Previous Trading Day’s Events (28.06.2024)

- The U.S. manufacturing contracted for a third straight month in June as demand remained subdued. Inflation could continue to slow. Weakness at the end of the second quarter took place. Manufacturing is being pressured by higher interest rates and softening demand for goods, though business investment has largely held up.

The ISM’s manufacturing PMI slipped to 48.5 last month from 48.7 in May. A PMI reading above 50 indicates growth in the manufacturing sector, which accounts for 10.3% of the economy.

“We expect the manufacturing sector to remain weak over the next couple of quarters,” said Oliver Allen, senior U.S. economist at Pantheon Macroeconomics. “The retreat in corporate bond yields since late last year … seems to have provided some support to investment spending, but not enough to get manufacturing growing again. A much more significant loosening in financial conditions is required to change that.”

Source: https://www.reuters.com/markets/us/us-manufacturing-mired-weakness-prices-paid-gauge-hits-six-month-low-2024-07-01/

______________________________________________________________________

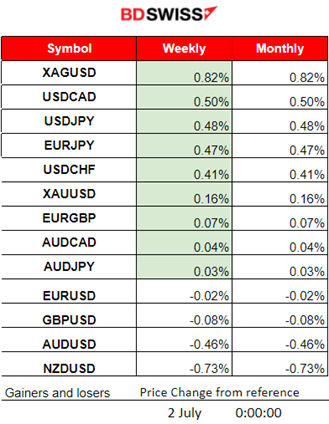

Winners vs Losers

Silver managed to gain 0.82% this week and reached the top. USDCAD and USDJPY follow since the U.S. dollar is gaining ground.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (01.07.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, no important scheduled releases.

- Morning – Day Session (European and N. American Session)

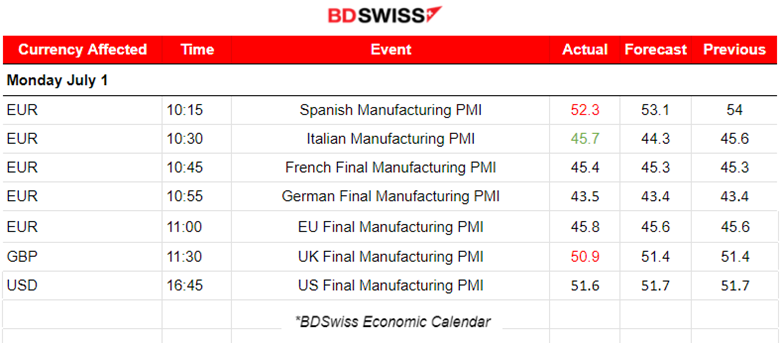

Manufacturing PMI releases

Eurozone Manufacturing PMIs

Spain’s manufacturing sector expanded further in June but at a more modest pace. The PMI figure is at the expansion area, at 52.3, less than the previous MI recorded at a figure of 54 points. Both output and new orders rose on the back of positive demand conditions. Firms turned on hiring. However, growth rates were down as well as confidence in the future.

The Italian manufacturing sector continued with a decline again in June, marking a third successive monthly deterioration in operating conditions. The PMI was reported slightly improved to 45.7. Weakening demand, with accelerating output reduction.

In France, the manufacturing sector experienced a deterioration in operating conditions at the end of the second quarter. PMI was reported again in contraction at 45.4 points. New factory orders decreased at an accelerated pace. Production volumes, purchasing activity, employment and stocks of inputs went down, while business confidence also eased during the month.

Germany’s manufacturing sector experienced rates of contraction in both output and new orders reaccelerating after having eased substantially in May. Firms reported deepening declines in both pre and post-production inventories. PMI figure is in contraction at 43.5.

Eurozone manufacturing activity suffered. The downturn in Europe was widespread, with Italy the only big player not to see a fall in its PMI, despite manufacturers largely cutting prices.

