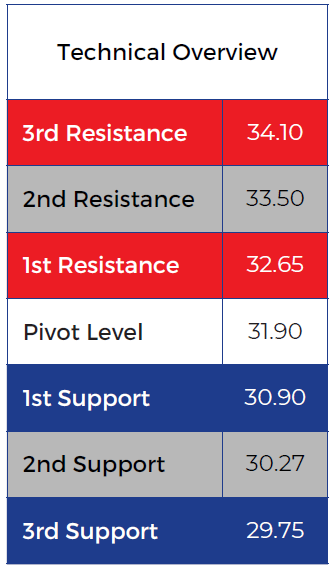

EURUSD

Three consecutive weeks of decline, EURUSD traded almost unchanged today at $1.0861 after USD index traded slightly higher today. After cutting the rates by ECB last week, traders are likely to shift the focus to more macro numbers in this week that include manufacturing & services PMI and ECB President Lagarde speech on Tuesday.

As expected, the last major support remained solid, as price action keeps advancing, the next target will be at a higher level $1.0896. The weakness of EZ economy was mostly priced in.

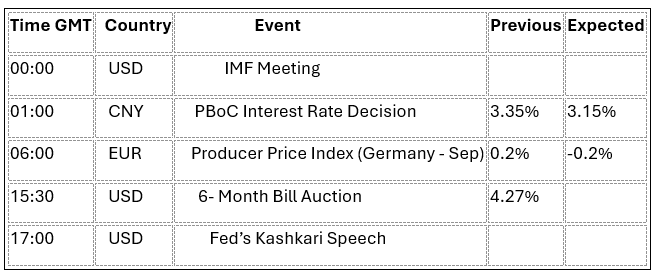

USDJPY

USDJPY traded weaker this morning at 149.23 after it fell by -0.30% in a week. There will be no major economic releases from Japan for today. In the meantime, traders are likely to rely on the technical levels before releasing Tokyo’s inflation on Thursday. As long as US 10Y bond yields remain above 4%, this currency will remain stable without heavy trade.

147.50 & 146 are important support levels. Positive channel persists. According to the price action, the technical correction to 148.45 is possible ( not far ) but unlikely be today. Volatility remains tight.

GBPUSD

GBPUSD lost -0.19% in the last week, traded slightly weaker this morning at $1.3041. UK retail sales in September unexpectedly improved by 0.3%, but that was not enough for the British Pound to close higher last week. We think that even if retail sales came stronger than before, BoE is unlikely to change the forward guidance & the next move will be to lower the rates sooner than later.

While 1H RSI is heading higher, the next target will be $1.3075. It is correct that the trading happens above the pivot, but the velocity of the price action remains fragile.

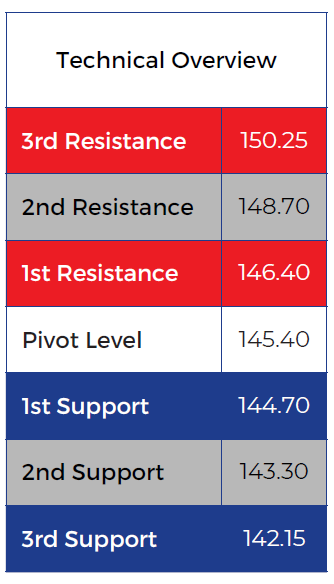

Gold

New record high in gold that traded this morning at $2728 per ounce, with almost 3% increase in the last week. The best scenario happened in gold after PBoC cut the rates to new lows at 3.1%, in other words, additional cheaper liquidity from the World’s second biggest economy. We keep an eye on USD index performance & US PMI numbers on Thursday.

Our technical view was accurate ( bullish) and new resistance was added. 1H RSI is approaching from overbought level, so be careful in your bets as correction to $2702 may happen.

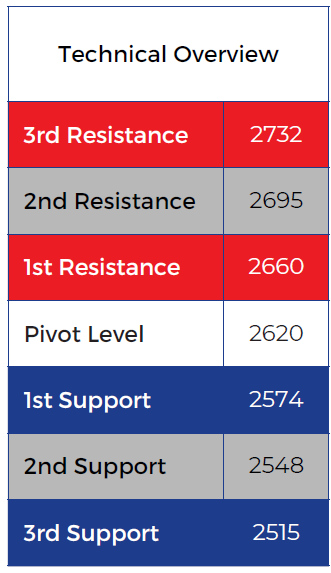

Silver

We repeated many times before that silver heavily relies on China’s data, that’s why cutting the rates by PBoC was the major catalyst in silver’s rally to $34 per ounce, the highest since 2012. Silver gained by more than 47% YoY, 43% YTD, surpassing yearly performance of gold that increased by 38.3%. The question now : is this rally sustainable? The answer will rely on the economic data, mainly from China & future market contracts. Totally overbought on 1H chart, correction to $33.50 may happen very soon. Trend is bullish, but the technical correction may become aggressive.

