The USDCAD rate has declined for the fourth consecutive session, with buyers holding the rate above the key 1.3600 support level. Find out more in our analysis dated 21 August 2024.

USDCAD forecast: key trading points

- Inflation in Canada eased to 2.5% in July, reaching three-year lows

- Canada’s unemployment rate remains at 6.4%, marking the highest level in two and a half years

- Low inflation and high unemployment confirm the need for further monetary policy easing by the Bank of Canada

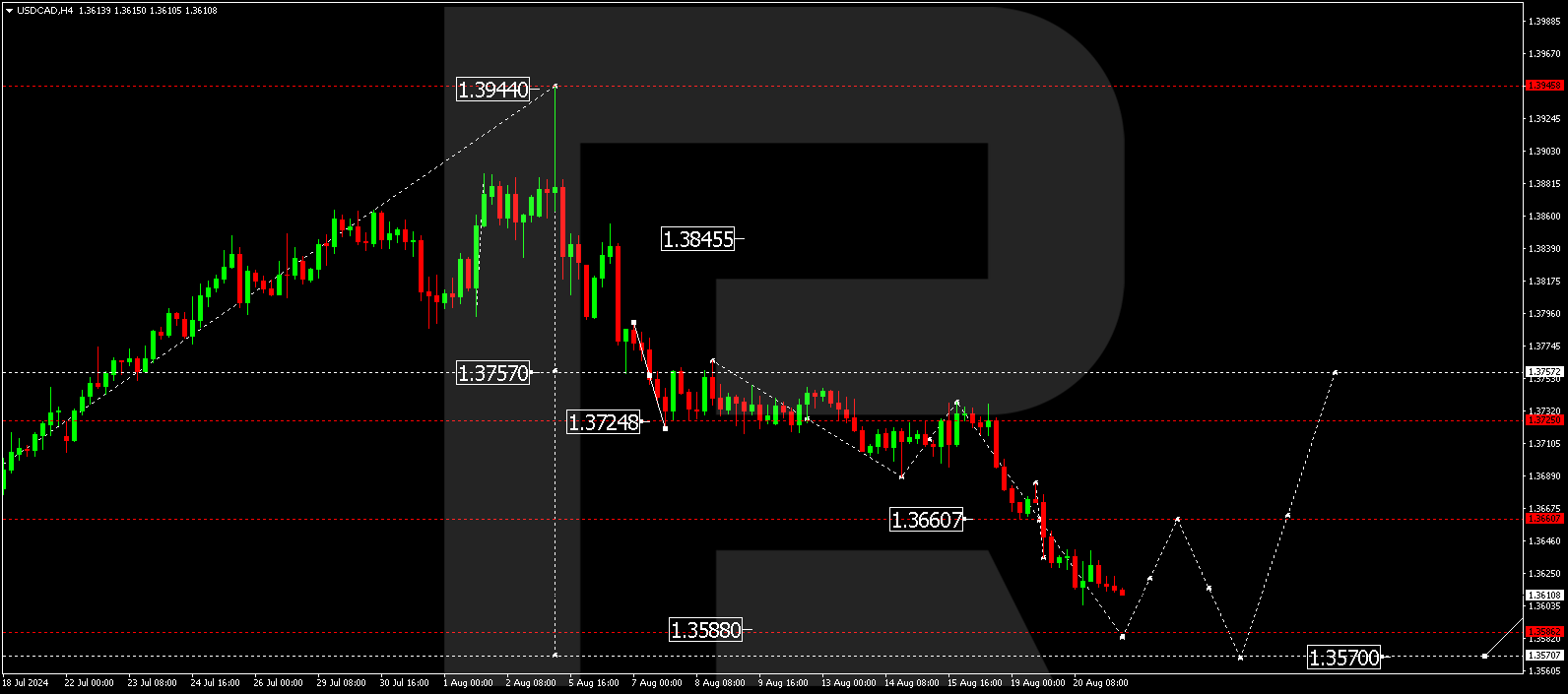

- USDCAD forecast for 21 August 2024: 1.3588 and 1.3570

Fundamental analysis

The weakening of the USDCAD pair is primarily driven by a decline in the US currency. Expectations of an imminent Federal Reserve interest rate cut are exerting pressure on the US dollar and boosting demand for other currencies, including the Canadian dollar, causing the USDCAD rate to decline.

Meanwhile, inflation in Canada fell to 2.5%, reaching a three-year low. This aligns with market expectations and indicates the need for further monetary policy easing by the Bank of Canada. According to the USDCAD forecast for today, this may limit the strengthening of the Canadian dollar.

While inflation is easing in Canada, the employment market situation is deteriorating. The unemployment rate remains at 6.4%, marking the highest level in two and a half years. Net employment has decreased for the second consecutive month, indicating a further decrease in job numbers. Additionally, investors are concerned about a decline in the labour force participation rate to its lowest level since 1998, which indicates that an increasing number of Canadians have abandoned their search for jobs.

USDCAD technical analysis

The USDCAD forecast for 21 August 2024 shows that the pair continues to move within a downward wave towards 1.3588. The price is expected to reach this target level today, which may provide a significant signal for traders. Once the rate hits the 1.3588 level, a correction is expected to begin, aiming for 1.3660. The USDCAD analysis suggests that the downtrend could resume after the correction, targeting 1.3600 and potentially declining to 1.3570. This target is considered a high priority in the current forecast.

Thus, the key levels in the USDCAD analysis for 21 August 2024 remain at 1.3588, 1.3660, and 1.3570, confirming that the current trend will continue.

.png)

Summary

Canada’s weak macroeconomic indicators and expectations of monetary policy easing by the Bank of Canada are preventing further declines in the USDCAD rate. Technical indicators in today’s USDCAD forecast suggest a downward wave to the 1.3588 and 1.3570 levels.