Previous Trading Day’s Events (31.07.2024)

Monthly CPI (Australia): CPI rose 3.8% YoY to June 2024, down from 4% in May. Key driver: easing transport costs (4.2% vs. 4.9% in May).

BOJ Interest Rate: Raised short-term rate to ~0.25% in July 2024; bond-buying cut to JPY 3 trillion from JPY 6 trillion starting January 2026.

Euro Area Inflation: Annual inflation ticked up to 2.6% in July 2024, exceeding forecasts; energy costs rose 1.3%.

US ADP Employment: 122K private sector jobs added in July 2024, below forecasts; pay gains continue to slow.

Canada Monthly GDP: Expected 0.1% growth in June 2024; construction and finance sectors up, manufacturing down.

US Fed Funds Rate: The Fed held rates at 5.25%-5.50% in July 2024, the eighth consecutive meeting; progress was noted towards the 2% inflation target.

Mastercard Earnings: Q2 net income of $3.3B; EPS of $3.50. Revenue up 11%, gross dollar volume up 9%, purchase volume up 10%.

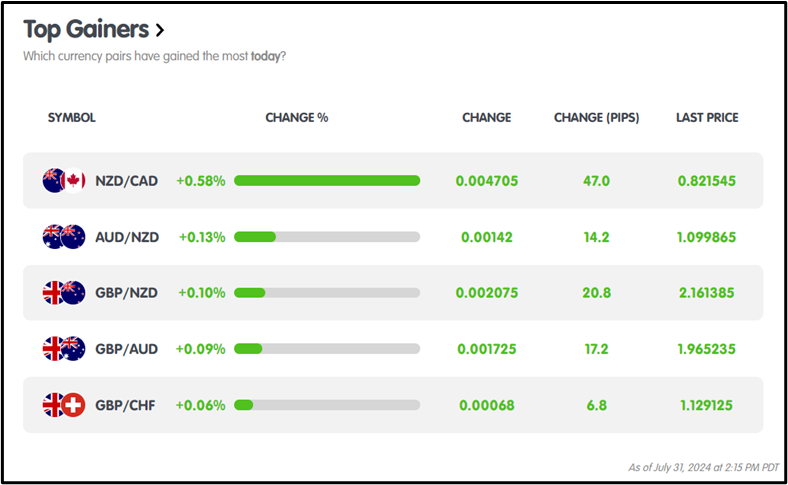

Winners Vs Losers

On July 31, 2024, NZDCAD led with a gain of 0.58%, translating to 47.0 pips, while CADCHF saw the largest decline, down -0.28% or -17.6 pips.

On July 31, 2024, NZDCAD led with a gain of 0.58%, translating to 47.0 pips, while CADCHF saw the largest decline, down -0.28% or -17.6 pips.

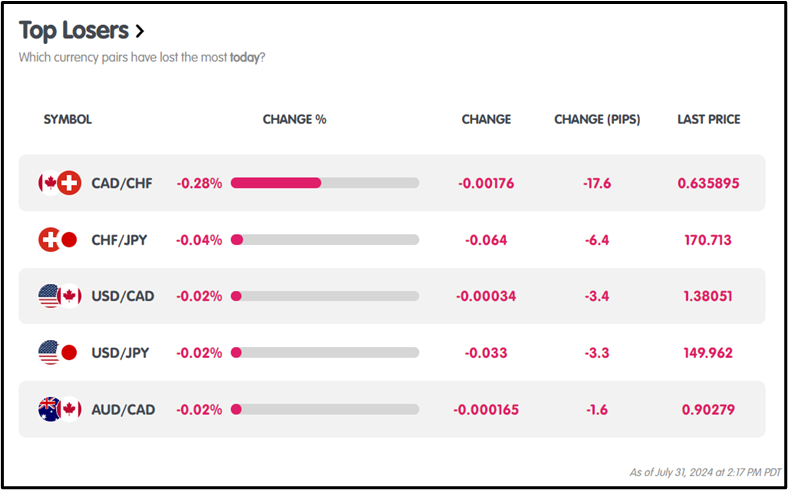

News Reports Monitor – Previous Trading Day (31.07.2024)

Server Time / Timezone EEST (UTC 03:00)

Tokyo Session:

Monthly CPI (Australia): CPI rose 3.8% YoY to June 2024, down from 4% in May. Major bearish impact on AUD pairs at 1:30 am GMT.

BOJ Interest Rate: Short-term rate increased to ~0.25% in July 2024; bond-buying was reduced to JPY 3 trillion from JPY 6 trillion starting January 2026. Major bearish impact on JPY pairs at 3:57 am GMT.

London Session:

Euro Area Inflation: Annual inflation rose to 2.6% in July 2024; energy costs increased by 1.3%. No major impact on the market when released at 6:00 am GMT.

New York Session:

US ADP Employment: Added 122K jobs in July 2024, below forecasts; pay gains slow. Bearish impact on USD pairs at 12:15 pm GMT.

Canada Monthly GDP: Expected 0.1% growth for June 2024; bullish impact on CAD pairs at 12:30 pm GMT.

US Fed Funds Rate: Held at 5.25%-5.50% for the eighth consecutive meeting; major bearish impact on USD pairs at 6:00 pm GMT.

Mastercard Earnings: Q2 net income of $3.3B; EPS of $3.50. Revenue up 11%, with a major bearish impact when released at 1:00 pm GMT.

General Verdict:

- Market reactions varied by session.

- AUD, JPY, and USD pairs experienced significant bearish impacts.

- CAD pairs saw a bullish impact.

- Euro Area inflation had minimal effect on market sentiment.

