GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is correcting after breaching the upper boundary of the Triangle pattern. The pair is moving above the Ichimoku Cloud, suggesting an uptrend. A test of the Cloud’s upper boundary at 1.2740 is expected, followed by a rise to 1.2905. A rebound from the lower boundary of the bullish channel would be an additional signal confirming the increase. The scenario could be cancelled by a breakout of the Cloud’s lower boundary, with the price securing below 1.2695, indicating a further decline to 1.2605.

XAUUSD, “Gold vs US Dollar”

Gold is bouncing off the indicator’s signal lines. The instrument is moving below the Ichimoku Cloud, suggesting a downtrend. A test of the Cloud’s lower boundary at 2335 is expected, followed by a decline to 2255. A rebound from the upper boundary of the bearish channel would be an additional signal confirming the fall. This scenario could be cancelled by a breakout above the upper boundary of the Cloud, with the price securing above 2395, indicating a further rise to 2445. Conversely, a decline could be confirmed by a breakout below the lower boundary of the bearish channel, with the price gaining a foothold below 2305.

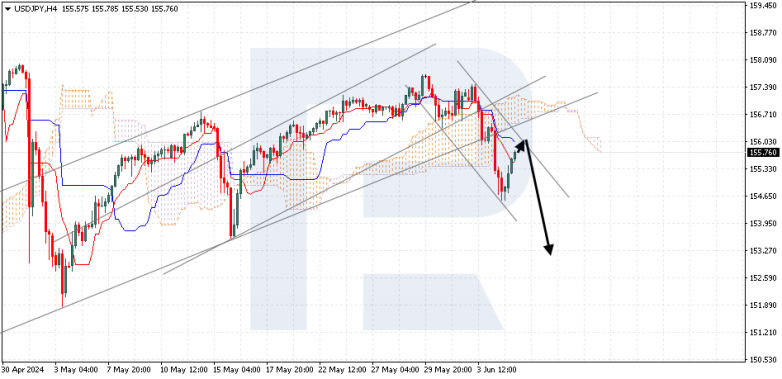

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is on the rise after an aggressive decline. The pair is moving below the Ichimoku Cloud, indicating a downtrend. A test of the Kijun-Sen line at 156.05 is expected, followed by a rise to 153.25. A rebound from the upper boundary of the bearish channel would be an additional signal confirming the decline. The scenario could be cancelled by a breakout of the upper boundary of the Cloud, with the price securing above 157.55, indicating a further rise to 158.45.