PREVIOUS TRADING DAY EVENTS – 04 July 2023

- The Reserve Bank of Australia (RBA) yesterday announced its decision to keep rates unchanged, stating that more time is needed to assess the impact of past hikes. However, it made it clear that further tightening might be needed to bring inflation down.

RBA Governor Philip Lowe: “In light of this and the uncertainty surrounding the economic outlook, the Board decided to hold interest rates steady this month.”

Lowe highlighted the warning that some further tightening of monetary policy might be required as “inflation is still too high and will remain so for some time yet.”

“Today’s decision to pause rate hikes shows the RBA has realised the economy is on a knife’s edge and that it must pivot to achieve its goal of threading a ‘narrow path’ through current economic conditions,” said Stephen Smith, Deloitte Access Economics partner.

The RBA surprised markets by resuming its hikes both in May and June.

Economic data over the past month have been mixed. Inflation cooled, but the strong jobs report and retail sales are pushing for more hikes. Data suggest that financial conditions might have not been tight enough.

“With the labour market still very tight, house prices rebounding strongly and unit labour costs surging, another 25bp rate hike in August still looks likely and we suspect the Bank will follow it up with another one in September,” said Marcel Thieliant, a senior economist at Capital Economics.

The central bank currently forecasts headline inflation to return to the top of its target range of 2-3% by mid-2025.

Source: https://www.reuters.com/markets/australias-central-bank-holds-interest-rates-41-2023-07-04/

______________________________________________________________________

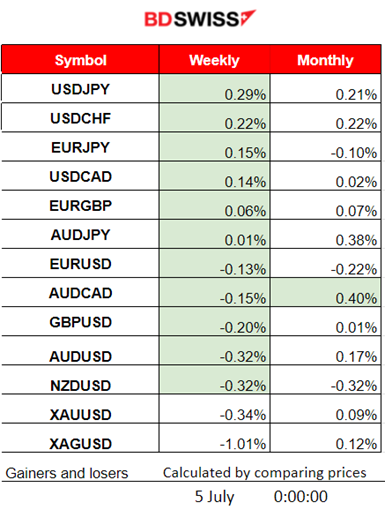

Summary Daily Moves – Winners vs Losers (04 July 2023)

- USDJPY is on the top of the week’s list but with no significant gains, only 0,29% so far.

- This month finds AUDCAD on the top with 0.40%.

______________________________________________________________________

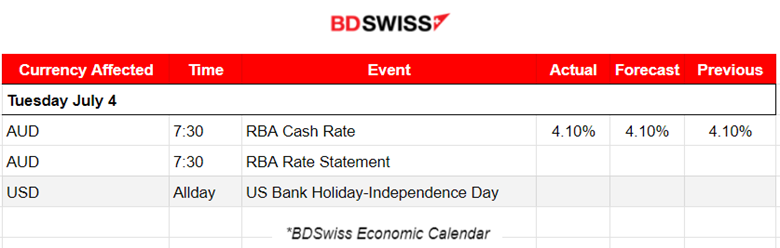

News Reports Monitor – Previous Trading Day (04 July 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

The RBA left the Cash rate unchanged at 4.10%. The Australian dollar weakened, 0.25% to 0.6652 against the U.S. dollar. Retracement followed quite soon after the release, more than full.

- Morning – Day Session (European)

No major news, no significant scheduled releases.

General Verdict:

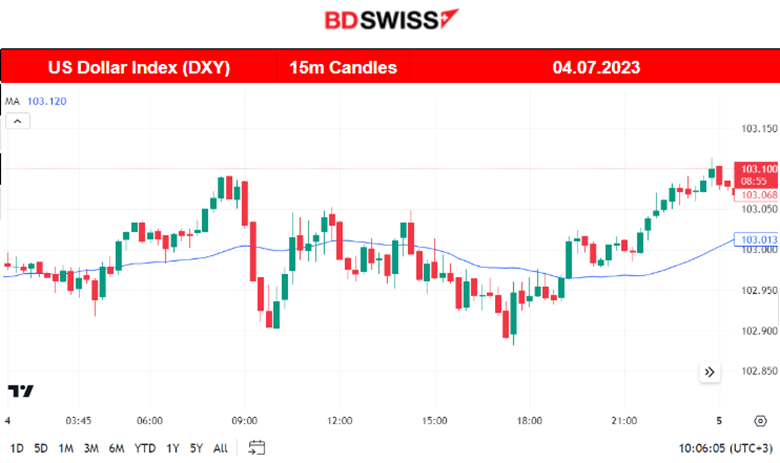

- Absence of major news announcements, steady movements in one direction and retracements from previous rapid movements.

