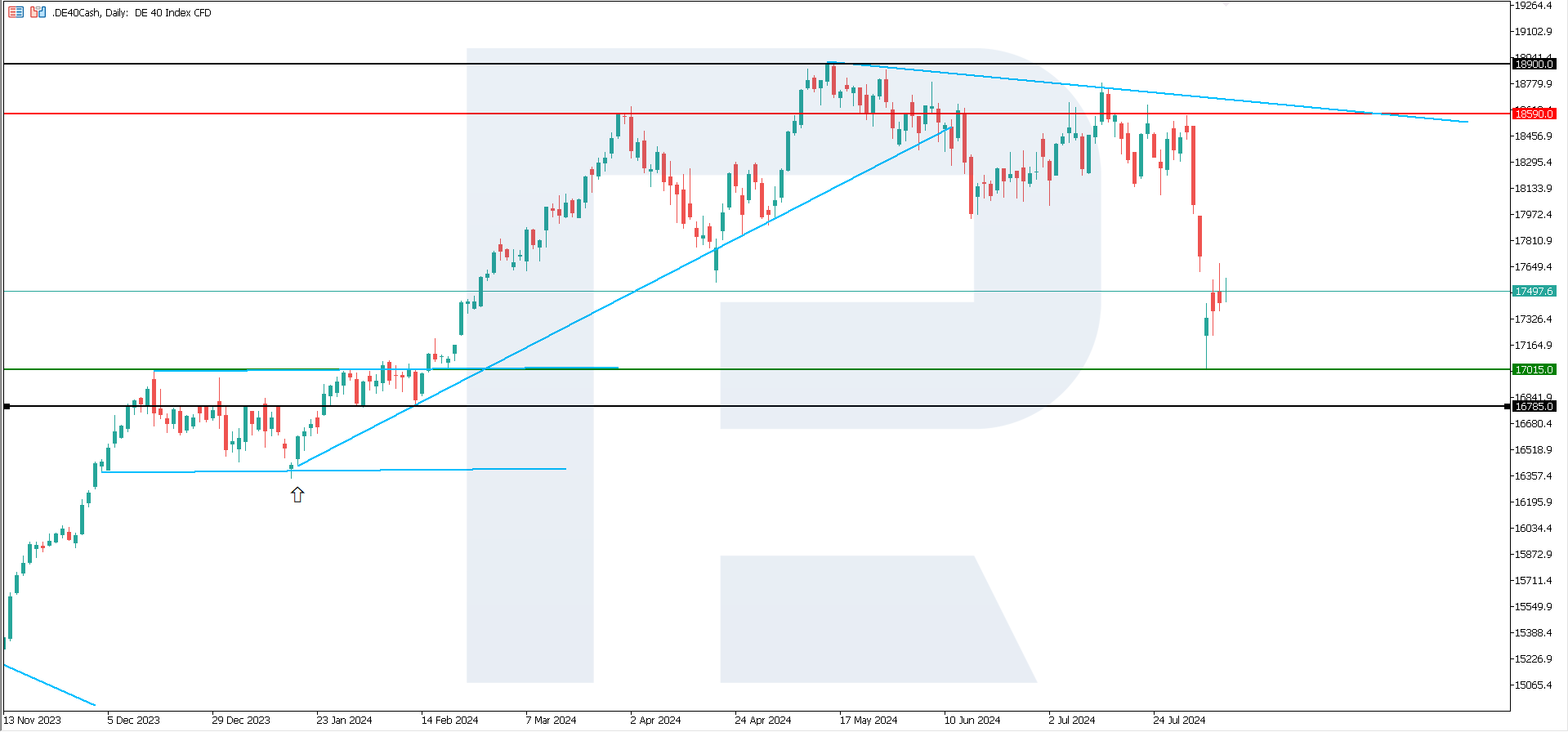

The DE 40 stock index fell by 9.88% from its all-time high, exiting a sideways channel on Monday. The DE 40 index forecast suggests a further decline.

