Previous Trading Day’s Events (04.07.2024)

- Swiss inflation unexpectedly eased and was reported at 0% — offering reassurance to Swiss National Bank officials who’ve lowered borrowing costs for two straight meetings.

Consumer prices rose 1.3% from a year ago in June. The slowdown was aided by a 0.2% annual decline in the cost of goods, while services were up 2.4%. Core inflation also moderated to 1.1%, defying expectations of its quickening.

The SNB has cut interest rates at its last two meetings — kicking off its easing campaign before global peers like the European Central Bank.

Policymakers have said the third quarter will see slightly faster inflation, but that it will then slow — reaching 1% in 2026.

Source:

https://www.bloomberg.com/news/articles/2024-07-04/swiss-inflation-unexpectedly-slows-as-goods-costs-decline

______________________________________________________________________

Winners vs Losers

Metals are still on the top with Silver gaining nearly 5% in just one week so far. Gold follows with 1.61% gains. The USD pairs reached the top (USD as Quote) since the U.S. dollar has weakened significantly.

______________________________________________________________________

______________________________________________________________________

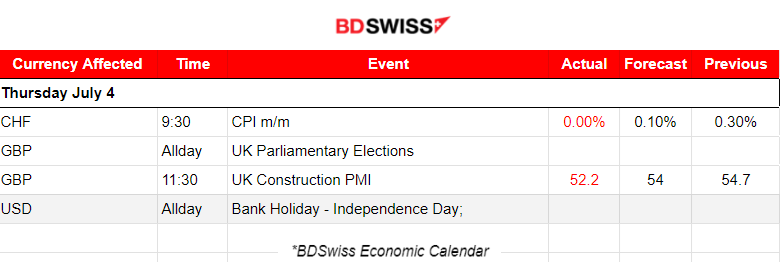

News Reports Monitor – Previous Trading Day (04.07.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, no important scheduled releases.

- Morning – Day Session (European and N. American Session)

The consumer price index (CPI) remained unchanged in June 2024 compared with the previous month. CHF depreciated heavily at the time of the release. USDCHF jumped nearly 40 pips at that time.

Equities, US/Stocks were closed for trading due to the 4th of July Holiday.

General Verdict:

- Moderate volatility in FX. Currencies affected greatly involve JPY, CHF and USD. The parliamentary election in the U.K. did not have much impact on the GBP.

- Gold moved sideways with low volatility and closed nearly flat.

- Crude oil experienced more volatility and closed higher.

- U.S. indices were tradable (CFD prices derived from the futures market) despite the U.S. stock market closure and volatility was moderate with an apparent slowdown of the uptrend that was formed recently in regards to index price movements.

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURCHF (04.07.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The pair moved sideways with low volatility until the news at 9:00. At the time of the Swiss CPI inflation figure release the CHF depreciated heavily causing the pair to jump near 40 pips before retracing soon, after hitting resistance close to 0.97550. It experienced a full reversal to the downside, reaching the 30-period MA eventually. It moved sideways after that around the MA, with volatility levels lowering as the trading day was approaching its end.

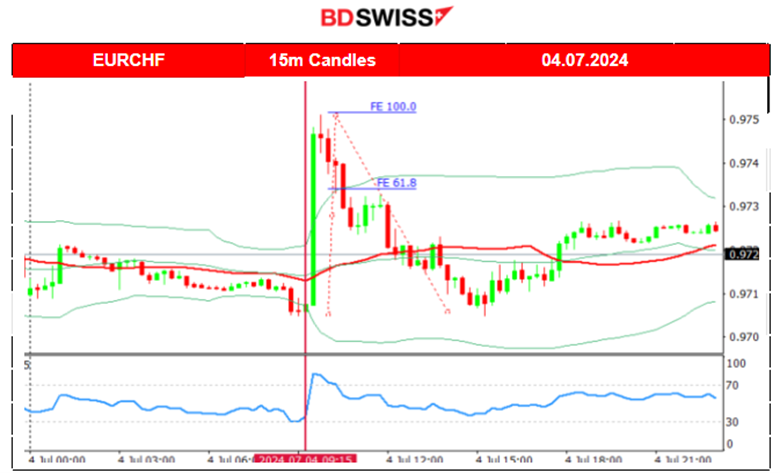

EURUSD (04.07.2024) 15m Chart Summary

EURUSD (04.07.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The pair was moving sideways during the Asian session and around the 30-period MA but after the start of the European session, it went to the upside driven by the USD weakening. A clear intraday uptrend took place, which was quite steady until the end of the trading day, due to the absence of important scheduled releases.

