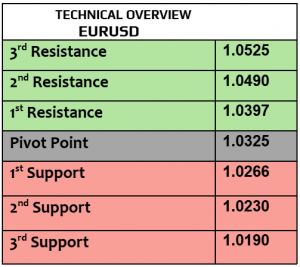

EURUSD

EURUSD fell today & traded at $1.0458 after USD index gained. EZ leaders & policy makers were busy by Trump’s ignorance to EU leaders after he spoke to the Russian president Putin & discussed the possible ending of the ongoing war between Ukraine & Russia without any discussion with EU leaders, that was a major concern to them. Eurogroup meeting will be held later today.

Price action is still showing technical correction to $1.0430. Traders’ sentiments remained mostly bearish with bearish bias.

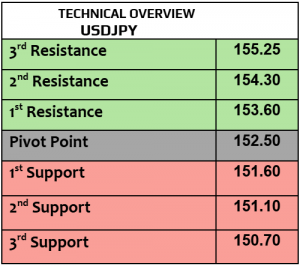

USDJPY

After three consecutive days of losses, USDJPY traded higher today at 152 . Many Fed members indicated that the Fed is in no rush to cut interest rates, which means that the rates may stay higher for longer, such a scenario would support US bond yields. As Japan’s economy grew higher than the estimates in Q4/2024, the expectations tend to show further hawkish stance by BoJ. Exports & imports from Japan will be due later today.

After hitting support level at 30 ( 1H RSI) , price action advanced further, targeting 152.60. According to traders’ forecast, sentiments remained bearish among 40% of them which means that USD strength could be short-lived.

GBPUSD

Busy day ahead from the UK with the release of unemployment , wages & employment numbers, not to forget BoE’s governor Bailey speech as well. GBPUSD traded weaker today & fell to $1.2597. The weaker the macroeconomics from the UK, the more dovish BoE is likely to stay with further rates cuts ahead.

While 1H RSI is sideways now, 1H trend index remained bullish, but the sentiments have not yet become bullish. $1.2550 is support, $1.2620 is resistance.

Gold

Gold gained & traded higher for the second consecutive day at $2911 per ounce. Even if the Fed remained in no rush to reduce the rates, the appetite for gold never weakened. It is not only Trump’s tariffs or the global uncertainty, but also the inflation that remained elevated worldwide.

Price action remained bullish, supported by bullish traders’ sentiments with 75% of them were bullish and only 25% were bearish. $2930 will be the next target ( resistance). $2880 is support.

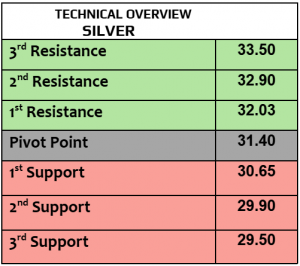

Silver

Silver was little changed today, trading at $32.40 per ounce. Silver is likely to remain correlated to the performance of gold, China’s demand & the future of Trump’s tariffs & its consequences on the global economy. Disruption of global trade may put pressure on supply.

Technically speaking, sentiments were mixed between bullish 15M , daily chart & strongly bearish in 1H chart. Momentum indicator remained positive.

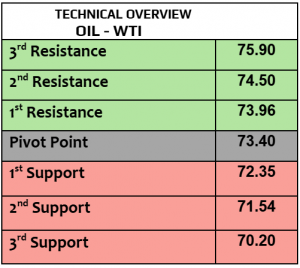

Oil – WTI

Crude oil prices slightly increased today, WTI $71.53 PB, Brent $75.47PB. Ukrainian drones stuck a major pumping station in Southern Russia , disrupting crude oil flows from Kazakhstan. At the same time, OPEC is not considering delaying a series of monthly oil supply increase, planned to begin in April.

While 1H price action kept advancing & targeting $71.90 , however traders’ forecast remained mostly bearish with only 20% were bullish.

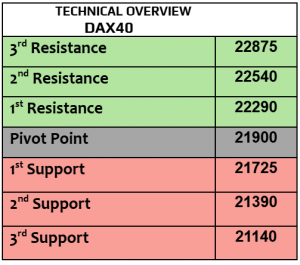

DAX

DAX index closed higher on Monday at 22797, new record-high. German ZEW survey for economic sentiment & current situation will be due later today.

1H RSI is still totally overbought ( 76 ) so the correction to 22490 is possible. Trend index remained bullish. Volatility is expanding, which means that further gains are highly probable.

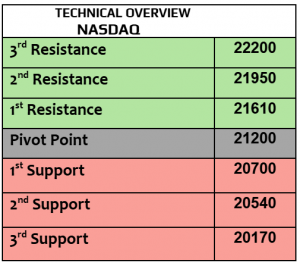

Nasdaq

US stock futures traded higher today after extended holiday weekend due to President’s Day. In the meantime, traders will be waiting for more macro numbers & additional clarification from Fed members & policy makers in Washington about the new proposed tariffs. NY empire state manufacturing index will be released later today by Federal Reserve of New York.

1H trend index remained bullish , heading higher to new record as price action shows today. 21960 is support.

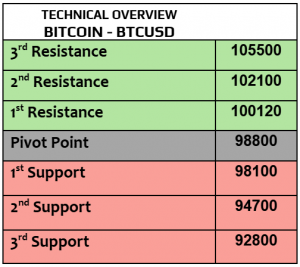

BTCUSD

Major cryptocurrencies fell today, BTC -0.32% at $95474, Eth -2.6%, Cardano -3.5% and Ripple – XRP lost -3.5% as well. In just two weeks, crypto market cap decreased to $1.15 trillion, it was at $3.48 trillion at the beginning of February. According to news, Argentina President Javier Milei faces impeachment calls over crypto crash, it was about LIBRA, amid allegations of fraud.

According to trader’s forecast, 75% of the traders were bearish in one week’s forecasts poll. Trend index in 1H remained strongly bearish . $94500 is support. $96800 is resistance.

Source: BDSwiss