Previous Trading Day’s Events (25.07.2024)

______________________________________________________________________

Winners vs Losers

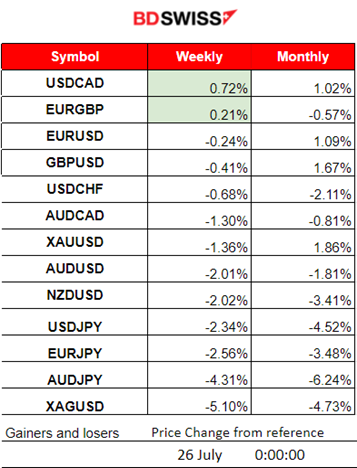

USDCAD remains on the top of the week’s list with 0.72% gains. The EURGBP follows as the EUR gains ground against the GBP and the USD. The USD has remained stable yesterday. Gold leads this month with 1.86% gains so far.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (25.07.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

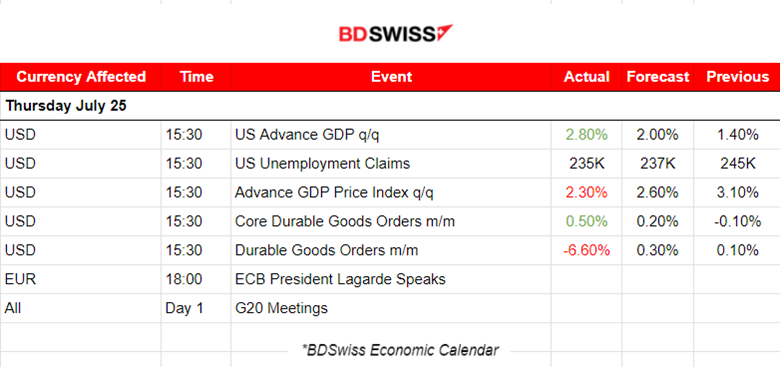

The U.S. Advance GDP growth for the second quarter was reported at 2.8%, which is higher than expected. Core durable goods grew by 0.50% while the regular durable goods figure experienced a surprisingly huge decline of -6.6% beating expectations of an increase instead of 0.3%. Unemployment claims were reported lower, at 235K, but remained high, near the expected figure. The impact in the market could have been better at that time, at 15:30 when all figures were released.

General Verdict:

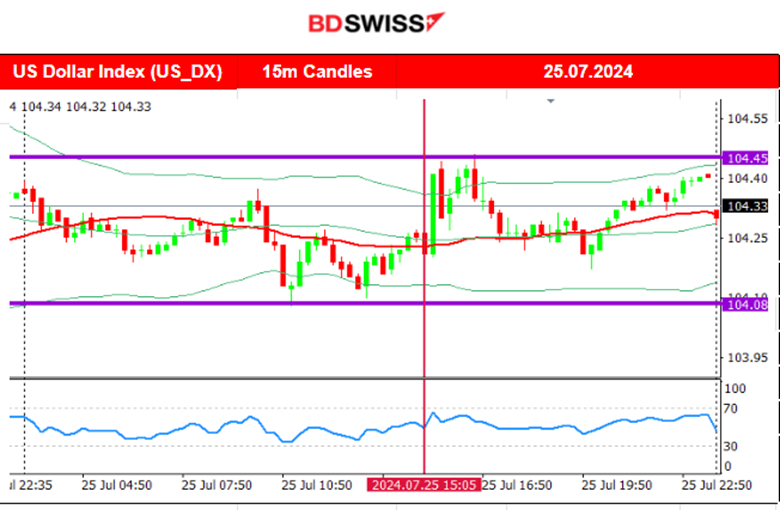

- Moderate volatility in the FX market. The U.S. dollar index moved sideways with low volatility. The U.S. news at 15:30 had no major impact. The EUR gained significant ground against the GBP and USD.

- Gold moved lower with stability.

- Crude oil closed higher despite the early drop.

- U.S. indices moved lower steadily but after the stock exchange opened they jumped and, before the trading day ended, they experienced a huge drop.

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (25.07.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The EUR managed to gain a lot of ground in the last couple of days. Yesterday, the pair was moving sideways early during the Asian session and after the start of the European session, it experienced more volatility. EURUSD was moving upwards within an intraday channel. The USD was barely affected by the news but the EUR drove the pair upwards closing the trading day higher.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC 03:00)