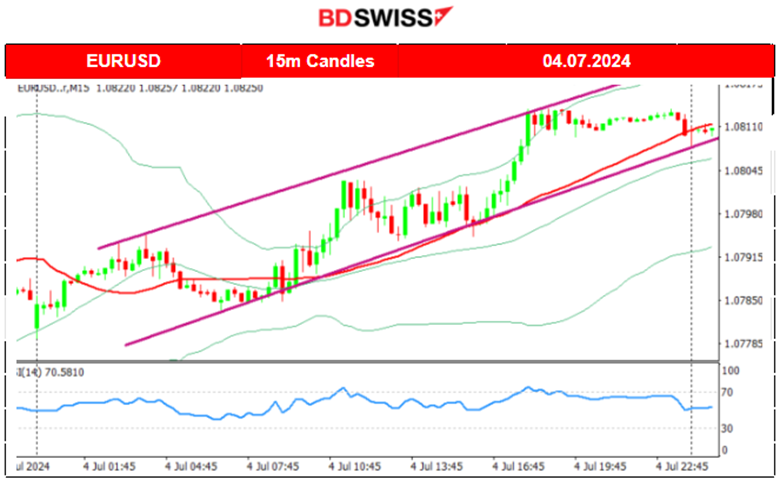

GBPUSD (04.07.2024) 15m Chart Summary

GBPUSD (04.07.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The pair moved to the upside steadily and around the upward-moving 30-period MA. It was mainly driven by the USD weakening. However, we can see that volatility was different, more ups and downs indicate more activity during the day as parliamentary elections were taking place.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 2nd of July, a clear and steady downtrend took place that resulted in Bitcoin breaking more and more support levels, eventually reaching the 60,500 USD support level. On the 3rd of July, the price dropped further, reaching 60K USD. July 4th found Bitcoin even lower breaking another support and reaching 58K, which is a crucial support level. On the 5th of July, the price fell further breaking the 57K USD level and dropped to the next support at 54K USD. A clear downtrend for now.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The 2nd of July was deterministic for Crypto. Most Crypto suffered losses and this extends until today as the market has experienced a strong downtrend recently. Massive losses for Crypto extend with over 10% loss in 24 hours!

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The index eventually moved to the upside on the 2nd of July as it was unsuccessful in breaking the support and broke the triangle formation instead on the upside. It crossed the MA on its way up with an overall 60 USD jump. No retracement has taken place on the 2nd. The 5,500 USD was broken as well and on the 3rd of July, it acted as a strong support. The index jumped after the market opening, reaching the resistance at 5,545 USD and marking the second day in a row without retracement to the 30-period MA. A slowdown took place yesterday, 4th of July. Despite the stock market closure due to the holiday, some volatility was observed in index trading (futures) with the uptrend experiencing a slowdown. Today the index moved aggressively upwards again early during the Asian session on index (futures) market opening. Will a retracement eventually take place? The RSI does not give supporting signals for that yet.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Since the 1st of July a new trend started with the price reaching 83 USD/b. On the 2nd however, the price retraced to the 30-period MA testing the 82.3 USD/b support. Despite the breakout of that support and the channel that formed, there was not a significant downside movement. The support was strong enough and the price moved sideways around the mean on the 3rd of July. On the 4th, the price remained above the 30-period MA and continued upwards within the channel.