- Low Volatility except for the AUD pairs at the time of the RBA Cash Rate decision release at 7:30.

- The DXY, U.S. Stocks and Metals moved sideways with low volatility.

____________________________________________________________________

FOREX MARKETS MONITOR

AUDUSD (04.07.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The pair experienced an intraday shock at 7:30 when the RBA announced its decision to keep rates unchanged. At first, the AUD was affected by a strong depreciation against other currencies and soon after, it appreciated greatly causing the pair to retrace fully. AUDUSD continued its steady movement upwards and above the 30-period MA until late.

EURUSD (04.07.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The markets experienced low volatility yesterday and steady movements in one direction took place. No high deviations though from the moving average. The pair moved almost sideways around the mean but more to the downside. This was due to USD depreciation close to the end of the trading day.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The index eventually settled at 15200. 15250 remains a significant resistance level while 15170 acts as a significant support. Breakouts of these levels cause strong one-direction and rapid movement. On the downside, the breakout will serve as a confirmation of a retracement back to the 61.8 Fibo level. Yesterday, the index moved sideways with low volatility and without breaking any of these levels.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 3rd of July, Crude reversed on the downside, crossing the 30-period MA and moving below it. It is currently moving sideways around the MA, though today’s OPEC Meetings are supposedly expected to greatly affect its price and increase volatility.

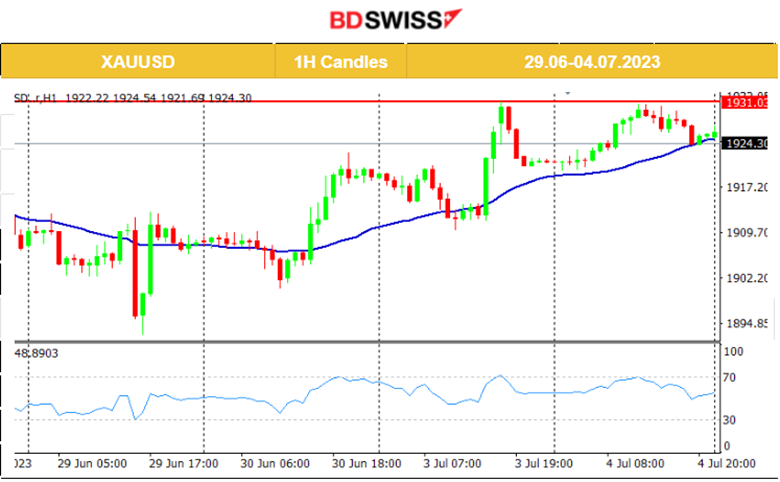

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Gold started to move significantly upwards after the 30th of June showing higher highs while the RSI had flat highs. This shows that the upward steady movement is slowing down. NFP ahead. Employment data for the U.S. will have a strong impact on the USD and thus XAUUSD. 1931 serves now as a strong resistance while Gold seems to be headed upwards as it moves above the 30-period MA.

______________________________________________________________

News Reports Monitor – Today Trading Day (05 July 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No major news, no significant scheduled releases.

- Morning – Day Session (European)

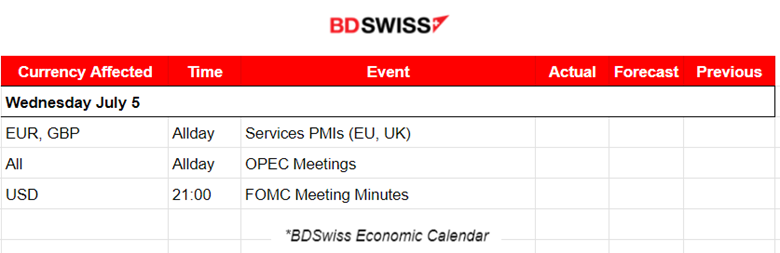

Today, it is PMI day again, though this time regarding the services sector. More volatility than normal is expected and some shocks might take place at the time of the major PMI releases.

OPEC Meetings are also taking place. It is expected that volatility will be high for Crude and if there are any important announcements such as production cuts, then its price will jump.

FOMC Meeting Minutes will be released today at 21:00.

General Verdict:

- PMIs are driving volatility today.

- No major shocks are expected to occur since there are no major scheduled releases except the Services PMIs.

- FOMC meeting Minutes might not cause an impact. The latest releases with the absence of rate decisions had no major impact on the USD pairs.

______________________________________________________________

Source: BDSwiss