EURUSD

What happened to EURUSD in the last week? Last week was the second consecutive week of loss in EURUSD that traded unchanged today at $1.0541, one-year low. EUR weakness was a mix of weak fundamentals, political instability from Germany and USD strength after USD index increased to 106.65, the highest in a year. ECB’s President Lagarde will deliver a speech later today.

$1.0590 remained short-lived resistance, but price action showed no strong bets. The correction in USD index may trigger further but slow correction to higher level.

USDJPY

USDJPY started the trading on Monday higher at 154.73 after BoJ governor reiterated that the central bank would increase the rates, but he gave no guidance on the timing. We clarified before that the excessive Yen weakness is likely to trigger further intervention by BoJ, it happened before & it may happen later if needed. Machinery orders in Japan fell by -0.7% in September, weaker than the estimates.

Keep in mind, 155.35 (executed) then 154.50 are support levels. Markets’ perception still expects an intervention by BoJ.

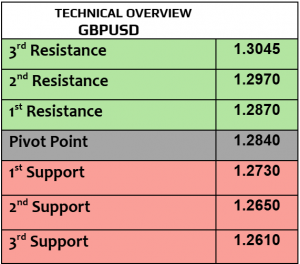

GBPUSD

GBPUSD lost -1.8% last week, trading slightly higher today at $1.2626. It is correct that BoJ cut the rates by -0.25% as expected, but BoE governor Bailey showed no appetite to keep cutting the rates aggressively, urging the UK government not to implement new policies of protectionism as Trump intended to do.

The improvement in price action was fragile, still targeting $1.26. $1.2690 & $1.2750 are resistance levels. Momentum is slightly positive but 1H RSI is sideways.

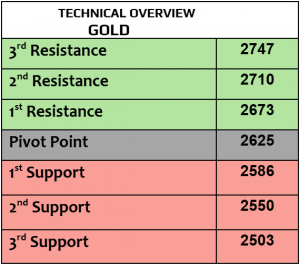

Gold

Gold traded higher today & advanced by 1% to $2588 per ounce after losing -1.3% in a week, two consecutive weeks of loss. While there was no change in markets’ fundamentals, the appetite for gold weakened in the last two weeks due to USD strength, higher US bond yields & falling in China’s inflation as well.

Price action is trying to recover, heading higher to $2612/$2620. $2560 & $2540 are important support, if broken then no major support before $2510.

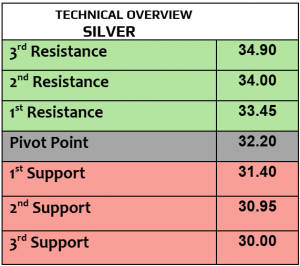

Silver

Silver gained today & traded higher at $30.60 per ounce after losing -0.26% in a week. China’s mixed data just complicated the outlook for silver after China retail sales increased but CPI fell. The US & China are the World’s biggest silver consumers. Trump is unlikely to support EV & renewable sectors which may result in weaker demand for silver, let’s wait the official start of his term after few weeks.

$30.20 and $29.75 are support levels, $31 remains short-term resistance. Volatility is low & 1H RSI is trading at 51 (sideways).

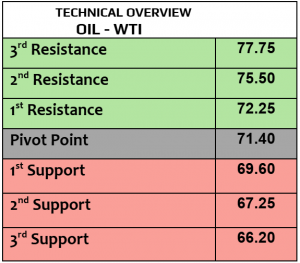

Oil – WTI

How was the weekly performance in oil market? Both WTI & Brent fell in the last week by -1.2% & -0.71% respectively, trading slightly higher today. Ongoing war between Russia & Ukraine, and geopolitical tensions from the ME remained priced in, not giving further risk to oil prices. In the meantime, traders will keep watching the new update from Trump about his oil policies that may support further oil production in the US.

$67 is important support (approaching), with bearish price action that is falling now. $68.80 & $69.25 are resistance (day-traders target), tight range of trading is likely to continue.

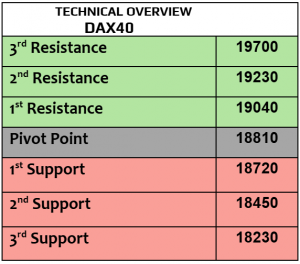

DAX

DAX index failed to close higher in the last week & fell by -1%, followed by -0.94% in France, while Italy & Spain stock indexes closed higher, DAX futures traded higher today at 19249. German Bundesbank president will deliver a speech later today. DAX is likely to follow the trend of the US equities as the calendar from Germany offers no major data for today.

Price action is mixed, but the markets’ sentiments were somehow bearish. 18900 is support (executed) then 18700, 19290 is resistance. Volatility is low.

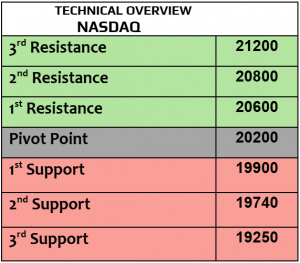

Nasdaq

US stock indexes fell last week, Dow Jones -1.8%, SPX -1.9% and Nasdaq dropped by -2.7% after the Fed chair Powell suggested that the central bank in not in hurry to reduce the rates, US stock futures traded higher today. Nvidia’s earnings will be reported later this week, others will follow, including Walmart & Target. We keep an eye on the last updates from president-elect Trump & his new cabinet appointments.

Price action started increasing from an oversold level, heading higher again to 20760. 20300 is support. Volatility is likely to remain subdued on Monday.

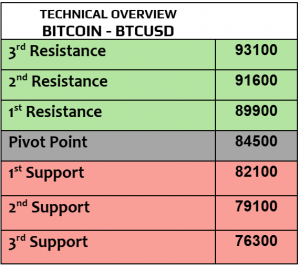

BTCUSD

Three consecutive weeks of strong performance in BTC, Bitcoin remained bullish & traded higher today at $90900, other major cryptocurrencies followed, Eth $3133, Cardano $0.7709, and XRP $1.16, the highest in three years as Ripple gained by almost 90% in a week. Crypto market euphoria is likely to continue due to Trump’s victory, which means that the speculation might become more aggressive.

Price action showed no appetite for profit taking, still heading higher to $93K. $88900 & $86500 are support. Further higher volatility ahead.

Source: BDSwiss