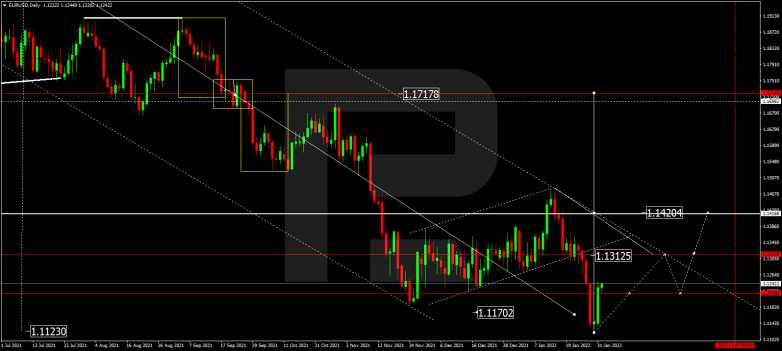

EURUSD, “Euro vs US Dollar”

As we can see in the daily chart, EURUSD is forming the structure of the ascending wave with the first target at 1.1313. Later, the market may correct towards 1.1220 and then resume trading upwards to break 1.1420. After that, the instrument may continue growing with the short-term target at 1.1600.

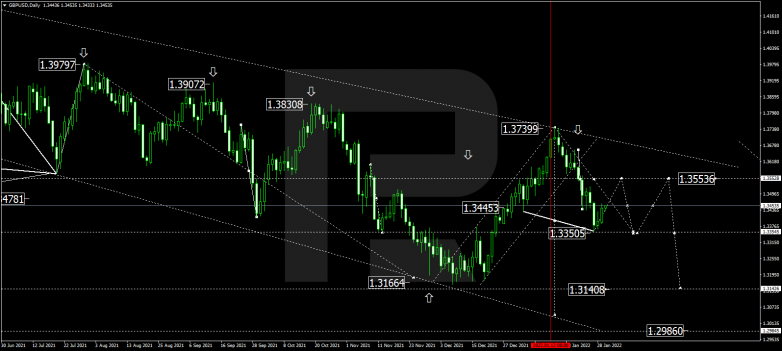

GBPUSD, “Great Britain Pound vs US Dollar”

In the daily chart, GBPUSD is falling with the target at 1.3350. After that, the instrument may correct towards 1.3555 and then start another decline with the short-term target at 1.3140.

USDRUB, “US Dollar vs Russian Ruble”

As we can see in the daily chart, USDRUB is trading downwards to reach 76.33. After that, the instrument may correct towards 78.00. Later, the market may form a new descending wave to reach 74.90 or even extend this wave down to 73.22.

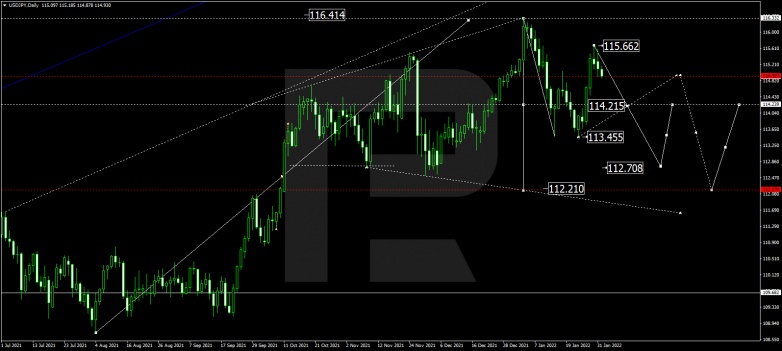

USDJPY, “US Dollar vs Japanese Yen”

In the daily chart, USDJPY has finished the correction at 115.66. Possibly, the pair may start a new decline to break 114.20 and then continue trading downwards with the short-term target is at 112.70.

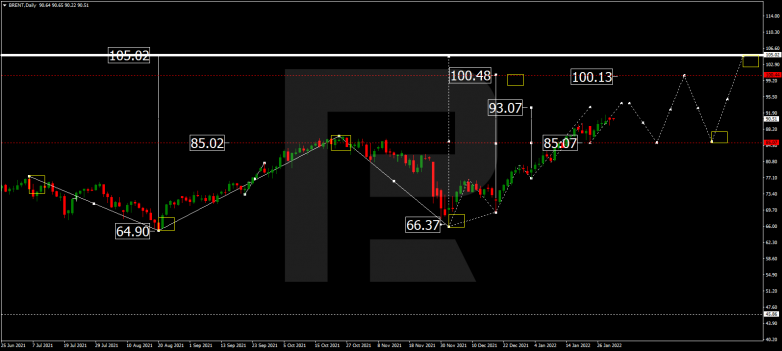

BRENT

As we can see in the daily chart, Brent has broken 85.00 to the upside; right now, it is still growing towards 93.00. Later, the market may start another correction to test 85.00 from above and then resume trading upwards with the target at 100.00.

XAUUSD, “Gold vs US Dollar”

In the daily chart, after finishing the correctional wave at 1782.00, Gold is expected to grow towards 1840.00. After breaking this level, the instrument may form one more ascending structure with the short-term target at 1900.40 and then start a new correction to return to 1840.00.

S&P 500

In the daily chart, the S&P index has reached the short-term correctional target at 4222.0; right now, it is correcting towards 4600.0. Later, the market may start a new descending wave with the first target at 4170.0.