Brent price has been falling for the third consecutive trading session amid declining economic activity in China and the Middle East negotiations. Find out more in our Brent analysis for today, 20 August 2024.

Brent forecast: key trading points

- US data: the market awaits data on the API US crude oil stocks

- Brent forecast for 20 August 2024: 79.30 and 75.00

Fundamental analysis

Brent quotes dipped further today as part of a downward correction, dropping below 77.00 USD. A decline in China’s economic growth rates exerts pressure on oil prices, potentially leading to reduced demand from China, one of the largest oil consumers.

There was also news that Israel was ready to negotiate with Hamas, which slightly reduces market concerns about possible restraints on oil supplies from the Middle East region. Brent price movements during today’s US session will depend on US oil inventory data from the American Petroleum Institute (API).

Brent technical analysis

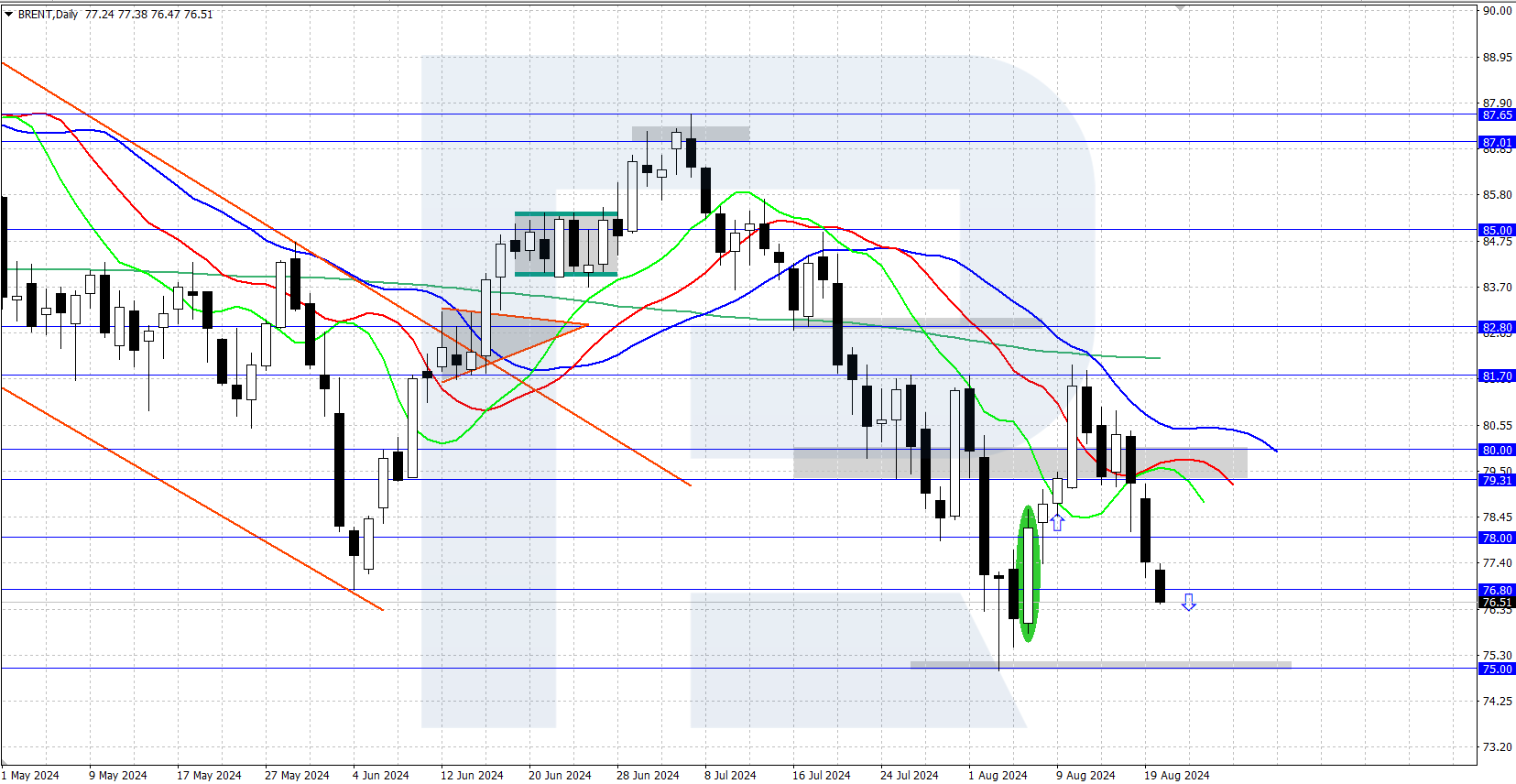

Brent price continues to decline, dipping below the 76.80 USD support level. The daily chart shows strong downward momentum, with bulls yet unable to prevent the quotes from falling. The key support level able to halt the price decline is currently at the 75.00 level.

The short-term Brent price forecast suggests that if bulls halt the decline and push the quotes above the 76.80 level, the price will have the potential to return to 80.00. If bears continue to control the situation, the price will more likely decline further and test the 75.00 support level.

.png)

Summary

Brent quotes dropped below 77.00 USD, falling for the third consecutive trading day. A decline in China’s economic growth rates and the prospect of peace talks in the Middle East exert pressure on oil prices.