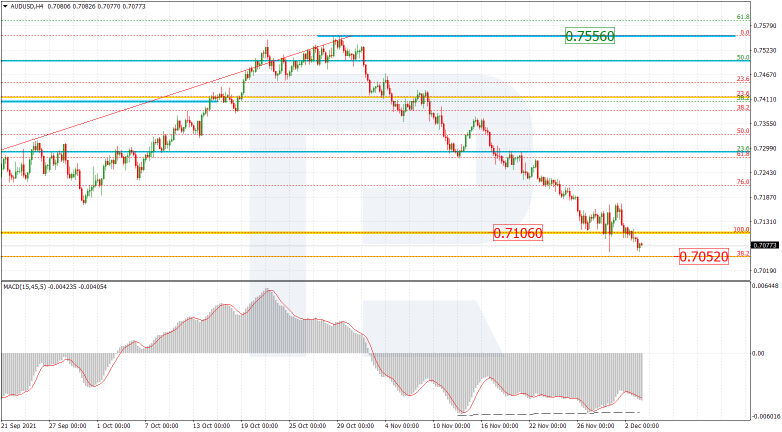

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, after breaking the low at 0.7106, AUDUSD is re-testing the long-term 38.2% fibo at 0.7052. The resistance is the local high at 0.7556. Convergence on MACD indicates a possible pullback soon.

In the H1 chart, the pair may start a new correction after reaching 38.2% fibo at 0.7052 and convergence on MACD. The upside correctional targets may be 23.6%, 38.2%, and 50.0% fibo at 0.7172, 0.7244, and 0.7304 respectively.

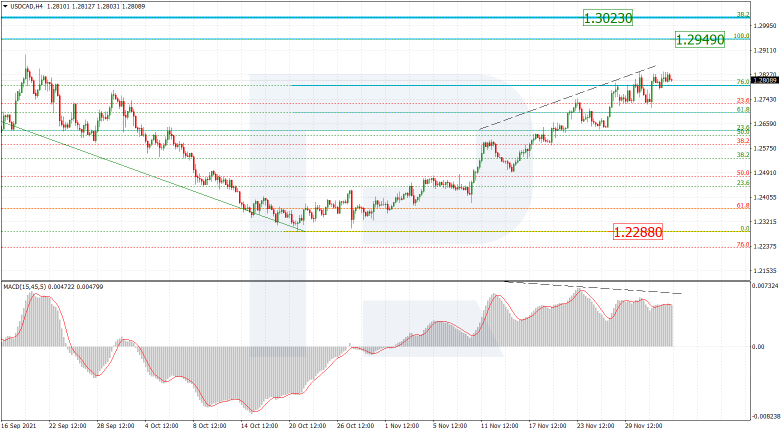

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, after breaking 76.0% fibo, the mid-term rising wave in USDCAD continues moving towards the high at 1.2949. Moreover, a breakout of the high will lead to a further uptrend to reach the long-term 38.2% fibo at 1.3022. The support is the low at 1.2288. Divergence on MACD hints at a possible correction soon.

The H1 chart shows the potential correctional targets after divergence on MACD – 23.6%, 38.2%, and 50.0% fibo at 1.2707, 1.2627, and 1.2563 respectively. A breakout of the local resistance at 1.2837 will result in a further uptrend.