The EURUSD pair hovers at a four-week low on Wednesday. The market appears wary. Discover more in our analysis for 11 September 2024.

EURUSD forecast: key trading points

- The EURUSD pair dropped to a four-week low

- Investors are keeping an eye on politics and the upcoming US inflation report for August

- EURUSD forecast for 11 September 2024: 1.0986

Fundamental analysis

The EURUSD rate is hovering at 1.1039 in the middle of the week.

The news landscape now looks highly busy. Today, the market is awaiting the release of the crucial US inflation report for August. Additionally, it will follow the long-awaited political debates between the main US presidential nominees. Neither event is likely to have a decisive impact on the Federal Reserve’s monetary policy. However, the main thing for investors is expectations as they shape the local sentiment.

The Federal Reserve will meet and make an interest rate decision next week. The main scenario suggests a 25-basis-point reduction in borrowing costs, the likelihood of which is estimated at 67%. Investors give nearly 33% to the scenario, suggesting a 50-basis-point interest rate cut.

The EURUSD forecast appears cautious.

EURUSD technical analysis

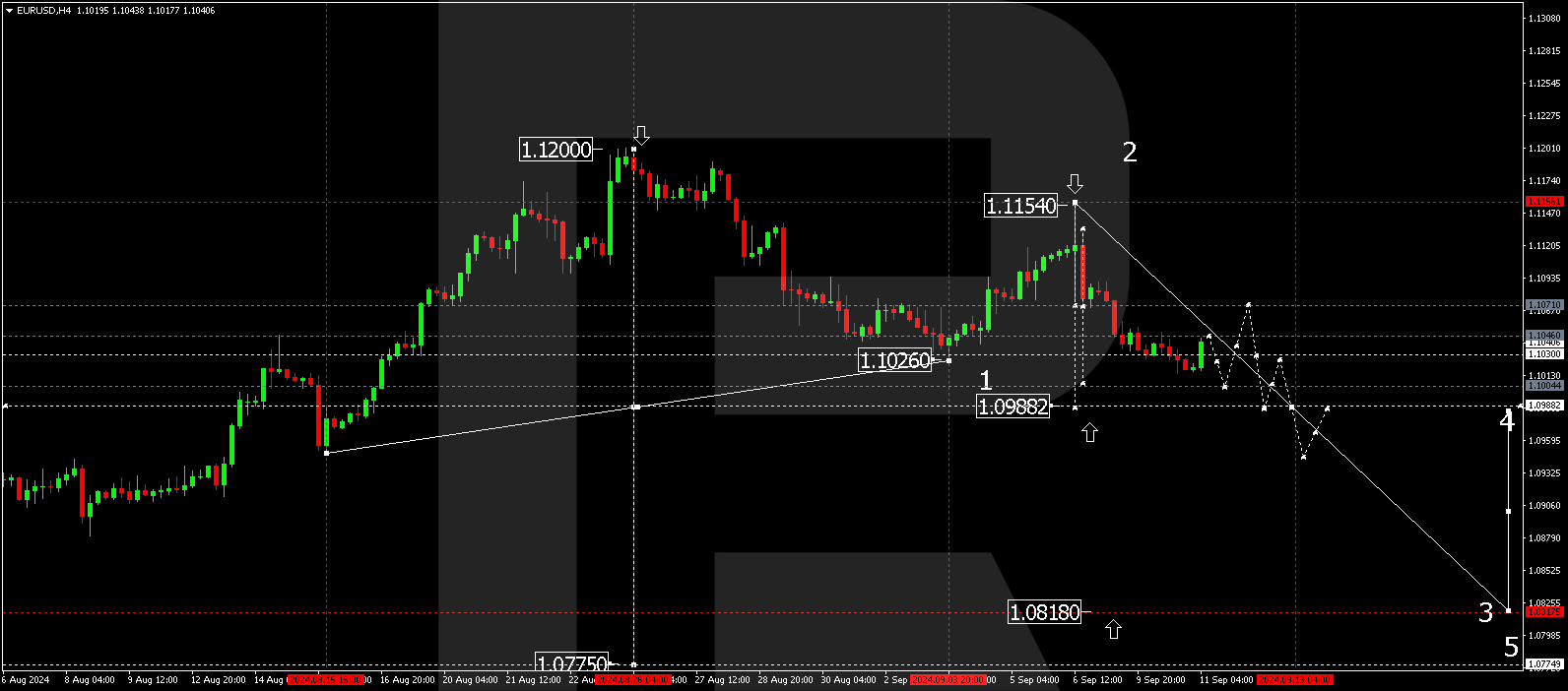

On the EURUSD H4 chart, the market has completed a downward wave, reaching 1.1015. A correction towards 1.1046 (testing from below) is expected today, 11 September 2024. Once the correction is complete, the downward wave could develop to 1.1030. Breaking below this level may signal a continuation of the trend to the local estimated target of 1.0986. After reaching this level, the price could correct towards 1.1030.

.png)

Summary

The EURUSD pair has declined markedly. The market has reduced its activity level as the news landscape is highly busy. Technical indicators in today’s EURUSD forecast suggest that the wave could continue to 1.0986.