Forex Metals Market

Precious metals are one of the best investment options

Forex market is first of all the market of leading world currencies. However, besides the currencies there are precious metals also traded, such as gold, silver and palladium. This possibility considerably increases your chances of earning. Two of the most important Forex metal trading markets are London and New York. Other important centers of Forex metals trade located in Zurich, Tokyo, Sydney, Hong Kong and other places. So, the precious metals trade, as well as the currency trading, goes on round-the-clock.

Precious Metals as the Active Currency in Trading Operations

Since 1919 the price of so-called "London fixing" is the main guideline for Forex metal traders around the world and is used in all contracts concluded on physical delivery of the precious metals. As a matter of fact, exactly in London the price of gold ands silver is determined.

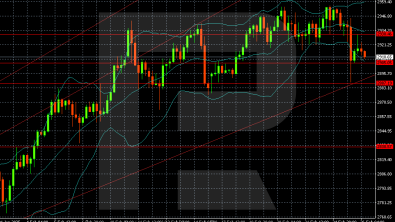

Currently the price of Forex precious metals (“London fixing”) is formed daily at 10.30 AM and 15.00 PM, and the price is determined in U.S. dollars per troy ounce. These rates are official, that is used by all participants on the market of precious metals - mining companies, consumers, central banks, etc. And in the time space between the announcement of "London fixing", prices of the Forex metals move freely, determined by supply and demand.

Technically the transactions with gold (symbol XAU) or silver (symbol XAG) are exactly the same as the deals with any currency pair, with the only difference being that as one of the active currency in these transactions acts the precious metal itself.

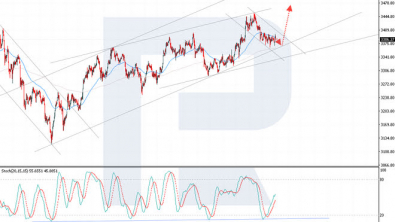

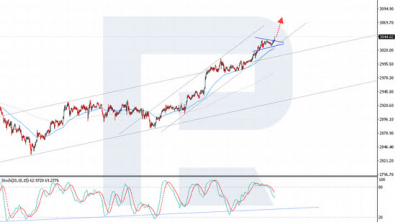

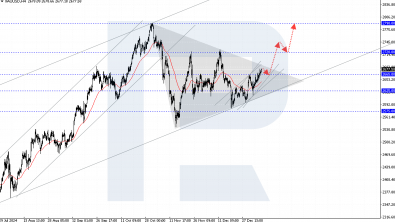

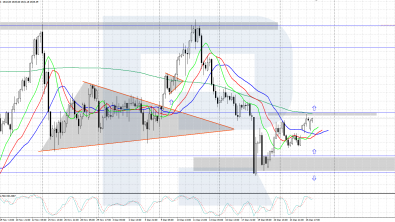

There are no any specific trading strategies when Forex metal trading. Any trading strategy applies for transactions with the precious metals, since all the components of trading tactics: technical indicators, linear instruments of technical analysis, moving averages - react to changes of the price itself, regardless of the type of the trading instrument.

The Historical Development of Precious Metals Quotes

According to the company MaxiForex, historic lows have been noted:

- The price of gold in 1999 ($251 per troy ounce)

- The price of silver in 1991 (3.5 dollars per ounce)

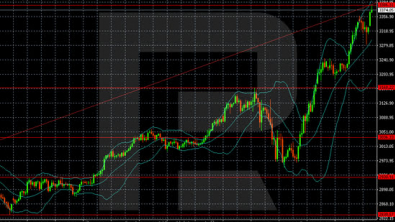

Since 2003, quotes for the Forex precious metals steadily have been increasing, reaching last year's highs: gold price in the world markets broke the mark of U.S. $1,000 ($1,032 per ounce). The prices for other Forex metals in recent years are also close to maximum. Particularly for the first time in 30 years the silver price came close to $21 per ounce. Platinum and palladium also rose up to $2273 and $582 respectively.