming for 0.8484 as the second target.

.png)

Summary

In conclusion, the USDCHF today's analysis suggests that the pair could continue its upward trajectory towards 0.8572, driven by fundamental data from both Switzerland and the US. Traders should monitor the upcoming CPI, GDP, and PMI releases closely, as these could provide significant signals and influence the USDCHF forecast. The overall outlook remains cautiously optimistic for the US dollar, but the actual data releases will be key in shaping the market's direction.