EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a corrective wave, reaching 1.0814, and continued a decline wave. Today, the market is forming a narrow consolidation range above the 1.0733 level. With an upward breakout, the price might rise to 1.0770. With a downward breakout, the trend will continue towards 1.0704, representing the downtrend’s first target.

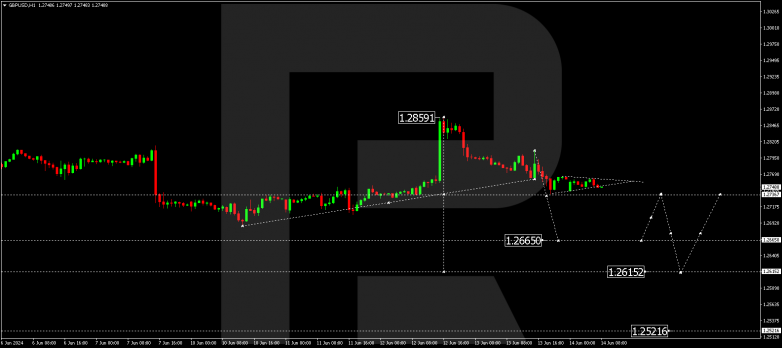

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has completed a correction, reaching 1.2807, and continued a wave towards 1.2738. Today, the market is forming a narrow consolidation range above this level. A downward breakout towards 1.2665 is expected. After reaching this level, the price might rise to 1.2737 (testing from below) and then decline to 1.2615, the downtrend’s first target.

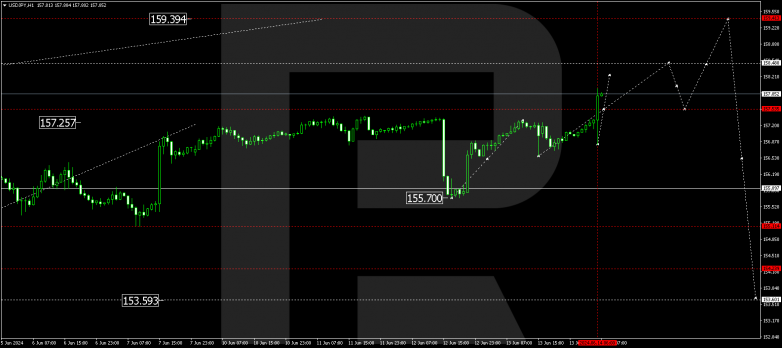

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has exited the consolidation range upwards, practically opening the potential for a growth wave towards 158.48, with the prospects of a further rise to 159.41. Once the price reaches this level, a decline wave might start, aiming for 156.55.

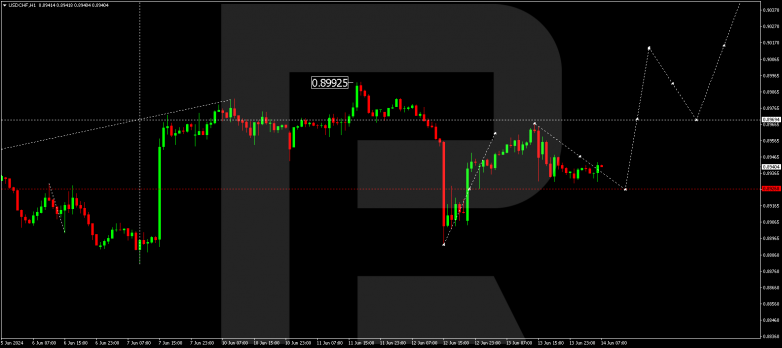

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair is forming a correction towards 0.8929. Once the correction is complete, a new growth wave towards 0.8969 could start. An upward breakout of this level will open the potential for a wave towards 0.9010, possibly continuing towards 0.9060, the uptrend’s first target.

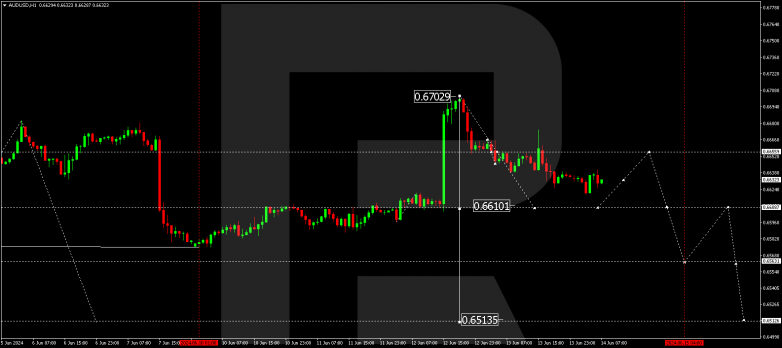

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has completed a corrective wave, reaching 0.6674. Today, the market continues to develop a decline wave towards 0.6608. After the price hits this level, a corrective phase might follow, with a target at 0.6650. Subsequently, a new decline wave is possible, aiming for 0.6565 and potentially continuing to 0.6515.

Brent

Brent is currently in a consolidation phase above 81.60 without any strong trend. An upward breakout will open the potential for a wave towards 84.00, possibly expanding to 86.66, the uptrend’s first target.

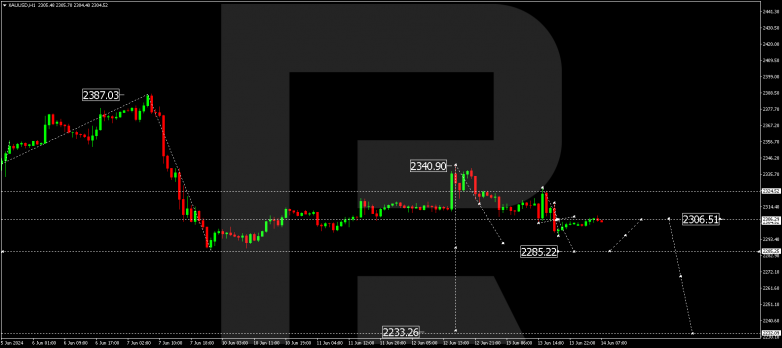

XAUUSD, “Gold vs US Dollar”

Gold has completed a corrective wave, reaching 2326.60. Today, a decline wave structure towards 2277.44 is forming. After the price hits this level, a corrective phase might start, with a target at 2300.00 (testing from below). Following this, the price could decline to 2260.60, potentially reaching 2233.22, the downtrend’s local target.

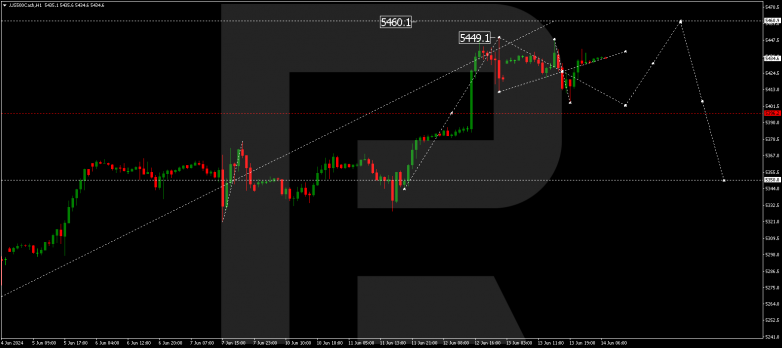

S&P 500

The stock index is forming a consolidation range around 5425.5, which might expand downwards to 5402.0 today. Subsequently, a rise to 5460.0 is expected. Once the price reaches this level, a decline wave could follow, aiming for 5350.0 as the downtrend’s first target.