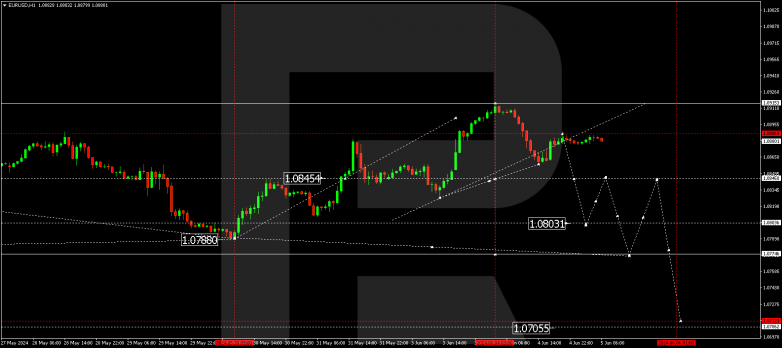

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a downward impulse to 1.0858 and corrected towards 1.0886, with a consolidation range forming below this level today. A downward breakout and a decline towards 1.0845 are expected. If this level also breaks, it will open the potential for a wave towards 1.0803, the downward wave’s local target.

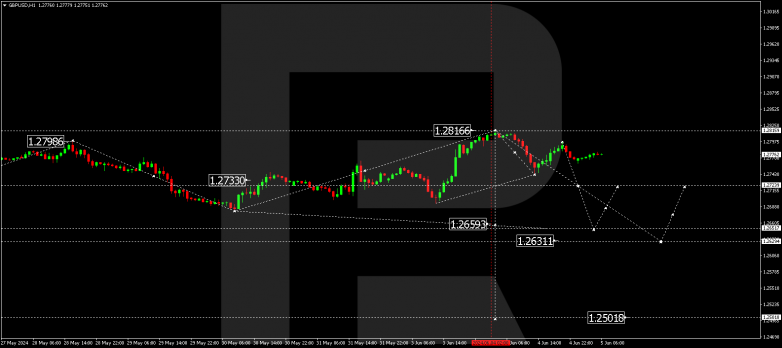

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has declined to 1.2742 and corrected towards 1.2796, with a fall to 1.2733 expected today. A breakout of this level will open the potential for a wave towards 1.2673, potentially reaching 1.2631, representing the downward wave’s first target.

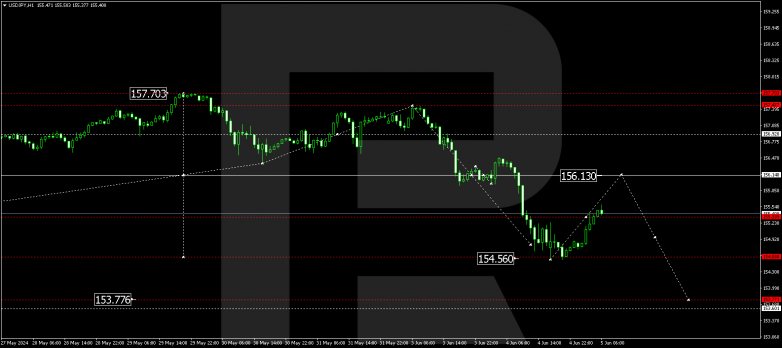

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has declined towards 154.56. Today, a correction might develop, targeting 156.13. Once the correction is complete, a new decline wave might start, aiming for 153.77 as the local target of the downtrend.

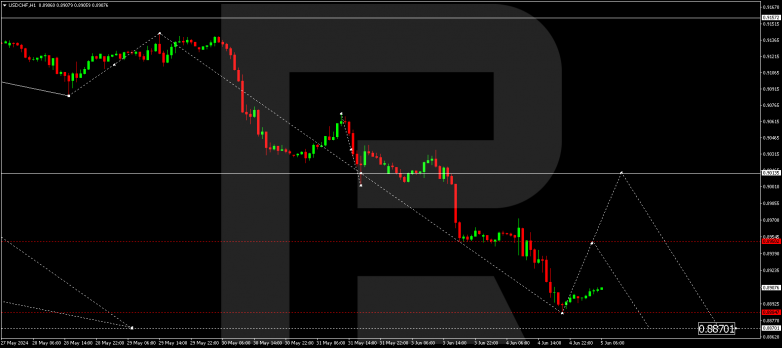

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has completed a decline wave, reaching 0.8885. Today, a consolidation range might develop above this level. With an upward breakout, a growth wave could continue towards 0.8950. A breakout of this level will open the potential for a wave towards 0.9013, representing the first target.

