The greenback is continuing its down streak this morning with five straight days of losses which hasn’t been seen since late March, as US yields retreat and stocks trade firmer.

Some notable movers amongst G10 currencies:

- Lower yields have helped the Japanese Yen which showed stretched, short JPY positioning most recently, on speculation the BoJ will tweak its uber-dovish policy soon.

- The British Pound is printing new cycle highs against the US dollar towards 1.30 following data showing higher than expected wage growth.

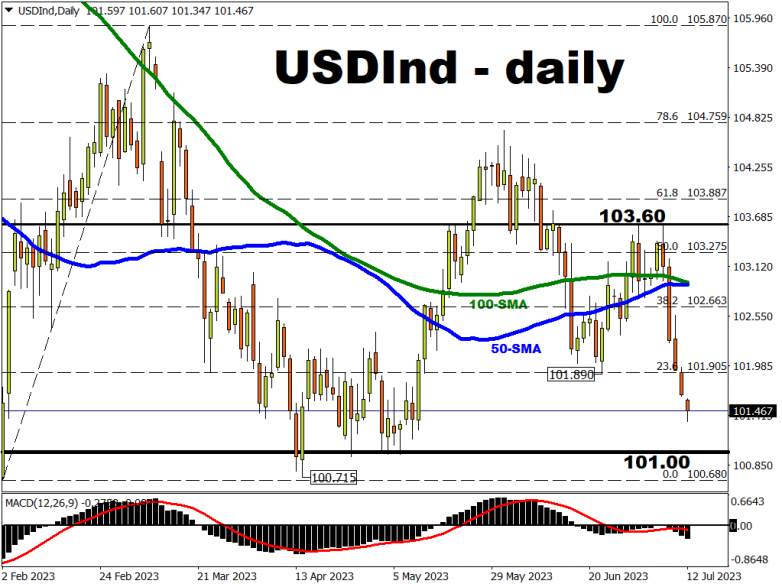

The broader trend in the USD is soft and seems poised to remain so as markets start to factor in the likely peak in the Fed tightening cycle.

The USD Index has broken down through the June lows around 101.890 with sellers looking to push towards the long-term bottom below 101.

Much will depend on today’s upcoming US inflation report.

This is expected to see the headline print drop sharply to 3.1% from 4.0% in May.

This would be the slowest rate of inflation since March 2021 and is primarily due to annual base effects.

That is because hot CPI readings from June 2022 will now be dropping out of the 12-month calculation.

It means, unless we get a much lower than expected print, the focus should be on the core print which is likely to remain uncomfortably high around 5%.

Key will be the core monthly rate which is forecast to come in at 0.3%.

That’s still higher than the 0.2% that is needed over a prolonged period to bring the annual rate back down to the FOMC’s 2% target.

It seems likely that the persistent nature of the core readings should keep hawkish Fed rhetoric in play and will do little to change the chances of a July 25bp rate rise in a few weeks’ time which is given above a 92% chance according to the CME FedWatch Tool.

But the odds of a second move after its “skip” in June have fallen to around 40% from a 50/50 bet before last Friday’s mildly softer US non-farm payrolls data.

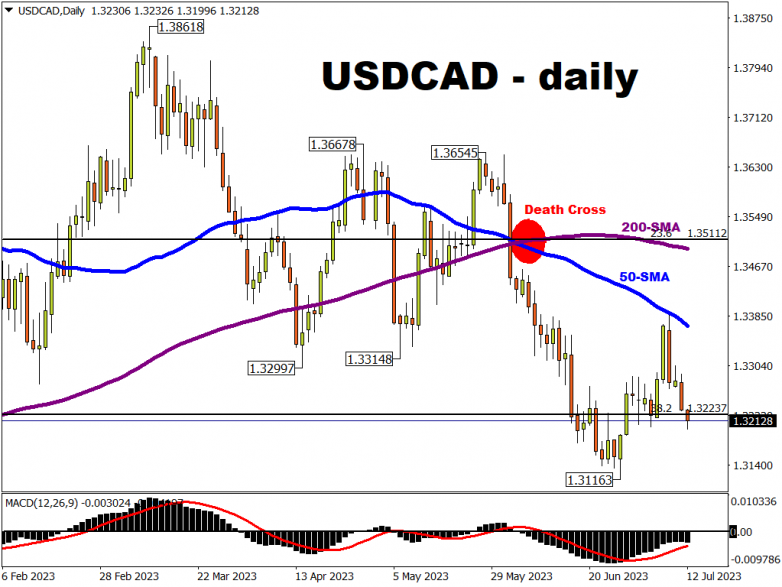

One eye on the Bank of Canada meeting

Markets remain cautious ahead of the BoC policy decision later today.

While there is a clearer consensus in favour of a 25bps rate rise amongst economists, money markets only price in around 16bps.

A hike should provide the CAD with some support though the overall reaction likely hinges on how the BoC characterises the policy outlook going forward.

The loonie was higher yesterday and is dipping today towards the 1.32 handle ahead of the central bank meeting this afternoon.

The CAD has lost ground versus most of its major currency peers so far in July as dollar weakness spills over into North American FX generally.

There is strong support in the mid-1.31s with the recent cycle low at 1.31163.