Previous Trading Day’s Events (26.07.2024)

- The personal consumption expenditures (PCE) price index nudged up 0.1% last month after being unchanged in May. Consumer spending slowed a bit last month. Signs of easing price pressures and a cooling labour market could boost the confidence of Fed officials that inflation is moving toward the U.S. central bank’s 2% target.

The increase in PCE inflation was in line with economists’ expectations. In the 12 months through June, the PCE price index climbed 2.5%. That was the smallest year-on-year gain in four months and followed a 2.6% advance in May.

Excluding the volatile food and energy components, the PCE price index rose 0.2% last month. The so-called core PCE inflation gain was 0.182% before rounding. May’s unrounded figure was revised up to 0.127% from the previously reported 0.083%. April’s core PCE inflation was upgraded to 0.261% from the previously estimated 0.259% rise.

In the 12 months through June, core PCE inflation advanced 2.6%, matching May’s rise. Core inflation increased at a 2.3% annualised rate in the three months through June, sharply slowing from the 2.7% pace in May.

The Fed tracks the PCE price measures for monetary policy.

“The much-improved inflation readings indicate that the flare-up in inflation in the first quarter was temporary,” said Kathy Bostjancic, chief economist at Nationwide. “Moreover, if rental inflation has finally decelerated as recent data suggest, then inflation looks to be back on a sustained downward trend.”

Source:

https://www.reuters.com/markets/us/us-inflation-rises-moderately-june-2024-07-26/

______________________________________________________________________

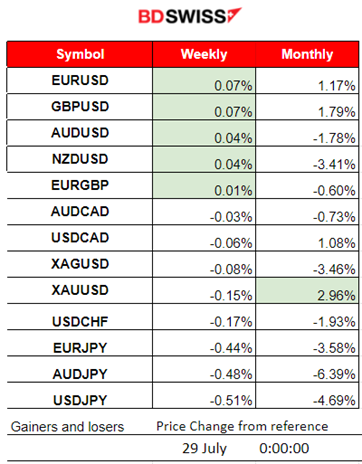

Winners vs Losers

EURUSD is leading this week with 0.07% so far. This month Gold has gained 2.96% and is leading. USD is stable for now.

______________________________________________________________________

______________________________________________________________________

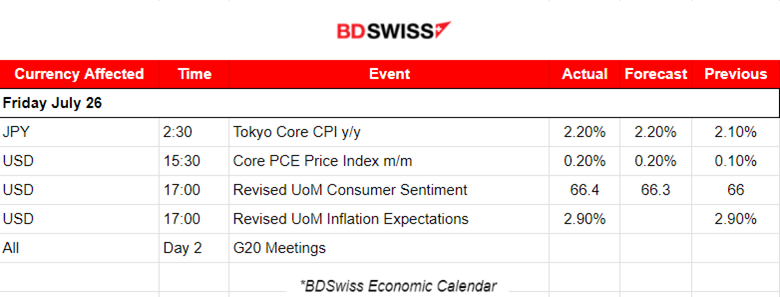

News Reports Monitor – Previous Trading Day (26.07.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

The Tokyo CPI inflation figure was reported as expected. The JPY was appreciated early and after the release. The USDJPY dropped around 80 pips from 2:00 before it found support.

- Morning – Day Session (European and N. American Session)

The core PCE price index figure was released at 15:30, as expected at 0.20%. No major impact was recorded in the market.

General Verdict:

- Minor volatility in the FX market. The USD was barely affected. The dollar index moved relatively sideways around the intraday mean.

- Gold moved to the upside.

- Crude oil dropped.

- U.S. indices corrected to the upside with Dow Jones experiencing a high jump.