In the U.K. the manufacturing sector saw further growth in June but input cost inflation rose to a 17-month high. The upturn continued at the end of the second quarter. June saw output and new orders both expand for the second successive month, with rates of expansion remaining close to the highs reached in May. PMI was reported at 50.9 points lower than the previous figure but still in the expansion area.

The U.S. manufacturing sector remained in growth territory at the end of the second quarter of the year. Client demand remained muted and business confidence hit a 19-month low. New orders rose however for a second month running. Production continued to rise. Although input costs continued to rise sharply, the rate of inflation eased in June. SPGlobal PMI figure was reported to be 51.6 points, in the expansion area not deviating much from the previous figure.

German inflation slowed after two months of accelerating. Consumer prices rose 2.5% from a year earlier in June — down from 2.8%. The EUR was showing strength during the start of the European session, however that changed mid-day.

The U.S. ISM Manufacturing PMI figure was reported surprisingly at 48.5, lower than the previous and in contraction. This is indicating contraction in the past 20 months, with only March breaking the trend with a 50.3 print. However, the economy continues to perform strongly despite the apparent softness in the surveys. At 17:00 at the time of the release, the USD appreciated heavily.

General Verdict:

- Moderate volatility in FX with moderate reversals during the trading day. EUR and USD were affected by the PMI releases. The U.S. dollar saw a moderate intraday shock at the time of the ISM Manufacturing PMI release.

- Gold saw high volatility and closed higher eventually.

- Crude oil moved significantly higher reaching 83 USD/b.

- Despite high volatility, the U.S. indices remained on a sideways path.

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (01.07.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The EURUSD moved to the upside early as the EUR was strengthening significantly following the French elections and due to USD depreciation. After finding resistance at near 1.07770 the pair reversed to the downside, crossing the 30-period MA on its way down. At 17:00. The ISM Manufacturing PMI release caused USD appreciation causing the pair to drop sharply, near 45 pips. It retraced to the MA after finding support near 1.07190.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC 03:00)

Price Movement

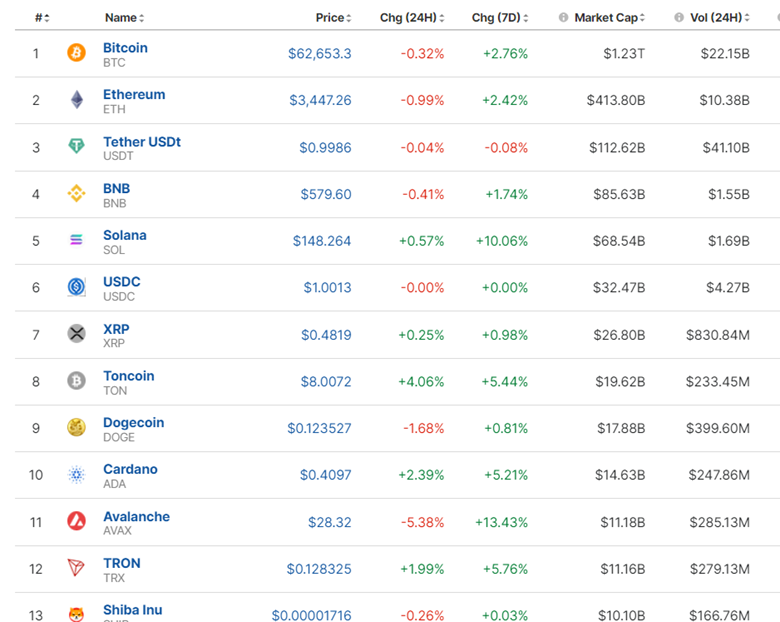

On the 24th of June, Monday, Bitcoin plunged to 58,400 before retracing to the 61.8 Fibo level and settling near the 30-period MA, very close to 61K USD. Since the 27th, the price moved sideways around the mean near 61K USD. That changed on the 30th of June when the price eventually moved rapidly upwards breaking the 62K resistance and reaching until the next resistance near the 63,600 USD level before starting to retrace. A big recovery for Bitcoin compared with the latest moves. After finding resistance at near 63,800 USD, Bitcoin eventually retraced to near the 62,500 USD level as mentioned in our previous analysis. A sideways movement around the mean now takes place, close to 62,700 USD.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The Crypto Market got a boost after recovering from the recent drop. Correction from the boost was expected and now Crypto prices settled higher.