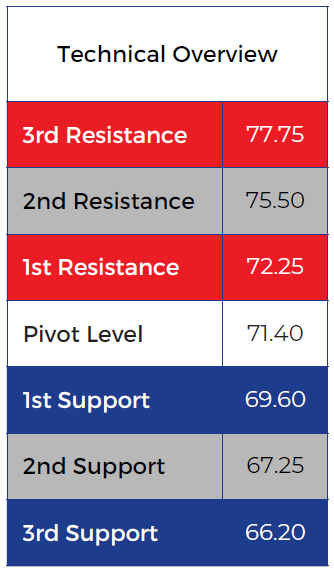

Oil – WTI

After losing almost -6% in the last week, crude oil prices are trading slightly higher today, WTI $69.49PB, Brent $73.29PB. China’s refinery output declined for the sixth consecutive month, not to forget that both OPEC & IEA lowered their demand forecasts. Cutting the rates by PBoC is not giving a positive sign as well.

The 1st major support was executed. Bearish sentiments continue, that’s why the 2nd major support is approaching. 1H RSI is almost at re-entry level, and it may help correction to $70.30 but it is unlikely today.

DAX

Last week was not a bad one for German DAX index that rose by 0.54% to new record high, DAX futures traded lower this morning. PPI from Germany will be due later today, the forecasts are showing contraction. Heavy -weight auto sector remained under pressure because of the concerns from China’s demand, BMW is still down by -21% YoY, Porsche -27% & VW -13%.

Momentum indicator remains positive, supported by price action & bullish behavior. Heading higher to the last major resistance 19600 is highly probable (executed) while technical correction will be at 19400.

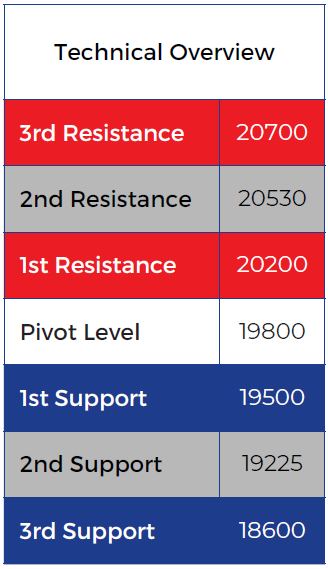

Nasdaq

How was the weekly performance in US stock indexes last week? SPX was almost unchanged, Dow Jones gained 0.43% and Nasdaq fell by -0.81%, US stock futures traded slightly weaker this morning. Q3 earnings from many big US corporations came stronger, supporting further bullish positioning. Traders will closely watch US PMI numbers & durable goods later this week.

Technical correction started from 20500 , the next support will be at 19750 , however the price action is not yet fully bearish. 1H RSI is cautiously increasing again amid a tight range of trading.

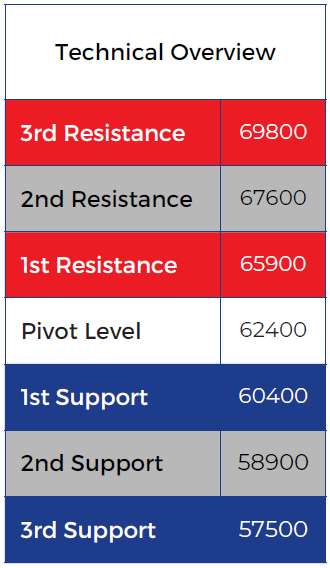

Bitcoin

BTC gained by 4.4% in a week, followed by 4% in Eth, 7.9% Solana and 1.6% in Cardano. While there was no major developments in the crypto market recently, cutting the rates by PBoC may trigger higher demand in BTC, as the cheaper liquidity will target high-risk assets like crypto & digital assets. Keep an eye on Trump’s trade in crypto as well, his comments always move the markets.

Technically speaking, BTC is approaching from $70K ( easily) then $73400K. Most important short-term support is at $65K, which is possible before heading to $73K. Daily RSI is heading higher.

Source: BDSwiss