Price Movement

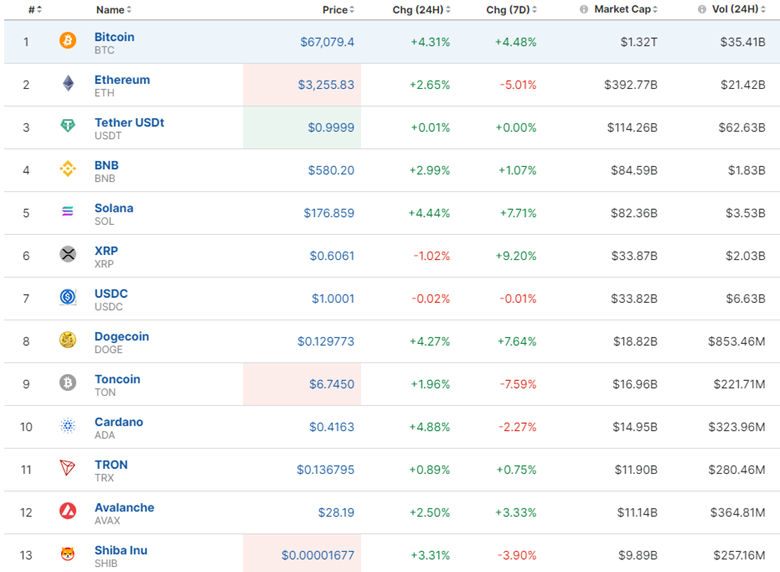

This week, Bitcoin is moving mainly sideways and consolidating after the high performance that took place since mid-July. The resistance area remained near 68K USD and the support area was near the level 66K USD, but on the 23rd however, that support was broken with the price just moving downwards at near 65.5K USD. On the 25th a huge breakout occurred of that support with the price reaching the 63,800 USD support level. Retracement could follow now. Alternatively, Bitcoin could get more traction if a breakout upwards, of this small consolidation, takes place with a target level of 68K USD.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Cryptos have experienced a significant correction since mid-July. A strong reversal to the upside. The market experienced a recent slowdown after the performance since then. However, now it seems that it gets a boost, starting on the 25th of July.

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

From the 22nd to the 23rd the index moved on an uptrend but on the 24th the index opened with a gap downwards. All indices have experienced a huge drop since the 24th and for the S&P500 it seems that the 5,425 USD currently acts as a strong support. On the 25th the index tried to break that support several times unsuccessfully but on market opening it actually broke that reaching the next support and psychological level at nearly 5,400 USD. It then soon reversed to the upside, suddenly reaching the 30-period MA and crossing the 61.8 Fibo. Later near the end of the N. American session experienced a sharp drop. Quite a volatile market. On the 26th it seems that significant correction is underway.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 24th Crude oil was not affected much but the U.S. Crude oil inventories only raised the volatility levels for a while before the price closed slightly higher. the price slowed down after the huge drop and moved sideways. On the 25th the price broke an important support area and moved lower. However, it found strong support near 76 USD/b and reversed to the upside quite strongly. It found resistance at near 78 USD/b after the reversal. On the 26th it eventually retraced back to the 30-period MA and the 61.8 Fibo. A mean reversion example.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The 2,400 USD/oz was an important level as mentioned in our previous analysis and its breakout could cause a jump. The breakout of that on the 23rd led to the price reaching the 2,420 USD/oz level and completing the retracement of the previous large drop, with the price reaching 61.8 Fibo at near the 2,425 USD/oz. On the 24th though, Gold experienced a sharp drop that continued all the way down to 2,365 USD/oz, marking a nearly 24 USD drop. On the 25th the price moved steadily downwards until it reached the support at near 2,353 USD/oz. Since then it reversed to the upside and reached the 30-period MA.

______________________________________________________________

______________________________________________________________

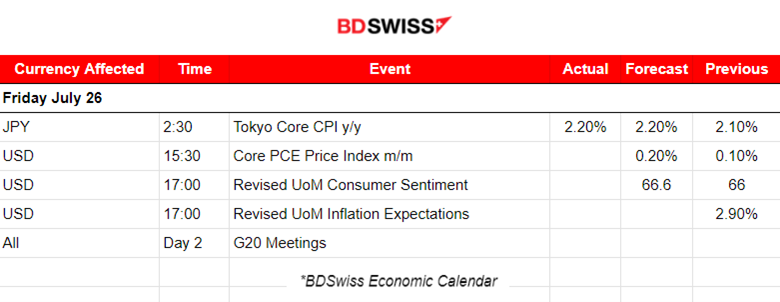

News Reports Monitor – Today Trading Day (26.07.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

The Tokyo CPI inflation figure was reported as expected. The JPY was appreciated early and after the release. The USDJPY dropped around 80 pips from 2:00 before it found support.

- Morning – Day Session (European and N. American Session)

The core PCE price index figure is released at 15:30 and because of its significance, the USD pairs could see a moderate intraday shock. The figure is expected to be reported higher. This figure has reduced significantly since February and it remains resilient for the upside. It could be the case that the forecast of a higher figure release will not be met.

General Verdict:

- Minor volatility in the FX market. The USD is barely affected.

- Crude and Gold in small ranges.

- U.S. Indices test the intraday highs. Could see a correction to the upside.

______________________________________________________________

Source: BDSwiss