PREVIOUS TRADING DAY EVENTS – 28 August 2023

- Australians’ spending was on despite the rising cost of living. Retail spending grew by 0.5% in July, according to the data released on Monday by the Australian Bureau of Statistics. The annual rate however slowed further.

Ben Dorber, ABS head of retail statistics: “While there was a rise in July, underlying growth in retail turnover remained subdued,” he said.

The Reserve Bank of Australia paused its rate hikes for two straight months due to a slowdown in spending. On the 1st of August, the RBA left the official cash rate unchanged. The current official cash rate, as determined by the Reserve Bank of Australia (RBA), is 4.10%. The next RBA Board meeting and Official Cash Rate announcement will be on the 5th of September 2023.

Source: https://www.reuters.com/business/retail-consumer/australia-retail-sales-rebound-after-fall-annual-rate-slows-further-2023-08-28/

______________________________________________________________________

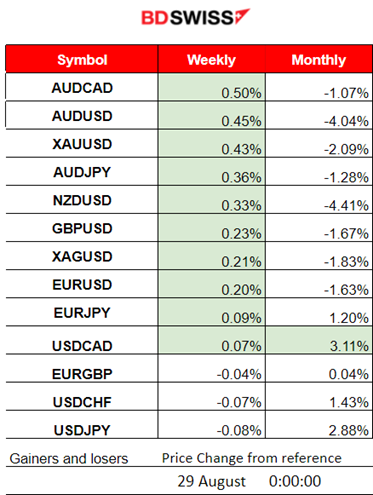

Winners vs Losers

- The AUDCAD is leading this week with 0.5% gains. The AUDUSD is following, indicating that the AUD has gained some ground this week against other pairs.

- USDCAD still holds the first place for the month’s winners with 3.11% gains.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (28 August 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

Australia Retail Sales were reported higher than expected at 4:30. This did not have much impact on the AUD pairs at that time.

- Morning–Day Session (European and N. American Session)

No major news announcements or special scheduled releases.

General Verdict:

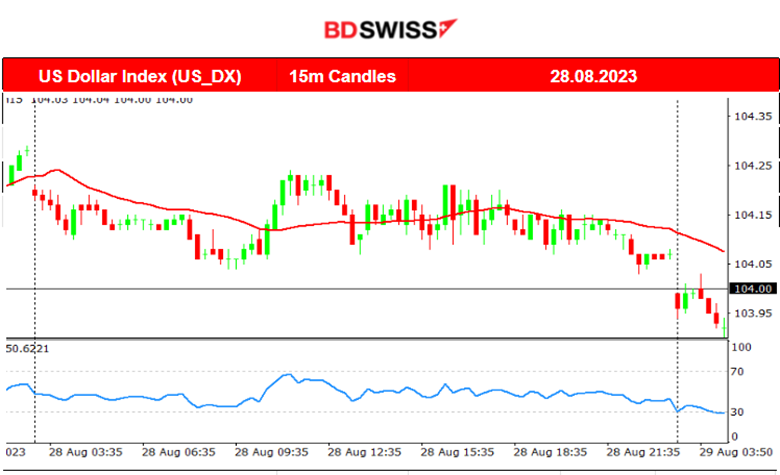

- Markets with low volatility since there was an absence of important scheduled releases. No intraday major shocks.

- Steady movements. DXY moves sideways around the mean with more direction to the downside.

- U.S. benchmark indices experienced volatility but overall they moved to the upside.

____________________________________________________________________

FOREX MARKETS MONITOR

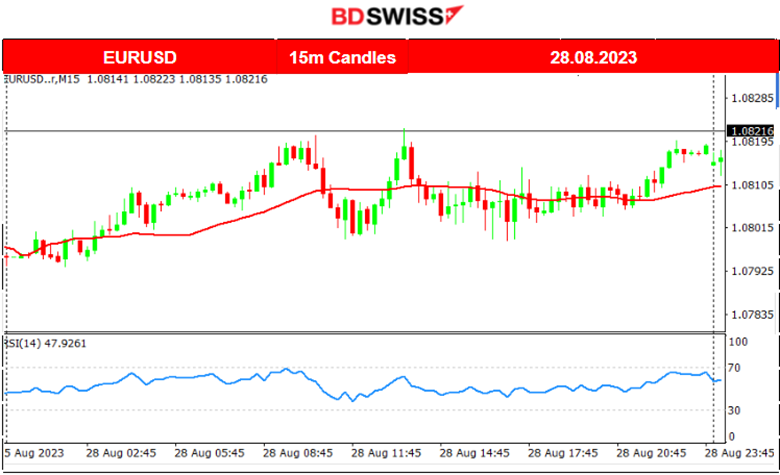

EURUSD (28.08.2023) Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The pair experienced low volatility throughout the trading day. A sideways path around the 30-period MA. No major shocks.