FOREX MARKETS MONITOR

EURUSD (31.07.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movements

On July 31, 2024, EURUSD displayed a bullish trend, opening at 1.08124 and closing at 1.08243. The pair hit a daily high of 1.08491 and a low of 1.08005.

On July 31, 2024, EURUSD displayed a bullish trend, opening at 1.08124 and closing at 1.08243. The pair hit a daily high of 1.08491 and a low of 1.08005.

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On July 31, 2024, BTCUSD exhibited a bearish trend, opening at $66,172.22 and closing at $64,521.36. The daily high was $66,843.76 and the low was $64,521.36.

On July 31, 2024, BTCUSD exhibited a bearish trend, opening at $66,172.22 and closing at $64,521.36. The daily high was $66,843.76 and the low was $64,521.36.

STOCKS MARKETS MONITOR

Mastercard ( NYSE : MA ) 15 minutes Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On July 31, 2024, Mastercard (NYSE: MA) experienced a bearish trend, opening at $468.05 and closing at $463.18. The intraday high was $473.07 and the low was $457.30.

On July 31, 2024, Mastercard (NYSE: MA) experienced a bearish trend, opening at $468.05 and closing at $463.18. The intraday high was $473.07 and the low was $457.30.

EQUITY MARKETS MONITOR

SP500 15 minutes Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On July 31, 2024, SPX500 displayed a bullish trend, opening at $5,430.65 and closing at $5,543.12, with a daily high of $5,556.68 and a low of $5,430.65.

On July 31, 2024, SPX500 displayed a bullish trend, opening at $5,430.65 and closing at $5,543.12, with a daily high of $5,556.68 and a low of $5,430.65.

COMMODITIES MARKETS MONITOR

GOLD 15 minutes Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On July 31, 2024, XAUUSD exhibited a bullish trend, opening at $2,409.45 and closing at $2,447.72. The day’s range saw a low of $2,403.53 and a high of $2,450.85.

On July 31, 2024, XAUUSD exhibited a bullish trend, opening at $2,409.45 and closing at $2,447.72. The day’s range saw a low of $2,403.53 and a high of $2,450.85.

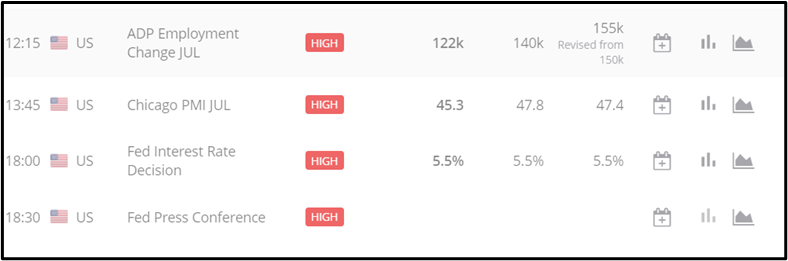

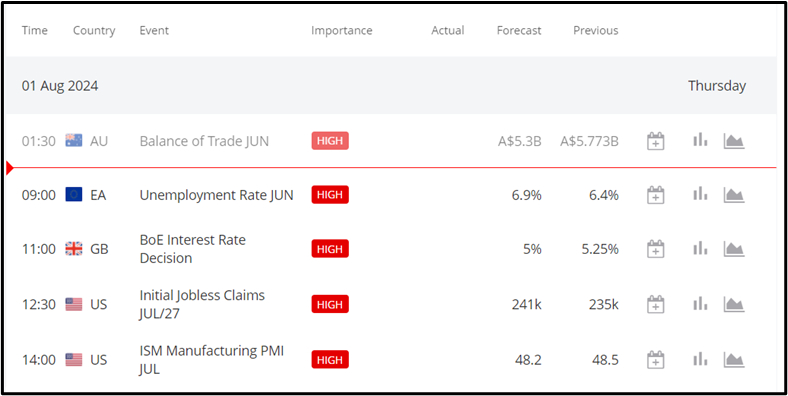

News Reports Monitor – Today Trading Day (01.08.2024)

Tokyo Session

Tokyo Session

Australia’s Balance of Trade for June was reported at 1:30 AM GMT, showing A$5.589B, surpassing the forecast of A$5.3B.

London Session

Euro Area unemployment rate is forecasted at 6.9%, to be released at 9:00 AM GMT.

BOE interest rate decision expected at 5%, announced at 11:00 AM GMT.

New York Session

Initial Jobless Claims are expected at $241K, released at 12:30 PM GMT.

ISM Manufacturing PMI data forecasted at 48.2, reported at 2:00 PM GMT.

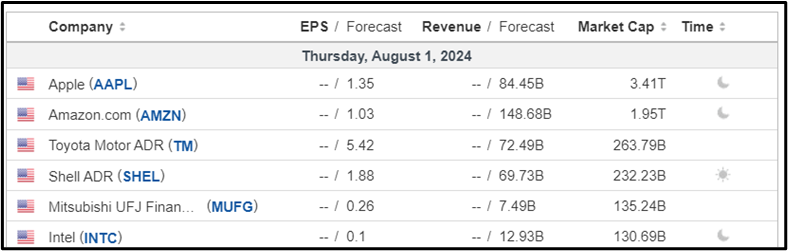

Apple earnings release anticipated with EPS of $1.35 and revenue of $84.45 billion.

General Verdict

- Australia’s Balance of Trade exceeded expectations in the Tokyo Session.

- Key economic releases for the Euro Area, BOE interest rate decision, and U.S. data, including jobless claims and manufacturing PMI, are expected to impact markets throughout the London and New York Sessions.

Sources

https://ec.europa.eu/eurostat/

https://adpemploymentreport.com/

http://www.federalreserve.gov/

https://investor.mastercard.com/financials-and-sec-filings/quarterly-results/default.aspx

Metatrader 4 ( MT4)

Source: BDSwiss