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 26th, the index tested the resistance near 5,496 without success and retraced to the MA continuing the path sideways. On the 28th breakout of the 5,500 resistance led finally to an upward movement continuation of the index. The index found a strong resistance near 5,530 USD before it started to drop significantly, reversing from the upside, crossing the 30-period MA on the way down and reaching the support area near 5,500 USD again without a successful breakout. Currently, it remains below the MA with the potential of a re-test. Several unsuccessful tests of that support have taken place so far. Will the exchange opening today see the breakout to the downside?

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 26th the price tested the support near 80 USD/b without success and retraced back to the MA. Max near 1 USD deviation from the mean. On the 27th however the resistance at 81.7 USD/b broke and Crude oil got a boost, passing the 82 USD/b. It was a quite rapid movement to the upside after that breakout. The price eventually found resistance at near 82.40 USD/b before the price plunged on the 28th by near 1.5 USD/b around 13:00 server time. That was a big dive to 80.70 USD/b and retracement followed soon after reaching the 61.8 Fibo level and back to the 30-period MA. Since the 1st of July a new trend started with the price reaching 83 USD/b.

Hurricane Concerns add to the upside as mentioned in the below article:

https://www.bloomberg.com/news/articles/2024-07-01/latest-oil-market-news-and-analysis-for-july-2

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

On the 26th, the price broke important support levels and moved lower rapidly to 2,293 USD/oz before retracement took place and settled at 2,300 USD/oz. A triangle breach on the 27th caused it to jump. As mentioned in our previous analysis the price of 2,330 USD/oz was reached and acted as a resistance. The price retraced, reaching the 61.8 Fibo level. On the 28th the price experienced volatility but closed near flat. After a long sideways path, a consolidation that lasts for almost 3 days, Gold could break the support and move significantly to the downside. The next target level could be 2,318 USD/oz.

______________________________________________________________

______________________________________________________________

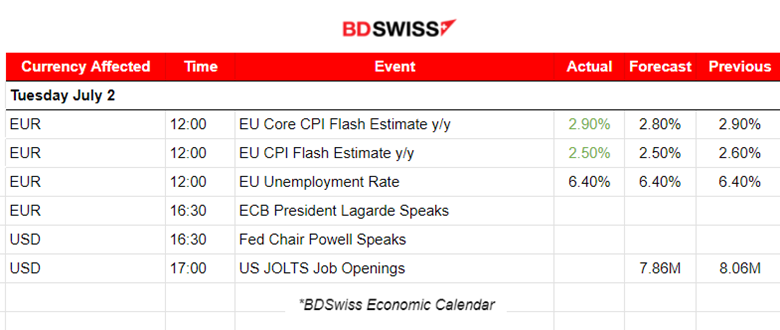

News Reports Monitor – Today Trading Day (02.07.2024)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No important news announcements, no important scheduled releases.

- Morning – Day Session (European and N. American Session)

Inflation from major regions so far shows that inflation could be more aggressive than expected or kept stable as price pressures seem to be high enough. ECB now sees a higher than expected Core figure in today’s CPI inflation report released at 12:00. No major impact was recorded in the market.

The JOLTS report regarding job openings is expected to have an impact on the USD pairs with moderate shock. The market usually waits for the NFP to react though. The figure is expected to be reported lower and it could be the case, supported by the decline in business conditions lately.

General Verdict:

- High volatility for major pairs in FX. EUR, GBP USD.

- Gold experiences moderate volatility and tests the intraday lows.

- Crude oil moved significantly upwards.

- U.S. indices moved lower.

______________________________________________________________

Source: BDSwiss