___________________________________________________________________

CRYPTO MARKETS MONITOR

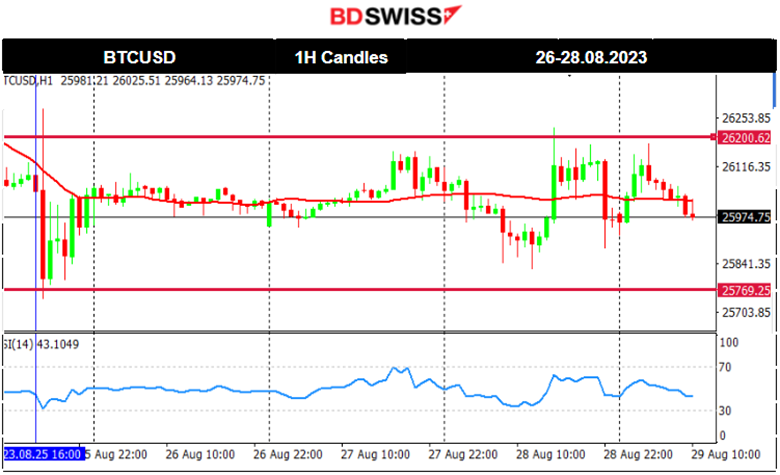

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The price of Bitcoin remains within the boundaries of 26200 and 25770. The MA is on a sideways path and we haven’t observed any special movement so far even though there were some important scheduled releases taking place. However, we are expecting to see some significant movement this week since we have several U.S. labour market-related data to be announced this week. The USD will be affected greatly and will potentially cause Bitcoin to deviate greatly from the MA. It might even break those boundaries and depending on the USD impact, should move rapidly to one direction after breakouts.

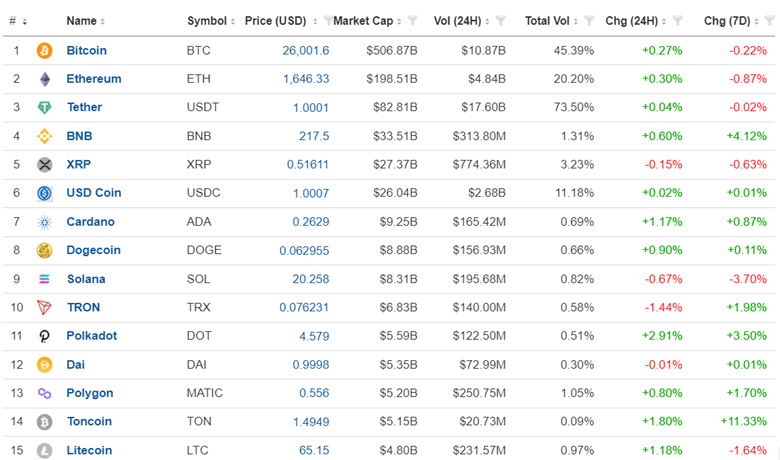

Crypto Sorted by Highest Market Cap:

In the past 24 hours, cryptos saw an increase in value, at least most of them. Toncoin has gained 11.33% in the last 7 days. BNB is also gaining much, 4.12% this month so far.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

The U.S. stock market performed well in the last few days and that’s why the U.S. benchmark indices have reversed to the upside. Since the 25th, the NAS100 has moved steadily upwards and is currently above the 30-period MA, on its way up. Will this upward movement hold though? Currently, there is resistance to the upside. 15375 serves as an important resistance level and a good signal for further upward movement if it breaks.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Crude remains close to the 80 USD /b level. It is touching the 30-period MA and moves on a sideways path. There was an apparent bearish divergence (RSI: lower highs, Price: higher highs) and the price found resistance at near 80.65 USD/b before reversing and returning back to the MA. It seems there is a strong resistance to the upside. The same case with other commodities, such as Gold. USD strengthening plays a role in this.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC 03:00)

Price Movement

Gold is currently above the 30-period MA and seems to follow an uptrend. Even though it broke the resistance near 1923 USD/oz, it still had a hard time moving more to the upside. The resistance to the upside is mostly attributed to the USD strength. A rising wedge is currently visible on the chart. If the Gold price moves to the downside and breaks the barrier of the wedge then it will probably move rapidly towards the support of 1911 USD/oz again.

______________________________________________________________

News Reports Monitor – Today Trading Day (29 Aug 2023)

Server Time / Timezone EEST (UTC 03:00)

- Midnight – Night Session (Asian)

No major news announcements or special scheduled releases.

- Morning–Day Session (European and N. American Session)

At 16:00, the release of the Change in the selling price of single-family homes in 20 metropolitan areas will take place and it might cause an intraday shock. It’s a leading indicator of the housing industry’s health and it is expected to have an impact on the USD pairs.

The CB Consumer Confidence and JOLTS Job opening reports are probably going to affect the USD pairs with an intraday shock. These are important data that could affect the decisions of the Fed regarding whether or not to rate hike. The job openings figure is expected to be reported higher while CC is expected to have dropped. This is in line with previous data and we are expecting these figures to coincide with the previous data.

General Verdict:

- More volatility is expected since we have important releases today.

- The USD pairs will probably see shocks intraday as well, especially at 17:00.

- The U.S. Stock market seems to have reversed and is performing well recently.

- Crude Oil is still stable, close to 80 USD/b.

- The USD weakened yesterday and gave Gold a little push to the upside.

______________________________________________________________

Source: BDSwiss