Oil Market Analysis

Analysis of the Latest Oil Market Events

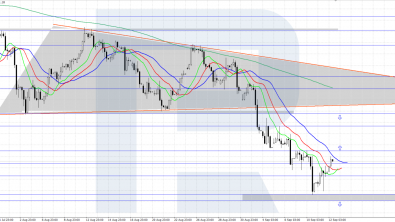

Oil is tangible and one of the most called-for commodities. USA, China and Japan are the largest consumers and importers of oil in the world. Any events and phenomena that trouble supply of “black gold” influence on its price on the oil market. Events such as weather conditions, war, terrorism, political disorders, and the decisions made by the Organization of the Petroleum Exporting Countries (OPEC) can cause its rise or fall in prices on the market. Oil trading refers to a variety of industries and, therefore, is often exposed to changes in the geo-political factors, as well as concerning the behavior of traders.

Oil Market and Analytical Standpoints Regarding this Kind of Market

The oil market is one of the most volatile, respectively, one of the most attractive in terms of investment. Although the trading of oil is a hard task, therefore, for a qualitative oil market’s analysis and oil’s rate is necessary to lend an attentive ear to the standpoints of the leading analysts of the market.

The crude oil technical analysis helps to determine total oil consumption, including the inventories, sales data and oil reports (EIA petroleum status reports). Traders can keep track of these reports and oil market news for better comprehension of the factors that affect the consumption of oil. Global oil market also has a direct effect on the Forex market by means of the germaneness with the dollar. This is due to the fact that the United States is one of the biggest breadwinners and consumers of this raw material. Change in the oil market price affects the intrinsic value of the dollar. In turn, the currencies that are in tandem with the U.S. currency, "look" on the dollar.

As far as oil is constantly taken into account in global business and trade, details that relates to its supply or distribution, will affect reliably the foreign exchange market, including the concomitant oil market analysis. That is why the terrorist attacks or natural disasters like Hurricane "Katrina" that threaten the regular supply of oil, often cause an immediate reaction of the Forex market.

Oil Market Analysis

The aforementioned events are something like shock to the market, making the oil forecast and analysis more difficult for the Forex market players. A more typical scenario usually consists of "fine" movements that occur in inter market relationships when oil trading, which only hint at the fact that the prices might change.

If the trader does not use inter market analysis, very likely he won’t be able to evaluate all these relationship, as well as the effects they exert on the markets, so long as this influence is not greatly substantially.