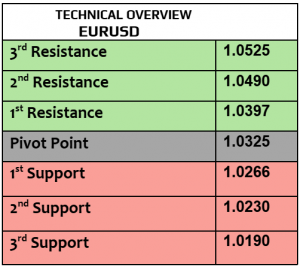

EURUSD

EURUSD was little changed today, traded at $1.0379. Retail sales from EZ improved in December YoY but contracted by -0.2% MoM. Traders are still thinking that Trump’s tariffs on EZ exports ( if happen) may cause deflation, that’s why ECB could ease further its monetary policy.

Hourly trend index remained bearish, supported by 33% bearish bets by the traders & only 17% bullish. 1H RSI traded sideways this morning.

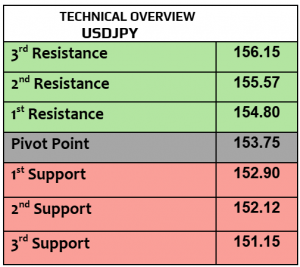

USDJPY

USDJPY traded higher today at 151.70, still at the lowest level since last December 2024. Household spending in Japan increased by 2.7% in December, the first growth in five months, such a growth may keep the inflation elevated in Japan, in other words, BoJ may keep the hawkish stance, unlike other central banks that cut the rates. Keep an eye on the US nonfarm payrolls later today, this currency pair is the most sensitive pair to the US job numbers & US yields.

Trend index is bullish , supported by price action. 152.50 will be the next target. 151.10 is support. Higher volatility ahead.

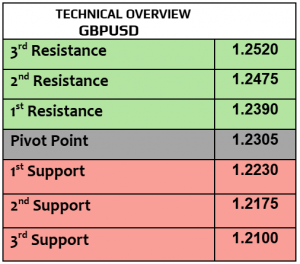

GBPUSD

GBPUSD was little changed today at $1.2426. As expected, & priced in before, BoE cut the rates to 4.5% from 4.75% yesterday, showing that further cuts remain appropriate. Markets expect three more rate cuts this year. Halifax house prices in the UK will be due later today.

$1.2370 is support, $1.2480 is resistance. Hourly trend index remained bearish but it seems that the traders are betting higher on GBP with 40% bullish bets & 20% bearish which means that the trend may change quickly from bearish to bullish.

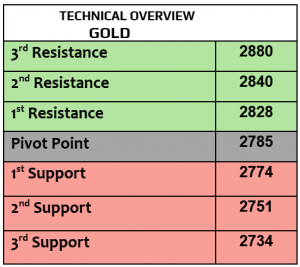

Gold

Gold gained & traded higher today at $2864 per ounce , recovering from yesterday’s losses. Gold is still up by 2.39% in a week. Central banks accelerated gold purchasing and easing policies by the major central banks are likely to have positive impact on gold’s trend. Nonfarm payrolls from the US later today will be the major catalyst for gold traders. Stronger US job market numbers may result in weaker demand for gold in the short term.

Technically speaking, $2840 is support, $2880 is resistance ( record high) . 1H RSI is heading higher slowly. Manage your risk exposure .

Silver

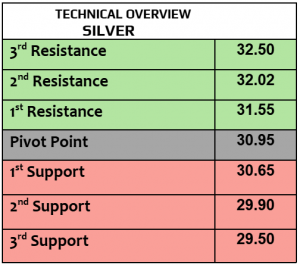

Silver traded unchanged today at $32.21 per ounce, waiting for the US job market numbers & the developments about Trump’s additional tariffs on China. FYI, Mexico is the World’s biggest silver producer, Mexico is home to five out of ten largest silver producing mines worldwide, so think about 25% tariffs on Mexico’s exports to America, what will be the impact ?

Volatility remained low with neutral RSI. $32.50 is resistance, $31.78 is support.

Oil – WTI

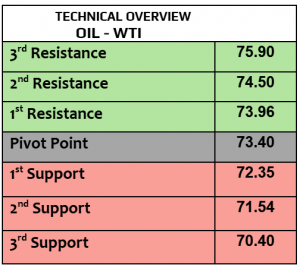

Crude oil prices slightly increased today but both oil benchmarks remained down by almost -2% in a week, WTI traded at $70.86 PB, the lowest in seven weeks, Brent $74.68PB. US crude oil inventories increased by 8.6 million barrels last week, higher than the estimates according to EIA. Trump wanted cheaper oil prices & asked OPEC to reduce the prices as well. So, keep an eye on the politics & trade tensions between the World’s biggest economies the US & China.

Price action remained bearish , and the trend failed to build a new strong support, however the traders have different views from the technical indicators as they are betting higher on oil with 62% bullish bets.

DAX

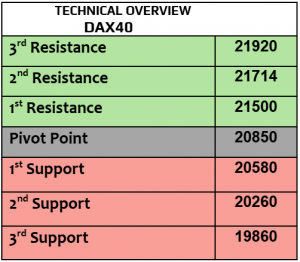

DAX index futures traded slightly weaker today after it gained by almost 1.5% on Thursday. There were rumors of peace plan for Ukraine which supported the market’s sentiments. Germany’s factory orders improved in December by 6.9%, higher than before, industrial production will be due later today.

Nasdaq

US stock futures traded almost unchanged today, Nasdaq increased on Thursday by 0.51%, followed by 0.36% in SPX and Dow Jones slightly fell by -0.28%. Big day ahead from the US with the US nonfarm payrolls numbers for the month of January, not to forget the unemployment rate & wages. ISM services PMI fell to 52.8 in January and the employment in the private US sector increased by 183K in January from 176K in December, so mixed sentiments among the traders.

Hourly trend index remained strongly bullish with high volatility. 21940 is resistance, 21300 is support. Strong US job market may have mixed sentiments on high-risk assets. Stay tuned.

BTCUSD

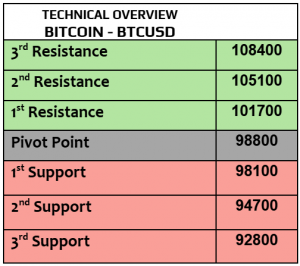

Major cryptocurrency traded higher today, BTC $973400, Eth $2710, Cardano $0.7147 and XRP $2.34. Coinbase pressures regulators to let banks hold cryptos according to Bitcoin.com. In the meantime, Trump’s effect started to fade as traders were still looking for solid & smart regulations by his admin that will make crypto regulations even easier.

Mixed sentiments prevailed with 25% bullish & 25% bearish, and 50% sideways.

Source: BDSwiss