The USDCAD pair started to rise amid expectations of the Bank of Canada’s business outlook survey. The Canadian dollar may continue to lose ground.

USDCAD trading key points

- Canada’s manufacturing sales (m/m): previously at 1.1%, forecasted at 0.3%

- Canada’s wholesale sales (m/m): previously at 2.4%, forecasted at 2.0%

- Bank of Canada’s business outlook survey

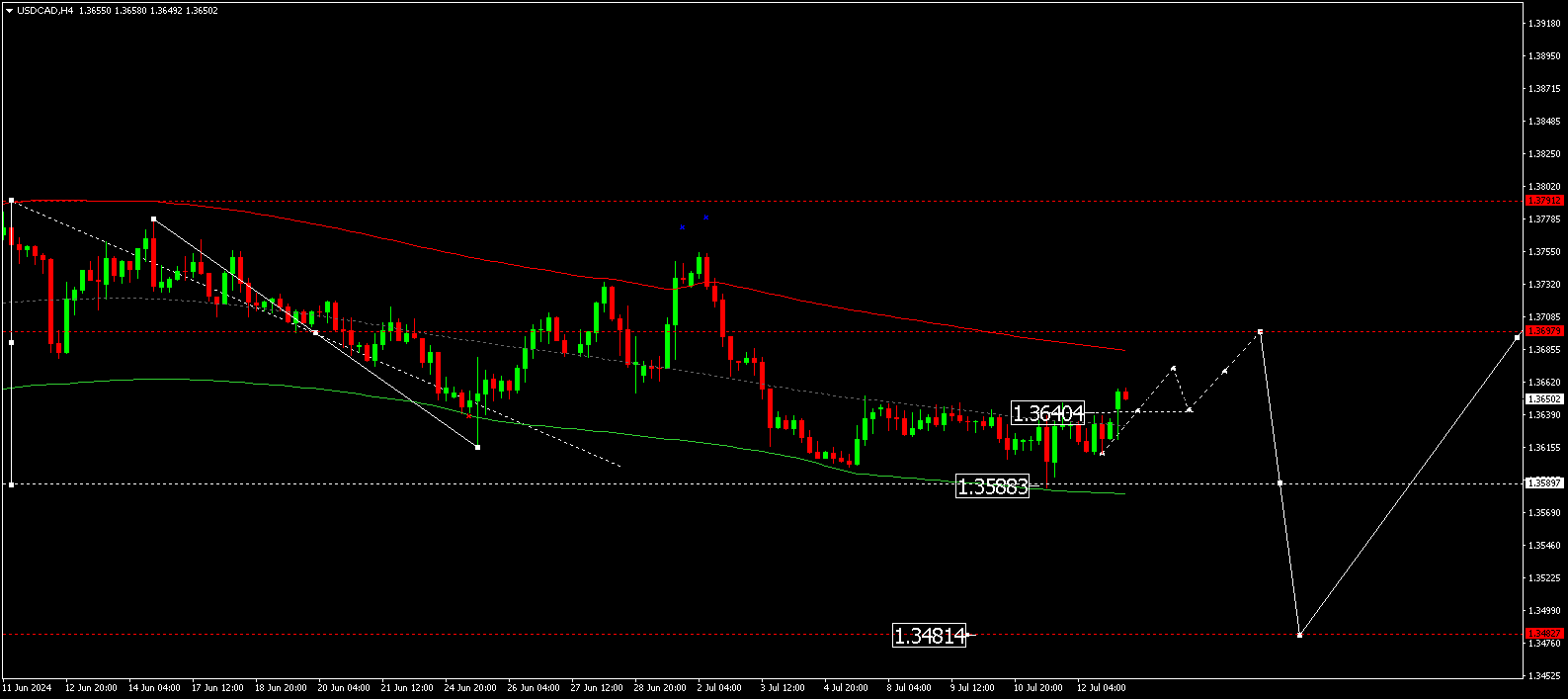

- USDCAD price targets: 1.3672, 1.3696, and 1.3580

Fundamental analysis

The Canadian dollar continues to lose ground against the US dollar. The forecast of economic indicators is not in favour of the CAD at this stage. Manufacturing sales are expected to decrease to 0.3%, while wholesale sales are anticipated to fall to 2.0%. The USDCAD pair has experienced growth amid such forecasts.

The Bank of Canada’s business outlook survey will be released by the opening of the US trading session. The economic situation is analysed through short interviews with senior management of 100 companies. If their sentiment is positive, this may positively impact the strengthening of the Canadian dollar. Negative sentiment could undermine confidence in the central bank’s actions and cause the CAD to lose ground.

At this stage, investors and analysts do not favour the CAD, betting on growth in the USDCAD rate.

USDCAD technical analysis

In the forecast for 15 July 2024, the USDCAD pair has completed a decline wave, reaching 1.3588. The market rose to 1.3640 and corrected to 1.3612. Today, the USDCAD rate is expected to continue rising to the local target of 1.3672. Subsequently, the price could decline to 1.3640 (testing from above) before rising to 1.3696.

.png)

Summary

Technical analysis of the USDCAD pair aligns with the projected decrease in economic indicators, suggesting a correction to 1.3672, with the trend continuing to the 1.3580 target.