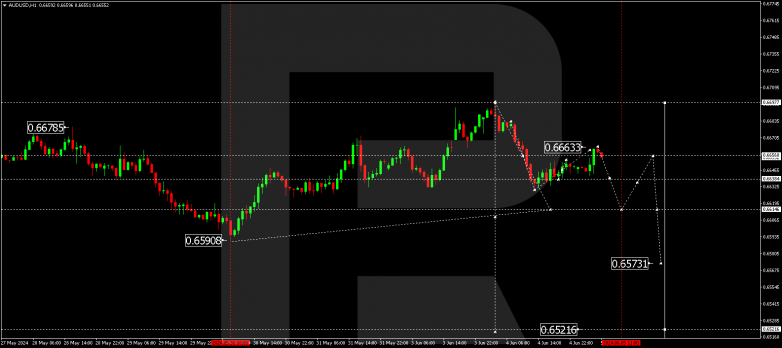

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has completed its movement to 0.6630 and corrected towards 0.6663. Today, a wave targeting 0.6630 is expected. A breakout of this level will open the potential for a wave towards 0.6614, potentially continuing towards 0.6575 as the local target of the downtrend.

Brent

Brent has completed a decline wave towards 76.76, practically reaching the estimated target for correction. Today, a consolidation range might form at the current lows. With an upward breakout, a new growth wave might start, aiming for 80.75. A breakout of this level will open the potential for a wave towards 88.50, potentially continuing towards 92.55, representing the first target of the next upward wave.

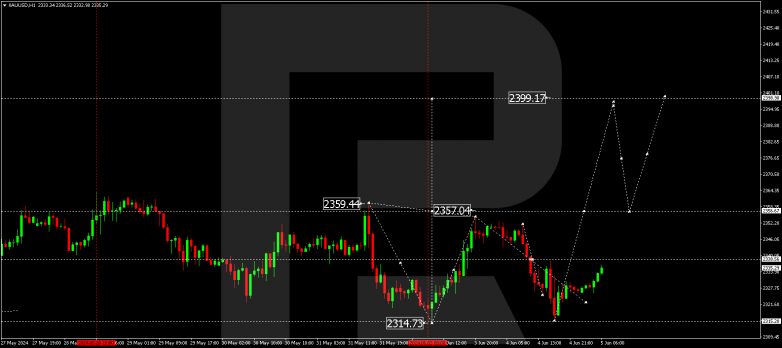

XAUUSD, “Gold vs US Dollar”

Gold is currently in a consolidation phase around 2338.55. The market has completed a decline towards 2315.55. Today, a rise towards 2338.55 is possible. If this level also breaks, it will open the potential for an increase to 2356.66. With an upward exit from this range, a correction might develop towards 2399.17. With a downward breakout, the trend could continue towards 2212.77, representing the local target.

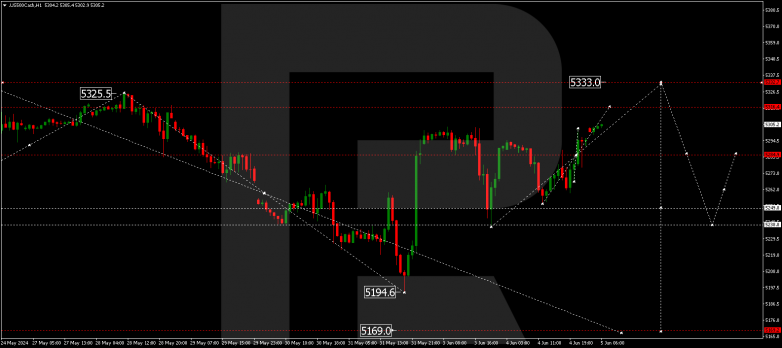

S&P 500

The stock index has formed a consolidation range around 5285.0, with the market exiting this range upwards today. Practically, the market suggests expanding the range to 5316.5, with the wave potentially continuing towards 5333.0. Subsequently, a decline towards 5238.8 is expected. A breakout of this level will open the potential for a movement by trend towards 5169.2.