DE 40 trading key points

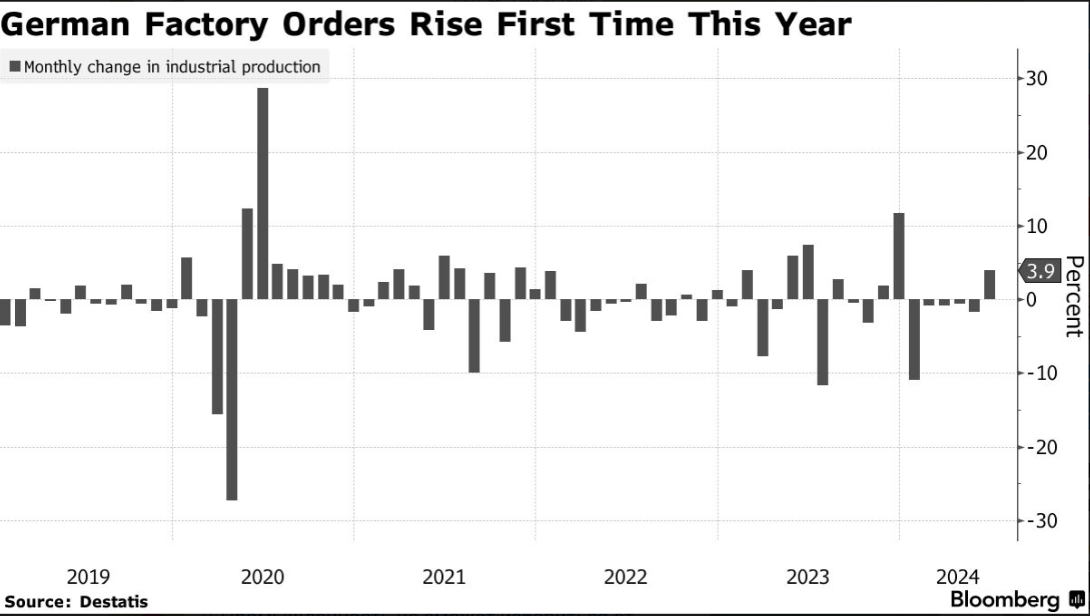

- Recent data: Germany’s factory orders unexpectedly rose by 3.9% in June, exceeding analysts’ forecast of 0.5%

- Economic indicators: the German economy largely depends on the manufacturing segment, as the services sector has a smaller share

- Market impact: the reviving manufacturing sector may heighten investor interest in German stocks

- Resistance: 18,590.0, Support: 17,015.0

- DE 40 price forecast: 16,785.0

Fundamental analysis

Germany’s factory orders unexpectedly increased in June for the first time this year, ending a five-month decline in Europe’s largest economy. Demand rose 3.9% compared to May, when it had decreased by 1.7%, revised this Tuesday. This gain exceeded all economists’ forecasts in the Bloomberg survey as they expected more moderate growth of 0.5%.

.png)

Business confidence in Germany fell sharply last week, and the GDP data decreased. The country that has long been considered Europe’s economic growth engine is beginning to resemble a burden. However, reviving demand for German factory products gives hope for overcoming the crisis.

Given the current dynamics, it will be a success for Germany if the GDP does not fall at the year-end. Growth is still improbable since energy prices in the EU remain high, which was the main reason behind German economic problems. Amid the US Federal Reserve monetary policy easing, the DE 40 forecast for next week is negative.

DE 40 technical analysis

The DE 40 technical analysis shows a strong downtrend. Recovery after Monday’s massive decline is relatively weak and resembles a technical correction with no hint of a trend reversal. Growth during the last two trading sessions has been restrictive, leading to an unfavourable DE 40 price forecast.

.png)

Key levels for the DE 40 analysis:

- Resistance level: 18,590.0 – with an upward breakout, the price could rise to 18900.0

- Support level: 17,015.0 – if the price breaks below the support level, the index could plunge further to 16,785.0

Summary

The DE 40 index continues to decline markedly, with the next decline target at 16,785.0. The trend is doubtful of being reversed by the end of this week. Increased factory orders in Germany marked the completion of a five-month downturn in Europe’s largest economy, giving hope for overcoming the crisis even before the year ends.