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

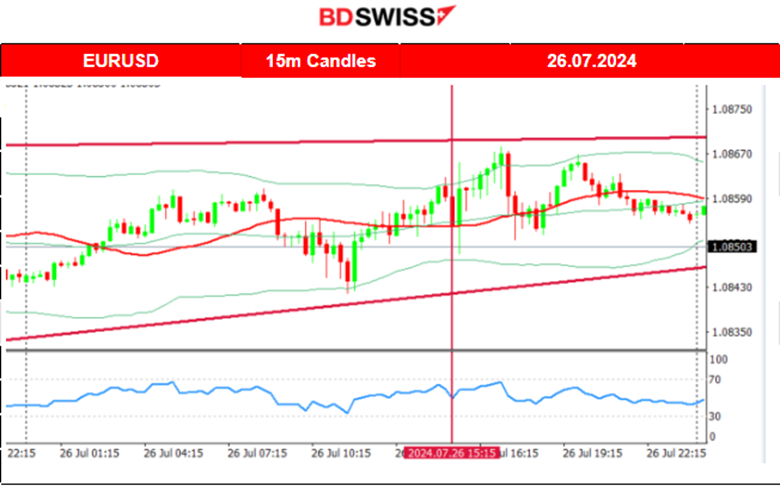

EURUSD (26.07.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The EURUSD moved sideways with low volatility within a near 30 pips range. There was the absence of significant figure releases except at 15:30 when the PCE price index figure was released. There was no significant impact on the market, so the pair continued moving sideways and closing slightly higher for the trading day.

___________________________________________________________________

___________________________________________________________________

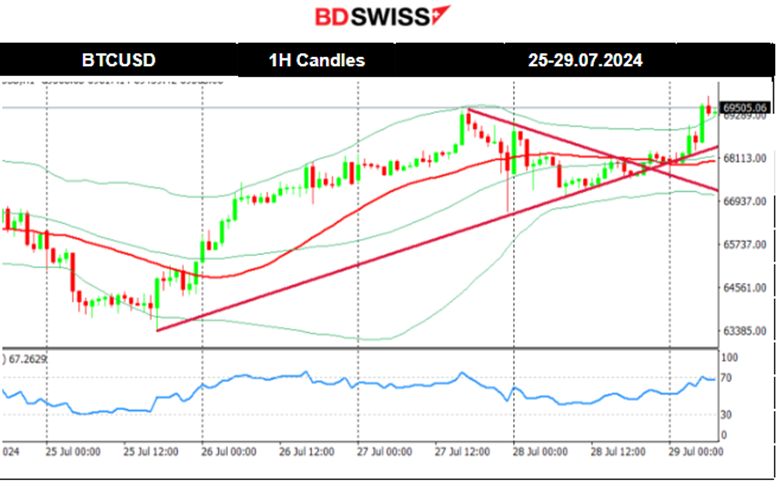

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Since the 25th, Bitcoin started to move significantly higher reaching 69,500 USD before seeing a correction to the 66,500 USD level, as a retracement. It reversed to the upside quite significantly and broke the resistance showing signs that it will head towards the previous June peak at 72K USD.

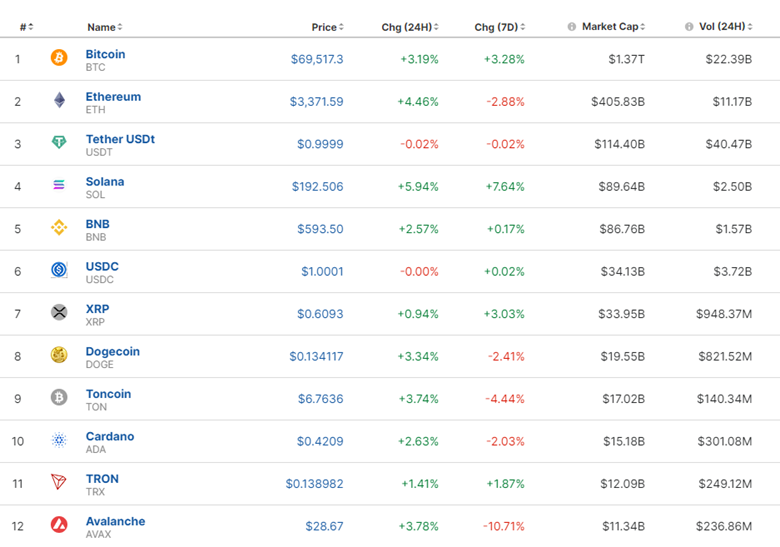

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Cryptos have experienced a significant correction since mid-July. A strong reversal to the upside. The market experienced a recent slowdown after the performance since then. However, now it seems that it got a boost, starting on the 25th of July. Currently, it is facing a significant correction.

