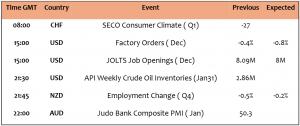

EURUSD

EURUSD remained under huge pressure, falling today by -0.50% & trading at $1.0292, the lowest in almost two weeks. Inflation in EZ increased by 2.5% in January, higher than December at 2.4%, this is the highest reading since July 2024 which means more pressure on ECB. ECB wants to fight the slowing economy by reducing the rates & attempts to contain the inflation as well, not an easy mission. In the meantime, traders are likely to keep focusing on the developments rom the US & Mr. Trump’s tariffs.

Even if the momentum indicator remains positive now, price action supports further drop to $1.0250. $1.0345 is resistance. Volatility index remains high with 17% bullish, 33% bearish.

USDJPY

USDJPY gained & advanced today to 155.23 after US president Trump decided to delay imposing tariffs on Mexico & Canada. US bond yields showed little change, maintaining the strength of USD vs Yen. BoJ raised the rates in January and further rate hikes remained highly probable, so the strength of the Yen may happen .

Even if USD strength remained intact, traders were 60% bearish in their forecasts in the last week, and only 27% bullish on monthly bias.

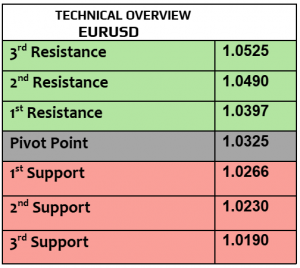

GBPUSD

Will BoE save the Pound on Thursday ? GBPUSD traded weaker today & fell to $1.2403. UK manufacturing PMI came slightly stronger than before in January, but it remained below 50. BoE is likely to cut the rates at Thursday meeting, reducing the rates to 4.5% from 4.75%.

Price action is slightly improving, trying to target $1.2430. Market’ sentiments were 40% bullish & 20% bearish in one week.

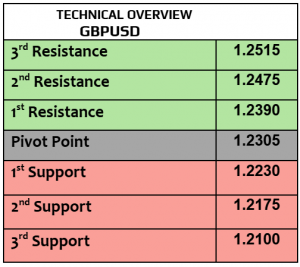

Gold

Gold traded unchanged today at $2813 per ounce, near a record high of $2820 per ounce. What happened in the last three days was that gold gained due to the global chaos because of Trump’s proposed tariffs, its consequences on the global economy & the expected retaliation by China & Canada. The higher the tariffs, the higher the probability for inflation globally, if that happens then the demand for gold is likely to remain intact.

Price action ( 1H ) starts falling & targeting $2800 ( support). Sentiments remained 25% bullish and 75% neutral bias, no bearish sentiments .

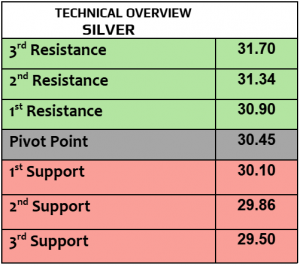

Silver

FYI, silver’s performance was higher than gold in 2025. Silver gained by 9% YTD, compared to 7.2% in gold, but platinum overcame both & rose 11% YTD. Silver traders are likely to watch closely the US factory orders on Tuesday & global manufacturing PMI numbers on Wednesday. New trade war just started between America & many other countries that include China, that’s not a good scenario for silver’s short-term demand outlook.

Trend index in 1H is bullish now, $31.60 will be the next target. $31.15 is support.

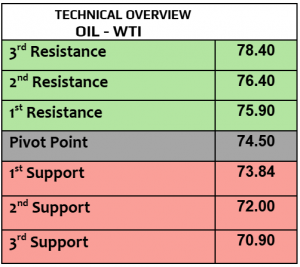

Oil – WTI

Crude oil prices fell on Tuesday, WTI dropped by -1.5% to $72PB, Brent $75.26PB. OPEC meeting started on Monday & supported its existing oil production policy, despite Trump’s demand to reduce oil prices. Chaina said it will impose 10% tariffs on coal & LNG from the US, in retaliation to the US tariffs by 10% on China’s exports to America. Global political Instability & the disruption in global trade are likely to have negative impact on oil prices. US weekly crude oil inventories will be released later today by API.

WTI traded at support now ( 30RSI) but the momentum remained negative. Trend index is bullish ( 1H) and even the markets sentiments remained bullish as well among 60% of the traders.

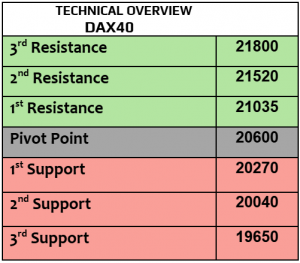

DAX

DAX futures traded weaker today after DAX closed lower by almost -1.5% on Monday at 21405. German automakers were the most to hit, Mercedes lost -3%, Daimler -3%, Porsche -3.5% and BMW -2.4%, many automakers have production facilities & factories in Mexico & Canada, which means that the exports to America will be levied by 25% tariffs as well.

1H trend index is bearish, while price action supports further advance to 21600. 21300 & 21190 remained support levels.

Nasdaq

US stock futures were mixed today after the losses on Monday, Dow Jones lost -0.28%, SPX -0.76% & Nasdaq dropped -1.2%. While the markets were busy by Trump’s new tariffs , the underlying markets risks have not yet been priced in. Trump agreed to delay the tariffs on Canada & Mexico for a month which may help the US equities to recover. US factory orders & job openings will be due later today.

1H trend index remains bullish. Price action recovers & advances to 21480. 21150 & 20900 are support levels.

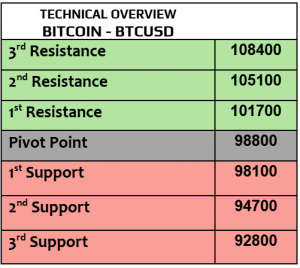

BTCUSD

Major cryptocurrencies continued its fall, BTC dropped by -2.4% to $99160, not far from the lowest level in three weeks, Eth lost -6% to $2715, the weakest since last November, Cardano was down by another -8% , XRP -5.2% and Solana lost -5%. Crypto market cap remained above $3.2 trillion but the sentiments remained bearish. Crypto assets are considered as high-risk ones which means it will be exposed to high risk & aggressive volatility.

Hourly trend index is bullish, but the price action shows that the market bears remain in control for now, targeting $98300 then $96900. $102 will be the next target.

Source: BDSwiss