GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is correcting within a Triangle pattern. The pair is moving above the Ichimoku Cloud, suggesting an uptrend. A test of the Cloud’s lower boundary at 1.2715 is expected, followed by a rise to 1.2885. A rebound from the lower boundary of the bullish channel would be an additional signal confirming the increase. The scenario could be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 1.2685, indicating a further decline to 1.2595. Conversely, a rise could be confirmed by a breakout of the upper boundary of the Triangle pattern, with the price gaining a foothold above 1.2805.

XAUUSD, “Gold vs US Dollar”

Gold is testing the support area. The instrument is moving below the Ichimoku Cloud, suggesting a downtrend. A test of the Tenkan-Sen line at 2335 is expected, followed by a fall to 2245. A rebound from the upper boundary of the bearish channel would be an additional signal confirming the fall. This scenario could be cancelled by a breakout above the upper boundary of the Cloud, with the price securing above 2395, indicating a further rise to 2445.

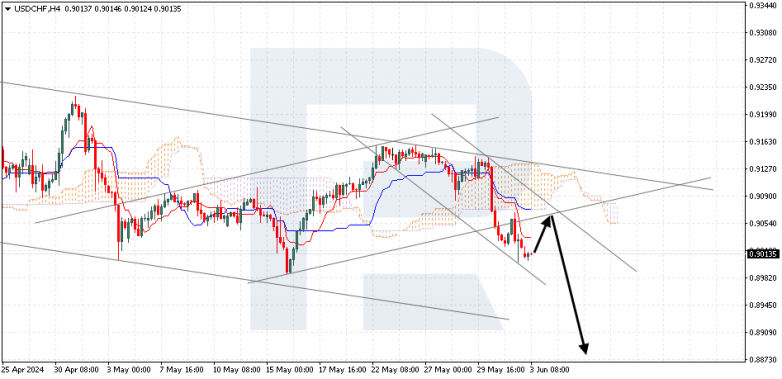

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has established itself below the lower boundary of the ascending channel. The pair is moving below the Ichimoku Cloud, suggesting a downtrend. A test of the Kijun-Sen line at 0.9055 is expected, followed by a decline to 0.8875. A rebound from the lower boundary of the bullish channel would be an additional signal confirming the fall. This scenario could be cancelled by a breakout above the upper boundary of the Cloud, with the price securing above 0.9140, indicating a further rise to 0.9230.