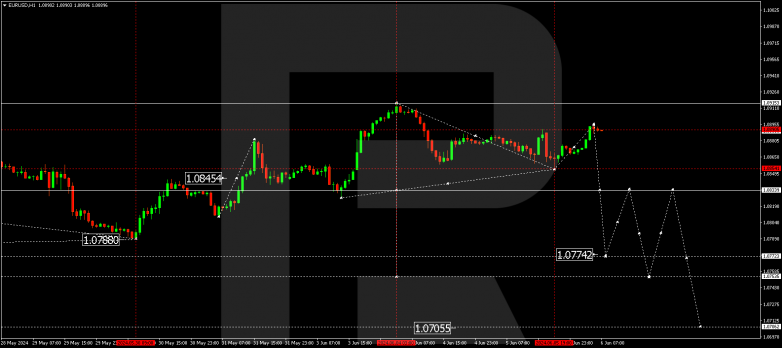

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a downward impulse towards 1.0854 and corrected towards 1.0893, with a consolidation range forming below this level today. A downward breakout and a decline towards 1.0833 are expected. If this level also breaks, it will open the potential for a wave towards 1.0774, the downward wave’s local target.

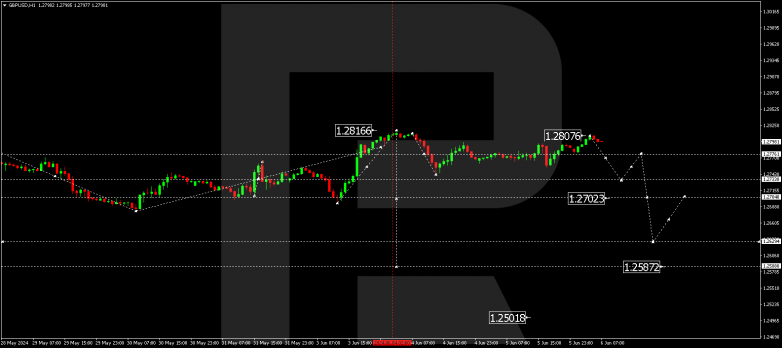

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has corrected towards 1.2807, with a fall to 1.2733 expected today. A breakout of this level will open the potential for a wave towards 1.2702, potentially reaching 1.2630, representing the downward wave’s local target.

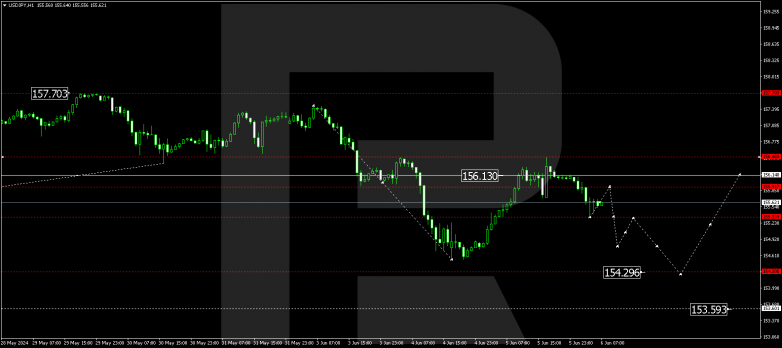

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has completed a corrective wave, reaching 156.46, and today declined towards 155.33. A rise towards 156.90 is expected. Subsequently, a new decline wave might start, aiming for 154.29 as the local target of the downtrend.

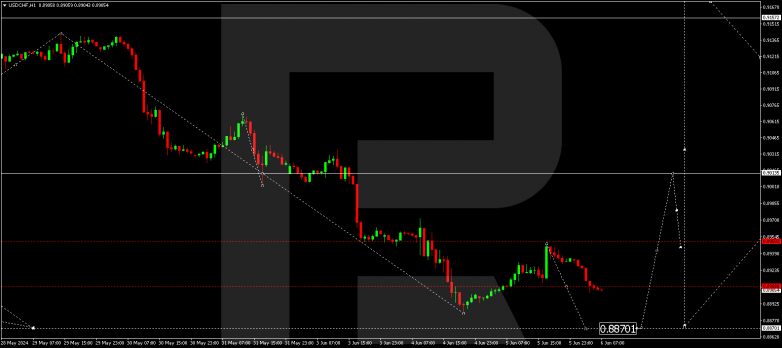

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has completed a growth wave, reaching 0.8948. Today, a correction towards 0.8908 might follow. Once the correction is complete, a new growth wave could start, aiming for 0.8950. A breakout of this level will open the potential for a wave towards 0.9013, representing the uptrend’s first target.

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has completed its movement towards 0.6624 and corrected towards 0.6680. Today, a wave aiming for 0.6611 is expected to develop. A breakout of this level will open the potential for a wave towards 0.6542, representing the downtrend’s local target.

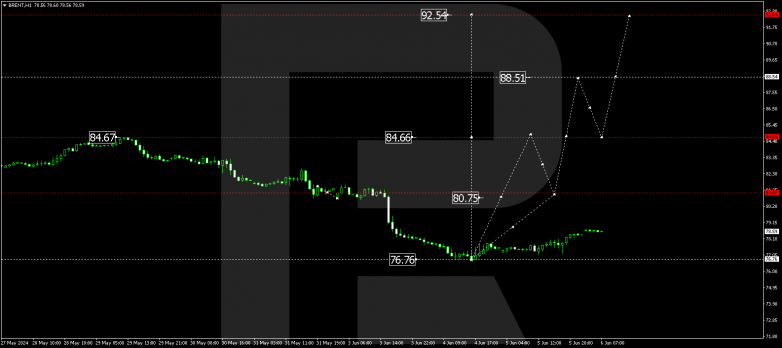

Brent

Brent is forming a growth structure towards 81.07. After the price reaches this level, a corrective phase targeting 79.15 is possible, followed by a rise towards 84.70, potentially continuing towards 88.50. This is the uptrend’s local target.

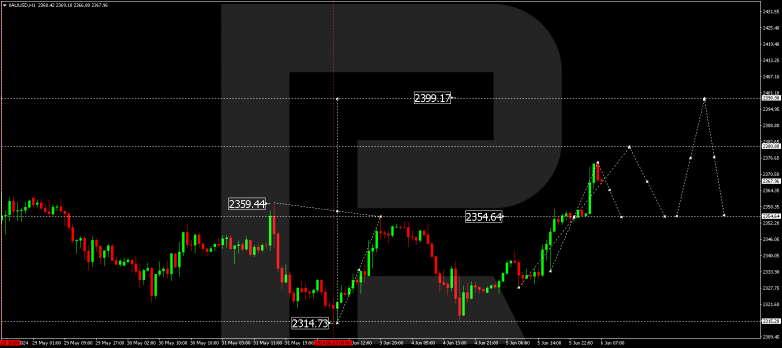

XAUUSD, “Gold vs US Dollar”

Gold has completed a growth wave, reaching 2354.64. A consolidation range has formed around this level. With an upward breakout, the wave is expected to continue towards 2380.00 today. Once the price reaches this level, a corrective phase targeting 2354.64 (testing from above) is possible, followed by a rise towards the local target of 2399.00.

S&P 500

The stock index has extended a consolidation range towards 5360.0. A correction towards 5298.0 is possible today. Subsequently, another growth structure could develop, aiming for 5400.0. After the price reaches this level, a consolidation range is expected to form. A downward breakout will open the potential for a new decline wave towards 5169.5, representing the downtrend’s first target.