Cryptos have experienced a significant correction since mid-July. A strong reversal to the upside. The market experienced a recent slowdown after the performance since then. However, now it seems that it got a boost, starting on the 25th of July. Currently, it is facing a significant correction.

Trump positioned himself as the pro-cryptocurrency candidate ahead of the Nov. 5 presidential election, saying he would make the U.S. the world’s cryptocurrency leader and embrace friendlier regulations than likely Democratic nominee Vice President Kamala Harris.

“If we don’t embrace crypto and bitcoin technology, China will, other countries will. They’ll dominate, and we cannot let China dominate. They are making too much progress as it is,” Trump said.

No wonder crypto is getting a boost

Source: https://www.reuters.com/business/finance/trump-cites-china-competition-vowing-create-bitcoin-stockpile-2024-07-27/

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 25th the index tried to break that support several times unsuccessfully but on market opening it actually broke that reaching the next support and psychological level at nearly 5,400 USD. It then soon reversed to the upside, suddenly reaching the 30-period MA and crossing the 61.8 Fibo. Later near the end of the N. American session experienced a sharp drop. Quite a volatile market. On the 26th the index started to experience a significant correction in order to reach the resistance near 5,500 USD. Currently, a triangle formation is formed. The index tests the intraday lows and could cause a breakdown of that triangle leading in the index to drop to 5,450 USD.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

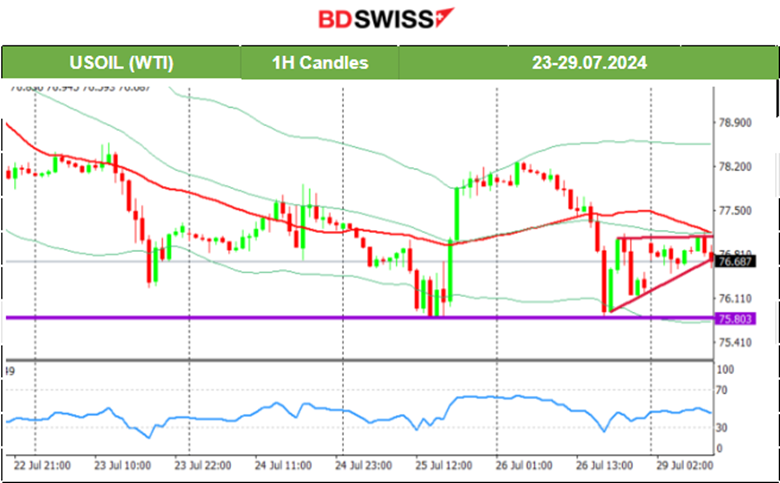

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 24th Crude oil was not affected much but the U.S. Crude oil inventories only raised the volatility levels for a while before the price closed slightly higher. The price slowed down after the huge drop and moved sideways. On the 25th the price broke an important support area and moved lower. However, it found strong support near 76 USD/b and reversed to the upside quite strongly. It found resistance at near 78 USD/b after the reversal. On the 26th it eventually retraced back to the 30-period MA and the 61.8 Fibo. This drop, however, continued aggressively even beyond, with the price crossing the 30-period MA on its way down and reaching the support again at 75.8 USD/b before retracement took place. Volatility levels lowered and a triangle formation is now visible. Its breakdown could lead to the price again testing that 75.8 USD support. Its breakout upwards could lead the price to reach 78.2 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 24th of July, Gold experienced a sharp drop that continued all the way down to 2,365 USD/oz, marking a nearly 24 USD drop. On the 25th the price moved steadily downwards until it reached the support at near 2,353 USD/oz. It reversed to the upside on the 26th and reached the 30-period MA. Mid-day, the price continued aggressively to move to the upside reaching again the mean level and resistance at 2,400 USD/oz. This reversal could lead the price to experience a retracement back to the 2,375 USD level if the resistance proves to be strong enough.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (29.07.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

No significant news announcements, no special scheduled releases.

General Verdict:

- Moderate volatility in FX and the USD is currently affected with appreciation greatly as the week starts. The dollar index is moving upwards.

- Crude oil and Gold are stable moving sideways.

- U.S. indices experience downward moves with testing the intraday lows.

______________________________________________________________

Source: BDSwiss