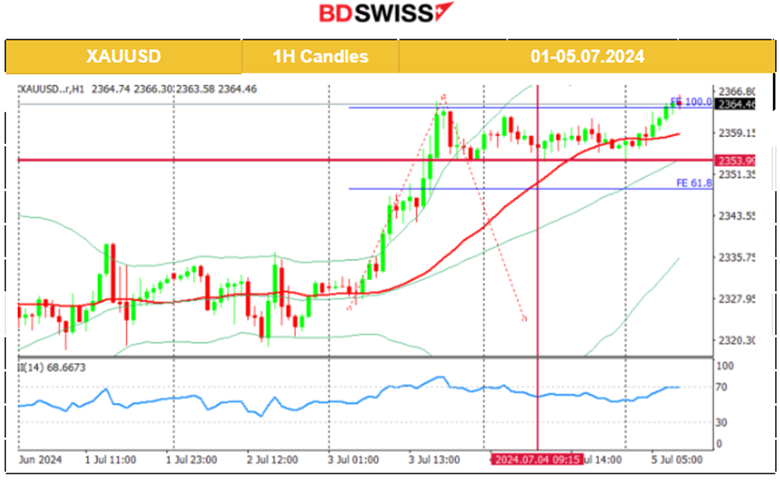

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 28th the price experienced volatility but closed near flat. After a long sideways path, a consolidation that lasted for almost 3 days, gold jumped to the upside on the 3rd of July with a target level of 2355 USD/oz. The momentum was strong enough to cause the price to reach 2,365 USD/oz before retracement eventually took place and the price reached back to the 30-period MA. A steady sideways movement took place on the 4th of July with the price closing bear flat as volatility levels lowered. Gold jumped today due to the USD’s early depreciation and tested the high at 2,365 USD/oz. NFP today at 15:30 can shake things.

______________________________________________________________

______________________________________________________________

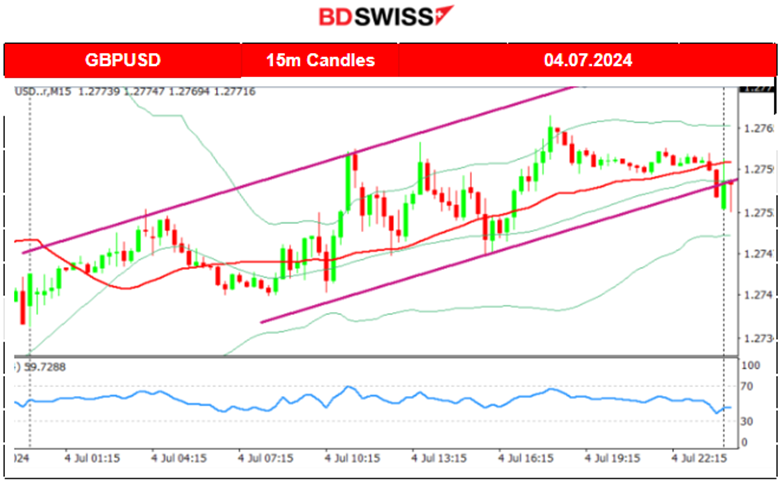

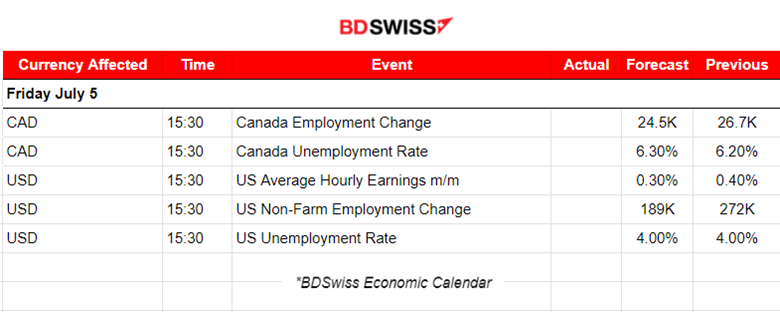

News Reports Monitor – Today Trading Day (05.07.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, no important scheduled releases.

- Morning – Day Session (European and N. American Session)

The U.S. NFP report and Average Hourly earnings report take place at 15:30. The results could have a great impact on the USD pairs. Canada employment data will also be reported and are expected to affect the CAD pairs. With lower interest rates in Canada, employment is expected to see stable growth. However, this might be a very low forecast. Canada’s employment change could be reported as actually higher. The NFP forecast makes sense for now considering that PCE inflation was reported lower and the PMIs showing non-improved figures so far.

General Verdict:

- Early high volatility in FX. The U.S. dollar is affected heavily early with weakening.

- Gold moved to the upside.

- Crude oil is volatile but in a sideways path.

- U.S. indices moved aggressively upwards and reversed soon after touching the intraday means.

______________________________________________________________

Source: BDSwiss