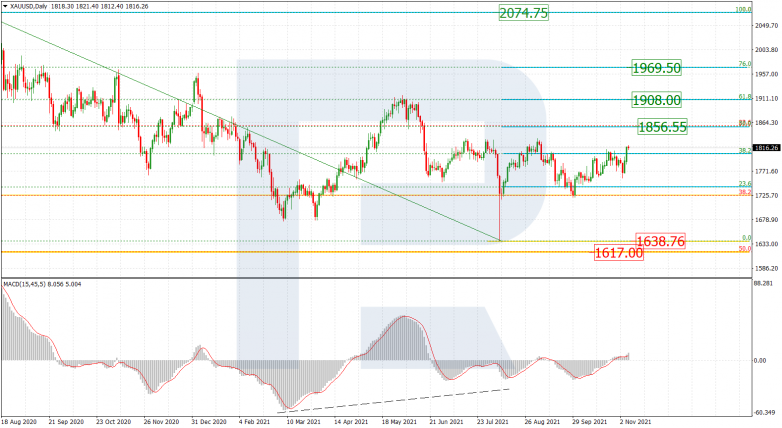

XAUUSD, “Gold vs US Dollar”

On D1, gold grew to 38.2% upon falling to 23.6%. Such a technical picture can be interpreted as a correction after a convergence, but the correction can turn into a wave of growth. The next aims can be 50.0% (1856.55), 61.8% (1908.00), and 76.0% (1969.50). However, the main goal is the all-time high of 2074.75. The current low of 1638.76 is the main support level.

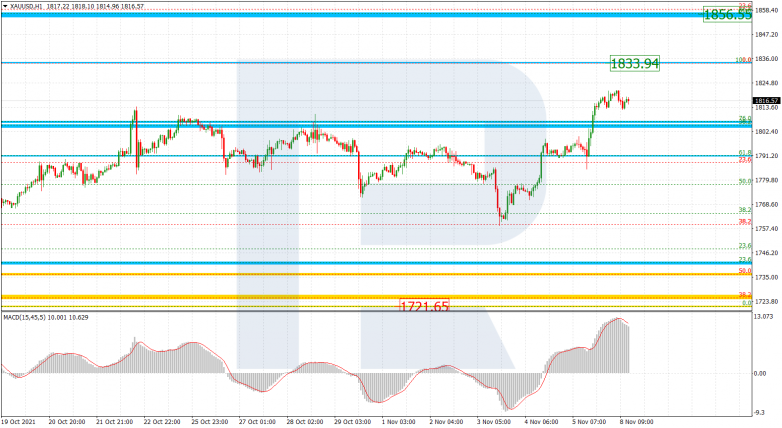

On H1, the quotations have risen above 76.0% (1807.00) and are heading for the local high of 1833.94. A breakaway of this high will confirm the idea of further growth to medium-term goals and the level of 50.0% (1856.55) in particular.

USDCHF, “US Dollar vs Swiss Franc”

On H4, the declining wave stopped somewhere near 76.0% Fibo. Current growth might be the beginning if a new wave of growth, aiming at the high of 0.9368. A breakaway of this will open a pathway to the post-correctional extension area of 138.2-161.8% (0.9475-0.9543). The main support is at 0.9018.

On H1, correctional growth after a convergence reached 23.6% Fibo. Further growth might aim at 38.2% (0.9193), 50.0% (0.9226), and 61.8% (0.9260). A breakaway of the local support level at 0.9085 will mean the downtrend continues.